- Sweden

- /

- Professional Services

- /

- OM:REJL B

3 Swedish Dividend Stocks Yielding At Least 3%

Reviewed by Simply Wall St

As European inflation edges closer to the central bank's target, the Swedish market has shown resilience, with major indices reflecting positive sentiment. This stable economic environment makes it an opportune time to consider dividend stocks, which can provide a reliable income stream. When evaluating dividend stocks, it's essential to look for companies with strong financial health and consistent payout histories. In this context, we will explore three Swedish dividend stocks yielding at least 3%, offering potential stability and income in today's market conditions.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 5.73% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.62% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.79% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.61% | ★★★★★☆ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.39% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.08% | ★★★★★☆ |

| Duni (OM:DUNI) | 5.02% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.41% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.81% | ★★★★★☆ |

| Bahnhof (OM:BAHN B) | 3.74% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Swedish Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

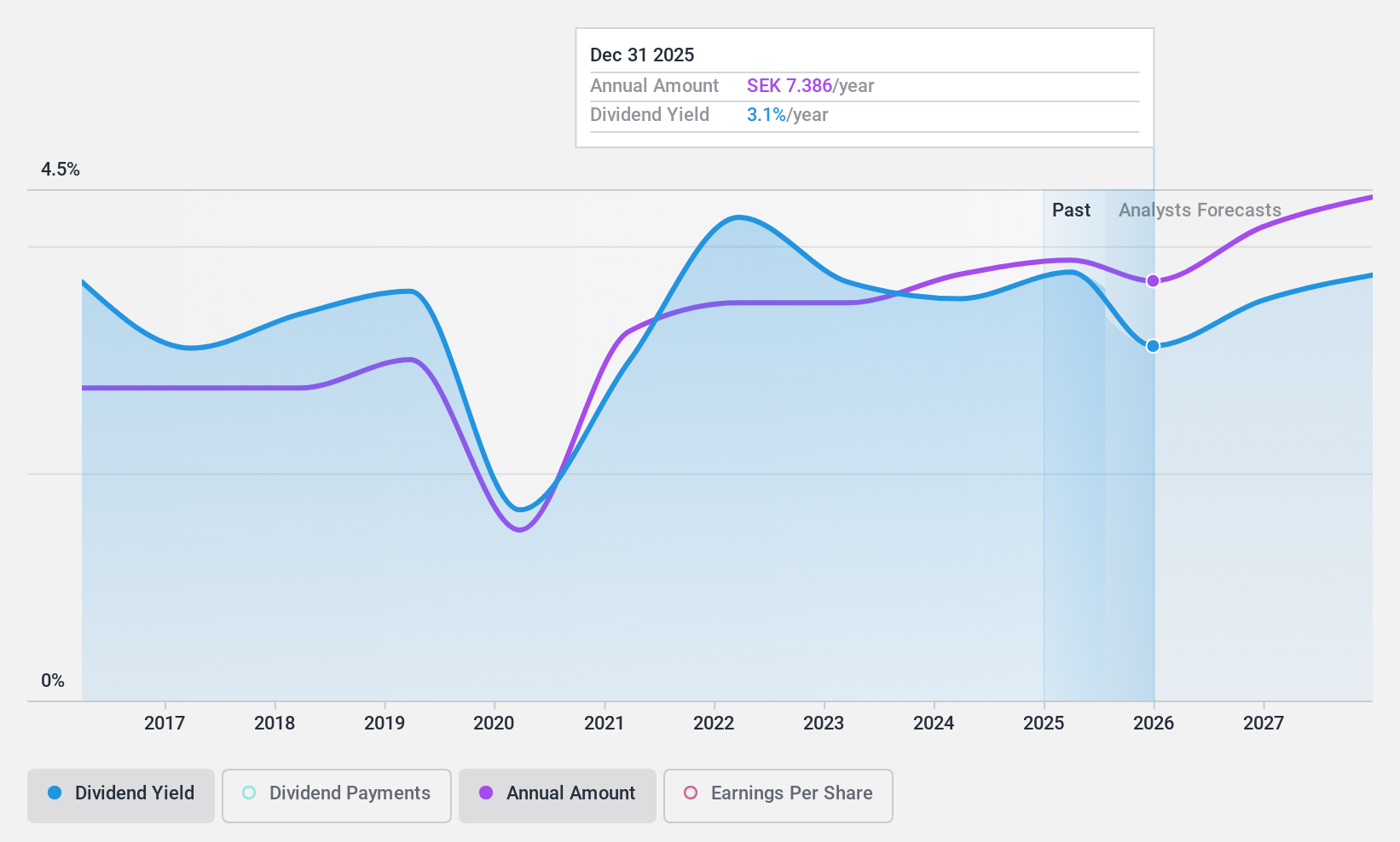

Rejlers (OM:REJL B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rejlers AB (publ) provides technical and engineering consultancy services in Sweden, Finland, Norway, and the United Arab Emirates, with a market cap of SEK3.32 billion.

Operations: Rejlers AB (publ) generates revenue from several key segments, including SEK2.63 billion from Sweden, SEK1.37 billion from Finland, and SEK304.40 million from Norway (including Embriq).

Dividend Yield: 3%

Rejlers offers a mixed picture for dividend investors. While its dividend payments have increased over the past decade, they have been volatile and sometimes unreliable. The payout ratio of 50% indicates dividends are covered by earnings, and a cash payout ratio of 30.7% suggests good coverage by cash flows. Recent projects like the Viskadalsbanan infrastructure upgrade and collaborations in energy storage bolster Rejlers' growth prospects but do not necessarily ensure stable or high dividends.

- Take a closer look at Rejlers' potential here in our dividend report.

- The valuation report we've compiled suggests that Rejlers' current price could be quite moderate.

AB SKF (OM:SKF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB SKF (publ) designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and services worldwide with a market cap of SEK83.10 billion.

Operations: AB SKF's revenue is segmented into Automotive, generating SEK29.44 billion, and Industrial, contributing SEK71.08 billion.

Dividend Yield: 4.1%

AB SKF's dividend payments have been volatile and unreliable over the past decade, although they are currently covered by earnings (59.9% payout ratio) and cash flows (53.6% cash payout ratio). The stock trades at 59.3% below its estimated fair value, presenting a potential value opportunity despite its low dividend yield of 4.11%. Recent executive changes, including a new CFO appointment, and strategic initiatives like green steel production could impact future performance but add uncertainty to its dividend stability.

- Unlock comprehensive insights into our analysis of AB SKF stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of AB SKF shares in the market.

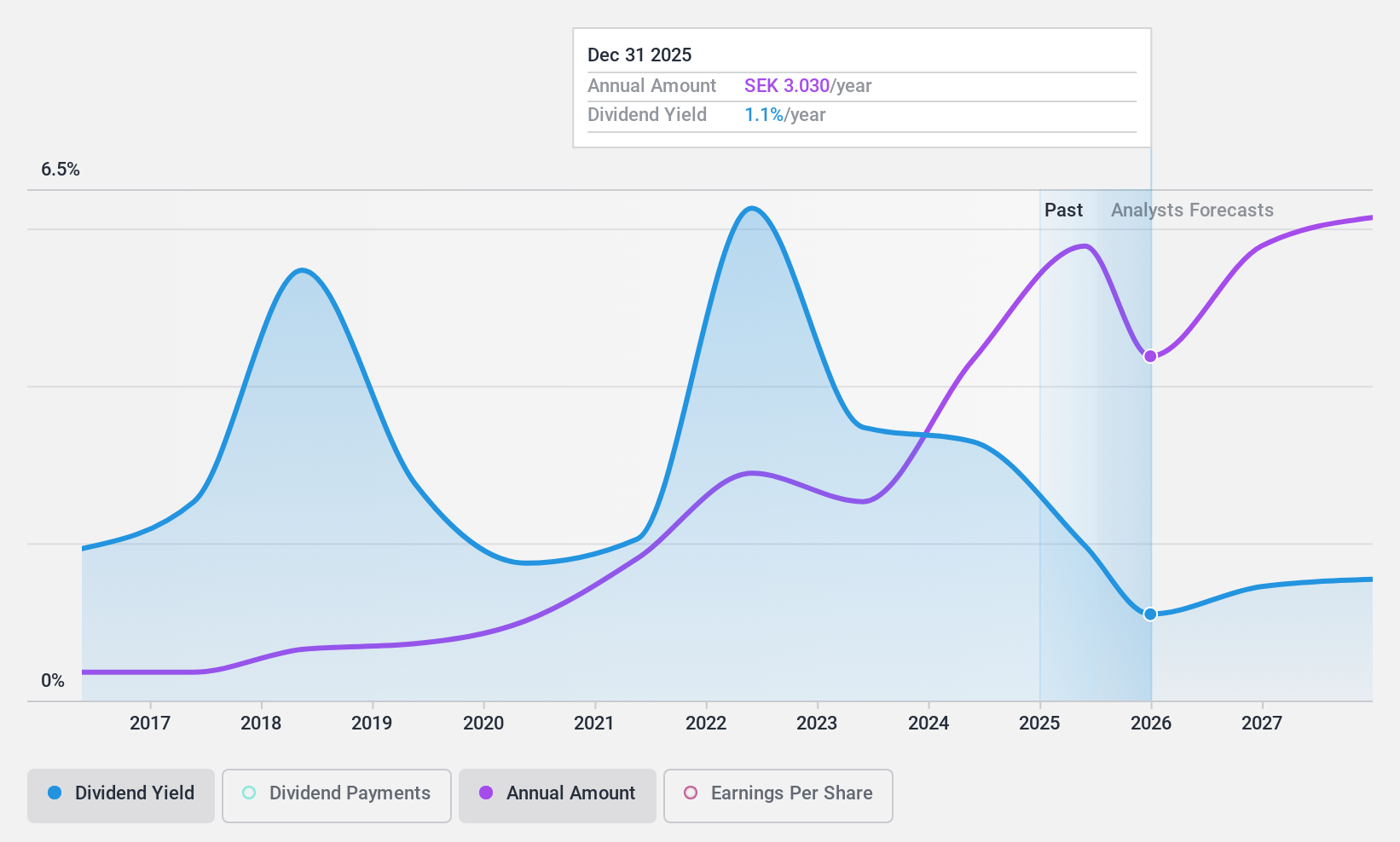

Zinzino (OM:ZZ B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zinzino AB (publ) is a direct sales company that offers dietary supplements and skincare products in Sweden and internationally, with a market cap of SEK2.72 billion.

Operations: Zinzino AB (publ) generates its revenue from dietary supplements and skincare products sold both domestically in Sweden and internationally.

Dividend Yield: 3.8%

Zinzino's dividend payments are well covered by earnings (56.3% payout ratio) and cash flows (47.4% cash payout ratio), with a reliable 10-year history of stable and growing dividends. Despite trading at 64.8% below its estimated fair value, its dividend yield of 3.79% is modest compared to top Swedish payers. Recent revenue growth of 39%, driven by strong sales in August, supports the sustainability of its dividends amidst ongoing expansion efforts in Europe and potential acquisitions in the US and Asia.

- Dive into the specifics of Zinzino here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Zinzino is trading behind its estimated value.

Make It Happen

- Unlock more gems! Our Top Swedish Dividend Stocks screener has unearthed 18 more companies for you to explore.Click here to unveil our expertly curated list of 21 Top Swedish Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:REJL B

Rejlers

Engages in the provision of technical and engineering consultancy services in Sweden, Finland, Norway, and the United Arab Emirates.

Undervalued with adequate balance sheet and pays a dividend.