Earnings are growing at AB SKF (STO:SKF B) but shareholders still don't like its prospects

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the AB SKF (publ) (STO:SKF B) share price is down 25% in the last year. That falls noticeably short of the market decline of around 8.5%. On the other hand, the stock is actually up 9.8% over three years. Unfortunately the last month hasn't been any better, with the share price down 29%. However, we note the price may have been impacted by the broader market, which is down 16% in the same time period.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the AB SKF share price fell, it actually saw its earnings per share (EPS) improve by 1.2%. Of course, the situation might betray previous over-optimism about growth.

It seems quite likely that the market was expecting higher growth from the stock. But other metrics might shed some light on why the share price is down.

We don't see any weakness in the AB SKF's dividend so the steady payout can't really explain the share price drop. We'd be more worried about the fact that revenue fell 5.0% year on year. So it seems likely that the weak revenue is making the market more cautious about the stock.

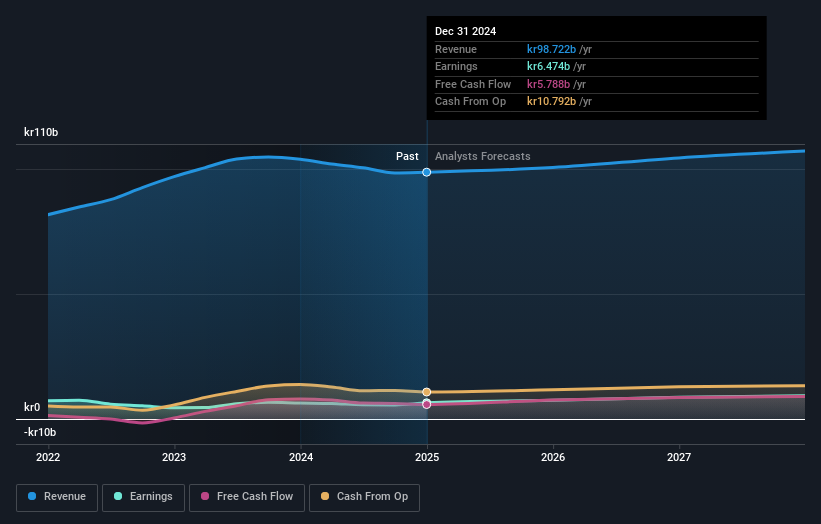

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for AB SKF in this interactive graph of future profit estimates .

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, AB SKF's TSR for the last 1 year was -22%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We regret to report that AB SKF shareholders are down 22% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 8.5%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 7% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand AB SKF better, we need to consider many other factors. For example, we've discovered 1 warning sign for AB SKF that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SKF B

AB SKF

Designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and services worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives