- Belgium

- /

- Metals and Mining

- /

- ENXTBR:VIO

Undiscovered Gems in Europe June 2025

Reviewed by Simply Wall St

As the European markets experience a boost with the pan-European STOXX Europe 600 Index rising by 0.90% amid easing inflation and supportive monetary policy from the European Central Bank, investors are increasingly optimistic about potential opportunities in lesser-known stocks. In this environment, identifying promising small-cap companies that can capitalize on favorable economic indicators and resilient market sentiment is crucial for uncovering undiscovered gems in Europe.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Viohalco (ENXTBR:VIO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Viohalco S.A. is a company that, through its subsidiaries, engages in the manufacturing and selling of aluminium, copper, cables, and steel products with a market capitalization of €1.48 billion.

Operations: Viohalco generates revenue primarily from the sale of aluminium, copper, cables, and steel products. The company's market capitalization stands at approximately €1.48 billion.

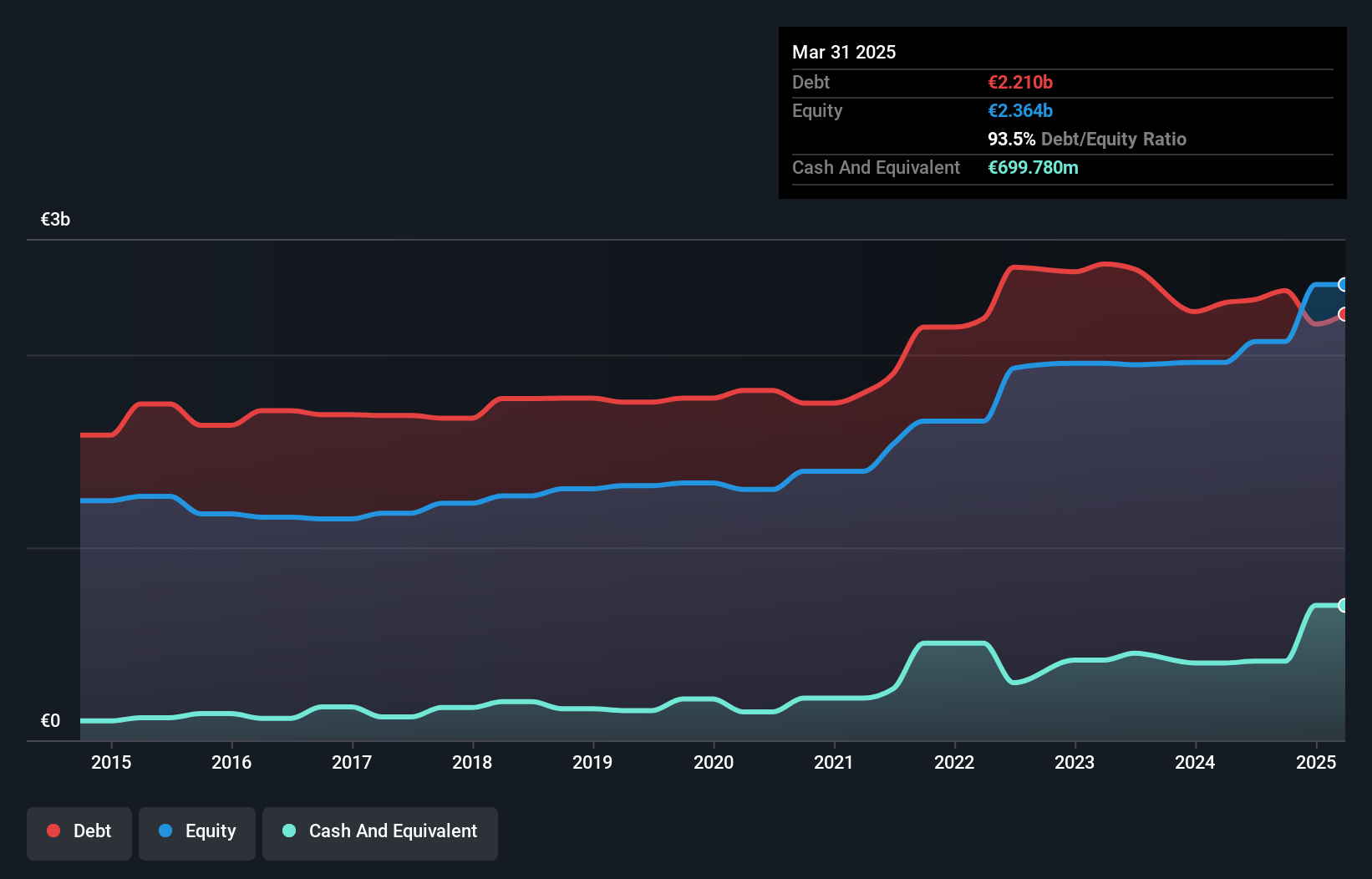

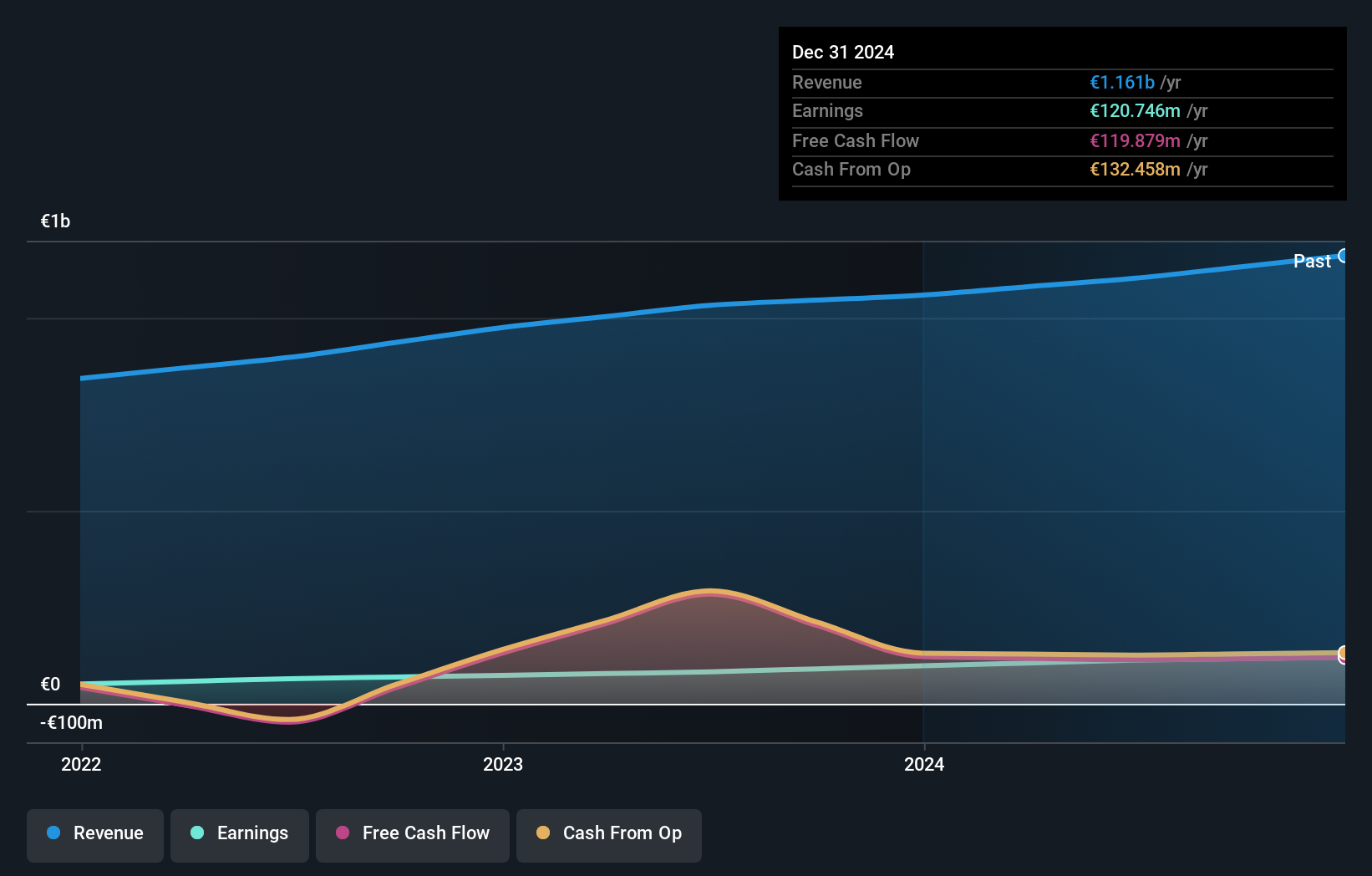

Viohalco, a notable player in the European industrial sector, has shown impressive growth with earnings surging by 336.9% over the past year, outpacing its industry peers. The company reported net income of €161 million for 2024, up from €48 million the previous year, and basic earnings per share rose to €0.62 from €0.19. Despite trading at 55.7% below estimated fair value and having high-quality past earnings, Viohalco's debt situation is mixed; while its debt-to-equity ratio improved to 93.5%, interest coverage remains low at 2.8 times EBIT due to high net debt levels of 63.9%.

- Dive into the specifics of Viohalco here with our thorough health report.

Review our historical performance report to gain insights into Viohalco's's past performance.

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Value Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme is an investment company offering interdealer broking, online trading, and private banking services across various regions including Europe, the Middle East, Africa, the Americas, and Asia-Pacific with a market capitalization of approximately €1.01 billion.

Operations: The company's primary revenue stream is derived from professional intermediation, generating approximately €1.11 billion. Stock exchange online activities contribute an additional €74.37 million, while holdings add €5.40 million to the total revenue mix.

VIEL & Cie, a nimble player in the financial sector, has demonstrated robust performance with earnings climbing 23.1% over the past year, outpacing the Capital Markets industry's 12%. The company's debt to equity ratio has impressively decreased from 98.3% to 63% in five years, signaling improved financial health. Trading at a valuation that's about 15% below its estimated fair value suggests potential upside for investors. With more cash than total debt and positive free cash flow of €116.83 million as of September 2024, VIEL seems well-positioned financially despite insufficient data on interest coverage by EBIT.

Systemair (OM:SYSR)

Simply Wall St Value Rating: ★★★★★★

Overview: Systemair AB (publ) is a company that manufactures and sells ventilation products across Europe, the Americas, the Middle East, Asia, Australia, and Africa with a market cap of SEK18.82 billion.

Operations: The company's primary revenue stream is from the manufacture and sale of ventilation products, generating SEK12.30 billion.

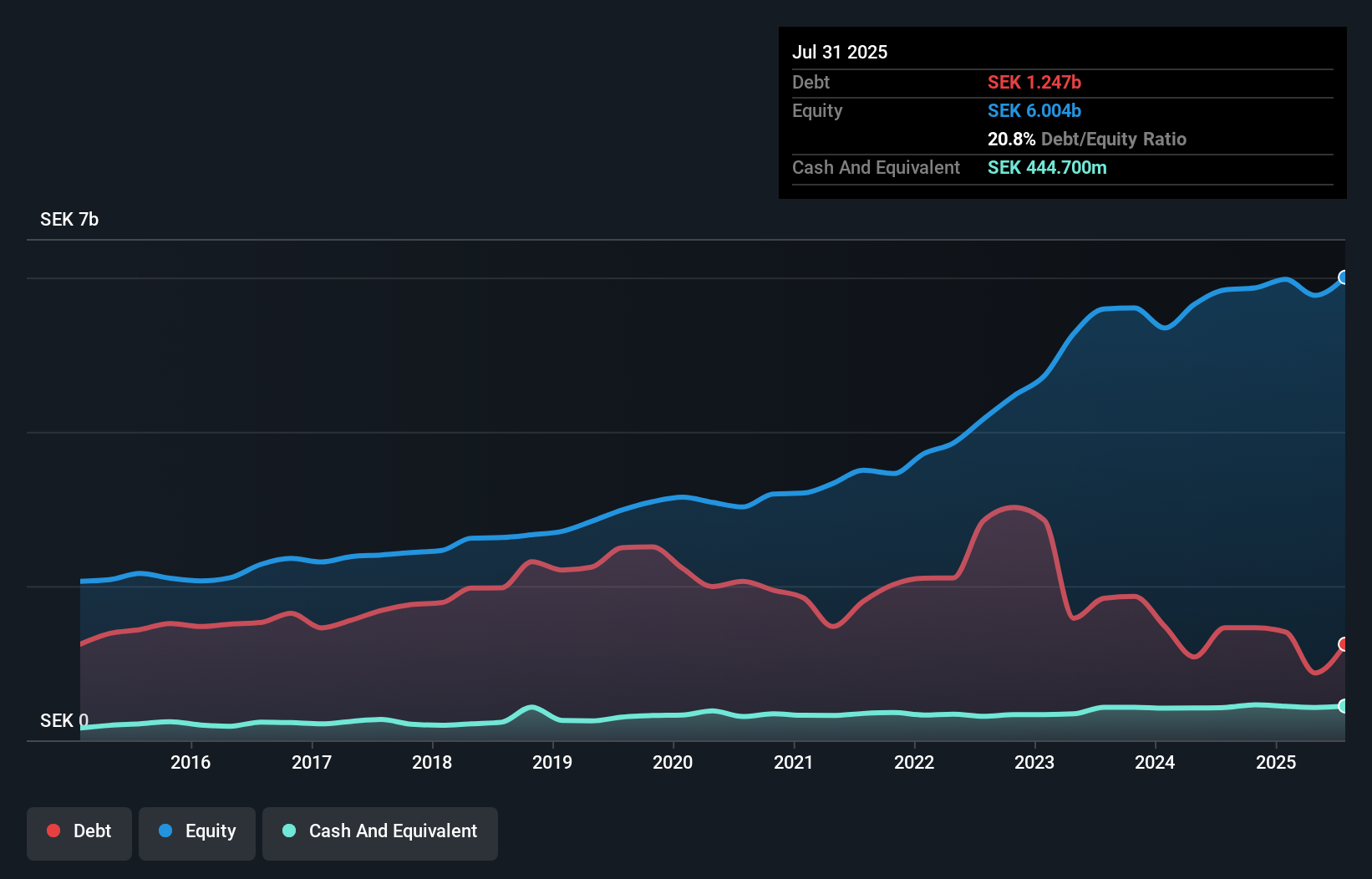

Systemair, a nimble player in the ventilation industry, trades at 8.8% below its estimated fair value and boasts a net debt to equity ratio of 15.1%, deemed satisfactory. The company’s EBIT covers interest payments nearly 15 times over, showcasing robust financial health. With earnings growth of 5.4% last year outpacing the building industry's -5.8%, Systemair is on an upward trajectory despite market challenges in Germany and Eastern Europe. Recent results showed full-year sales reaching SEK 12 billion with net income climbing to SEK 681 million, while strategic expansions into India and sustainability efforts signal promising future prospects.

Taking Advantage

- Get an in-depth perspective on all 328 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:VIO

Viohalco

Through its subsidiaries, manufactures, and sells aluminium, copper, cables, and steel and steel pipe products.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives