Sandvik (OM:SAND): Assessing Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Sandvik.

Sandvik’s share price momentum has steadily built throughout the year, with a 44% year-to-date share price return and an impressive one-year total shareholder return of 46%. Investors are paying close attention, as recent gains suggest renewed optimism around growth potential and underlying fundamentals.

If you think Sandvik’s surge is interesting, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership.

With Sandvik’s shares hitting new highs, the key question for investors is whether the current price reflects genuine value, or if the market has already factored in the company’s future growth, leaving little room for upside.

Most Popular Narrative: 2% Overvalued

With Sandvik closing at SEK288.8 and the most widely followed narrative assigning a fair value of SEK282.56, the story centers on a slight divergence between analyst projections and the prevailing share price. This apparent premium raises the stakes for investors weighing growth expectations against market optimism.

The company's launch of electrification and automation-ready products in mining and new product introductions in software are likely to enhance market position and boost future revenue. Sandvik's ongoing restructuring programs have improved cost efficiency, reducing expenses and increasing net margins through savings and operational improvements.

Are electrification breakthroughs enough to back this premium? The answer lies in bold financial forecasts and a future profit multiple that breaks from the pack. Find out which ambitious projections truly drive the valuation and what the narrative says Sandvik must achieve to earn its price.

Result: Fair Value of SEK282.56 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic uncertainty and persistent weakness in Sandvik's non-mining segments could challenge these positive forecasts and reduce future earnings momentum.

Find out about the key risks to this Sandvik narrative.

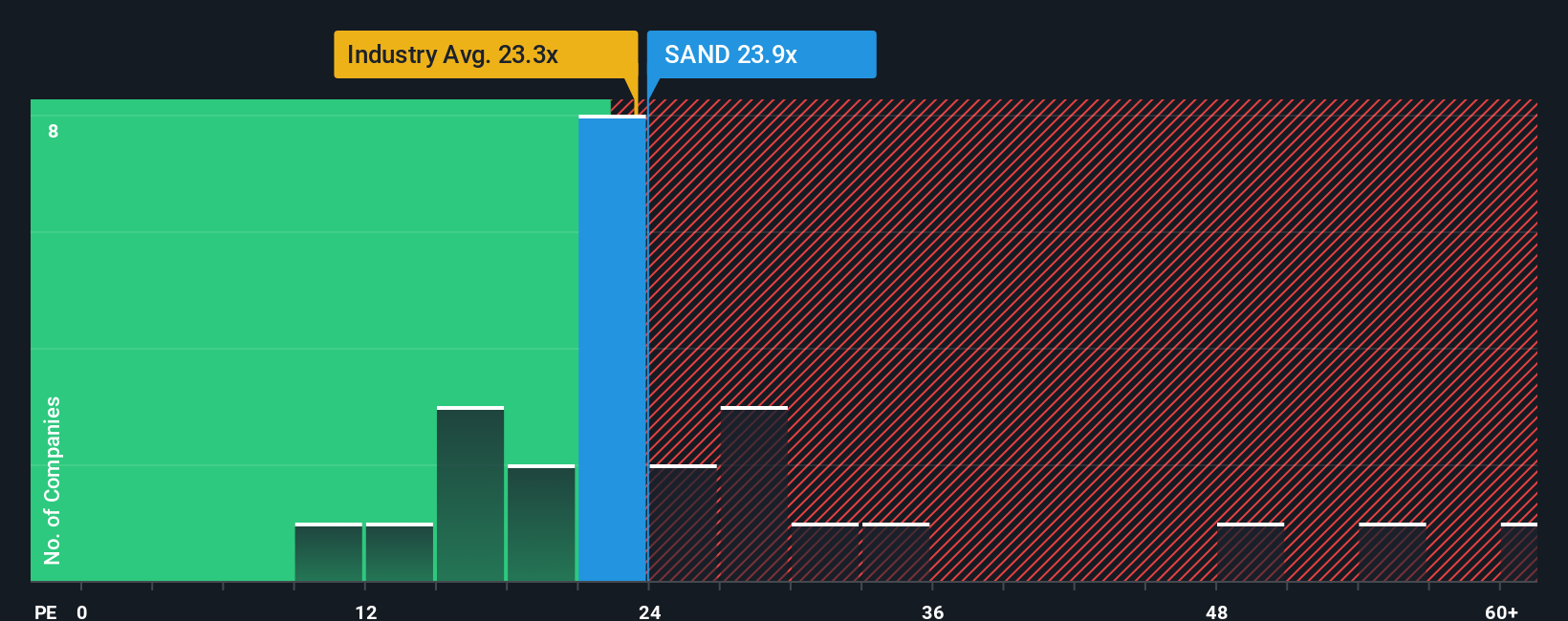

Another View: Comparing Market Multiples

While analyst consensus points to Sandvik being slightly overvalued, another perspective comes from comparing its price-to-earnings ratio. Sandvik’s P/E ratio of 24.5x is just under the industry average (24.7x), but it is slightly higher than the peer average (24.1x). The fair ratio stands at 28.4x. This suggests the market could move higher or Sandvik could offer a bargain if growth expectations hold. Are investors focusing too much on near-term volatility, or will the market reward the company’s steady growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sandvik Narrative

If you see Sandvik’s story differently or want to dig into the details yourself, know that crafting your own narrative takes just minutes: Do it your way.

A great starting point for your Sandvik research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Never let great opportunities slip by. The right investment fit could be just a click away when you use these powerful screeners trusted by savvy investors.

- Boost your income potential and start building wealth with steady payouts by checking out these 14 dividend stocks with yields > 3% offering robust yields above 3%.

- Fuel your curiosity about the future of healthcare by investigating the breakthroughs behind these 32 healthcare AI stocks.

- Stay ahead of the next tech surge by tapping into these 27 AI penny stocks that are set to transform tomorrow’s markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAND

Sandvik

An engineering company, provides products and solutions for mining and rock excavation, metal cutting, and materials technology worldwide.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives