- Sweden

- /

- Professional Services

- /

- OM:AFRY

A Fresh Look at Afry (OM:AFRY) Valuation Following Ambitious 2028 Revenue Guidance

Reviewed by Simply Wall St

Afry (OM:AFRY) has set new long-term expectations by releasing its financial guidance for 2028, projecting net sales of 35 billion SEK. This fresh revenue target gives investors a clear metric to evaluate the company’s growth plans over the next few years.

See our latest analysis for Afry.

Afray’s latest guidance arrived following a solid period for shareholders, with the total return over the last year coming in at 2.99 percent and a 7.84 percent share price gain over the past three months, which hints at renewed momentum. While longer-term returns are more modest, the recent uplift suggests investor confidence may be growing as new growth targets come into view.

If Afry’s growth ambitions have piqued your interest, this could be an ideal moment to expand your search and discover fast growing stocks with high insider ownership

Given Afry's ambitious revenue targets and the stock's recent momentum, is the market still overlooking value here, or are these growth prospects already fully reflected in the current share price?

Most Popular Narrative: 21.7% Undervalued

Against Afry’s last close of SEK 159.6, the most popular valuation narrative sets a materially higher fair value. This implies analysts see headroom for significant share price appreciation. This consensus is based on structural shifts within Afry’s business and optimism about its medium-term financial trajectory.

"Bullish analysts view the strengthening backlog and ongoing restructuring as supportive factors for earnings momentum in the coming quarters. Strategic project wins are seen as providing greater visibility and confidence in Afry's growth trajectory."

Ever wondered which deep operational changes and bold profit forecasts are behind this narrative’s punchy fair value? The calculation draws on surprisingly ambitious projections for margins, earnings, and revenue, raising questions about whether Afry’s recent momentum can be sustained. Ready to reveal the key numbers and expectations? Follow the full narrative to uncover what could be powering the next stage for Afry.

Result: Fair Value of $203.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in utilization or delays in integrating new acquisitions could quickly undermine Afry’s optimistic growth and margin outlook.

Find out about the key risks to this Afry narrative.

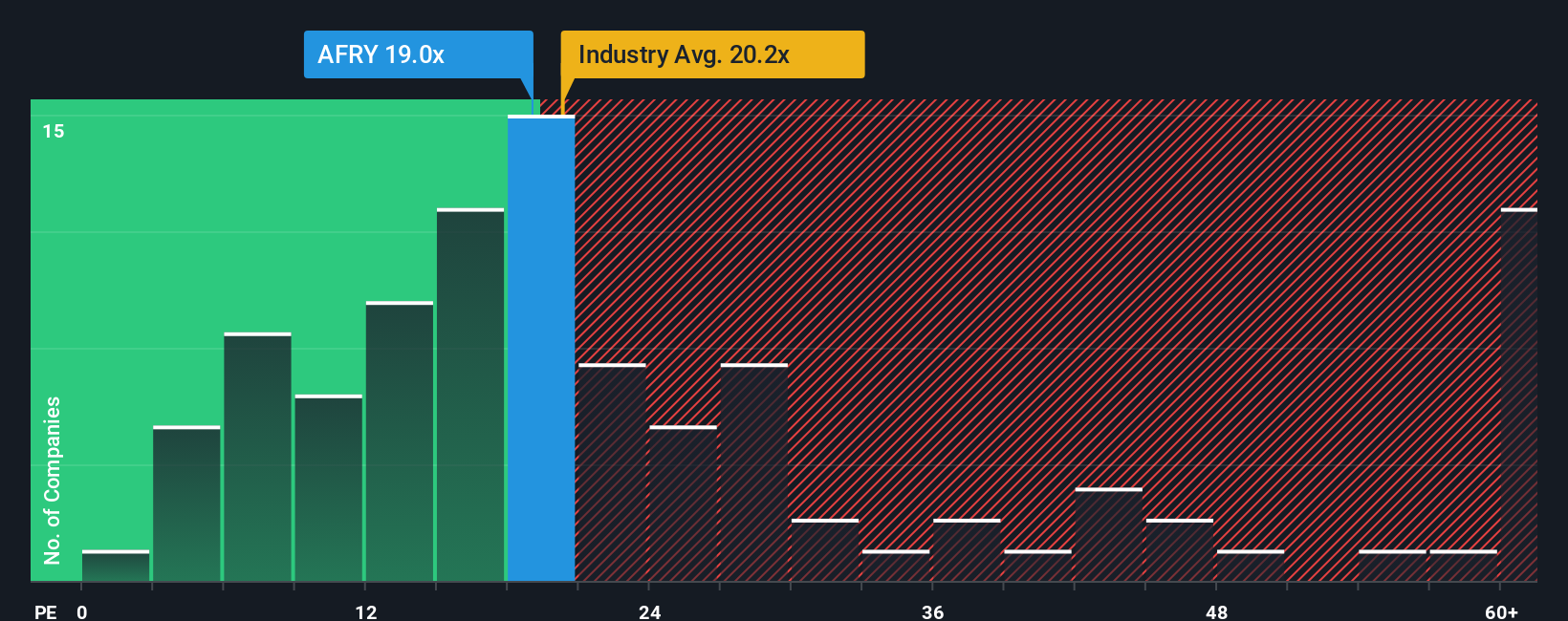

Another View: Looking Through the Lens of Earnings Multiples

Taking a step back from discounted cash flow, valuation based on the current price-to-earnings ratio paints a different picture. Afry trades at 19.5x, notably above its peer average of 15.4x, yet comfortably below the fair ratio of 23.4x. This signals potential valuation risk if the market tightens, but also possible upside should sentiment swing. Are investors correctly balancing growth hopes with the reality of today’s valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Afry Narrative

If you think another story takes shape or want to dissect the numbers firsthand, there's nothing stopping you from crafting your own insight in under three minutes, so why not Do it your way

A great starting point for your Afry research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their radar up for tomorrow’s winners. Don’t miss your chance. Fresh themes and unique opportunities could be just a click away.

- Spot overlooked bargains and seize your advantage through these 877 undervalued stocks based on cash flows, surfacing companies trading below their true value based on solid cash flow fundamentals.

- Ride the next big trend in medicine by checking out these 32 healthcare AI stocks, connecting you with companies advancing transformative healthcare intelligence and patient outcomes.

- Fuel your portfolio’s growth with strong yields by exploring these 14 dividend stocks with yields > 3%, helping you target stocks offering attractive dividends above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:AFRY

Afry

Provides engineering, design, and advisory services for the infrastructure, industry, and energy sectors in the Nordics, North America, South America, Asia, rest of Europe, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives