- Sweden

- /

- Industrials

- /

- OM:NOLA B

How Nolato’s Margin Gains Amid Lower Sales Could Shape OM:NOLA B’s Long-Term Investment Case

Reviewed by Sasha Jovanovic

- Nolato AB (publ) has released its third quarter 2025 results, reporting sales of SEK 2,342 million and net income of SEK 215 million, both for the period ended September 30, 2025.

- While sales saw a minor decrease from the prior year, the company achieved a notable rise in net income and earnings per share, highlighting effective cost management and margin enhancement.

- We now explore how Nolato’s improved profitability, despite softer revenues, influences its longer-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Nolato Investment Narrative Recap

To be a shareholder in Nolato, you need to believe in its ability to turn major investments and ongoing efficiency gains into steadily growing profits, especially as it expands in global healthcare and high-tech manufacturing. The latest quarterly report, with rising net income despite softer sales, reflects strong cost controls, yet it does not materially change the fact that the most important short term catalyst remains the ramp-up of new facilities, while the biggest risk centers on high capital spending possibly outpacing revenue growth if demand lags.

Of the recent company announcements, the SEK 600 million investment in new manufacturing capacity stands out, given its tie to growth expectations across Nolato’s medical segments. These expansions are meant to underpin long-term organic growth and future earnings power, but also increase the risk should utilization rates falter or market demand soften.

On the other hand, shareholders should be aware that elevated capital expenditures can quickly raise pressure on free cash flow and margins if...

Read the full narrative on Nolato (it's free!)

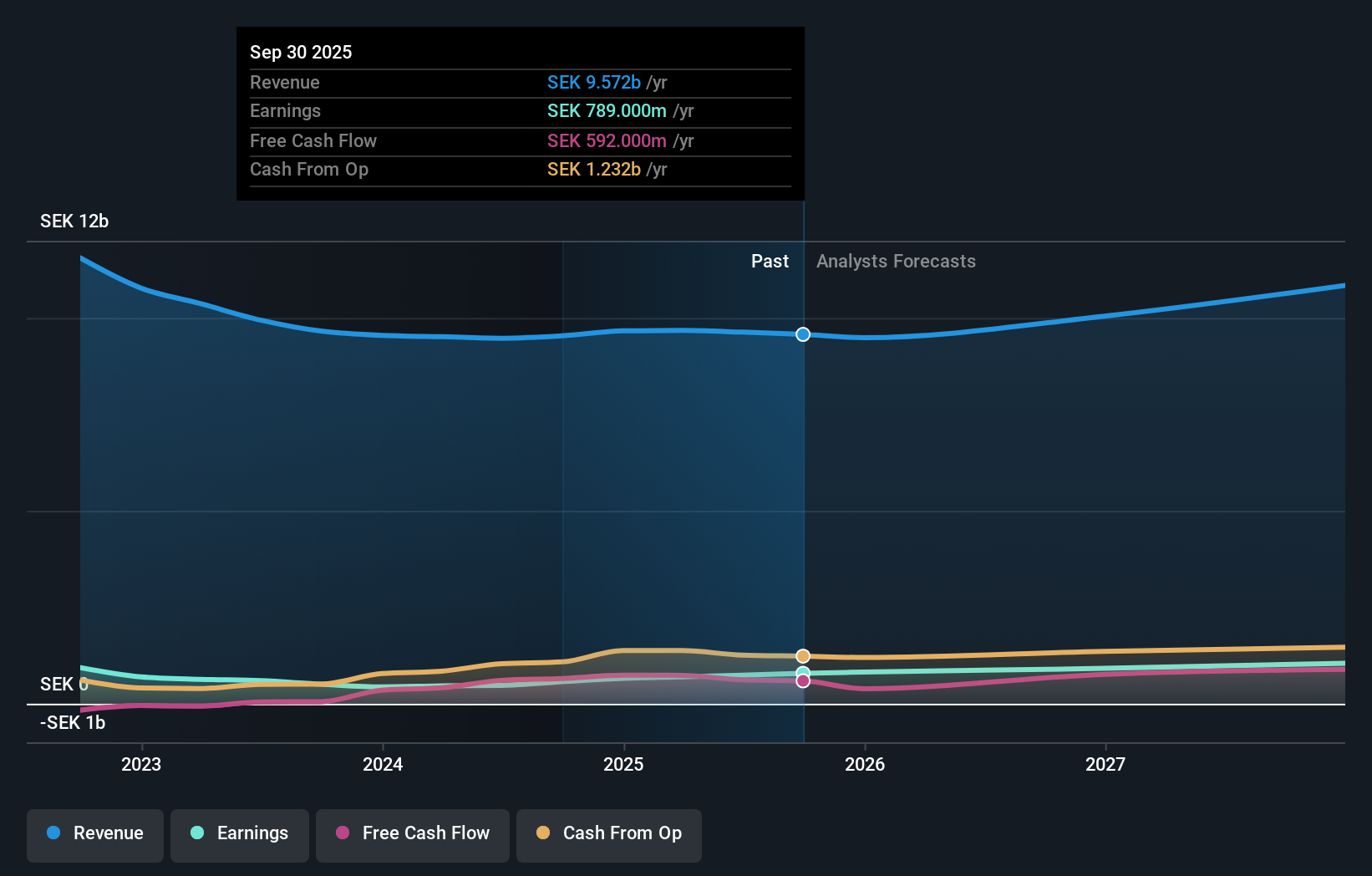

Nolato's outlook anticipates SEK11.3 billion in revenue and SEK1.1 billion in earnings by 2028. Achieving this would require 5.5% annual revenue growth and a SEK362 million increase in earnings from the current SEK738 million.

Uncover how Nolato's forecasts yield a SEK67.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Nolato, ranging from SEK67 to SEK94,161 per share. While opinions vary widely, the potential for overcapacity and margin pressure remains a central concern if new investments encounter slower-than-expected demand, highlighting different ways to consider the company's future.

Explore 2 other fair value estimates on Nolato - why the stock might be worth as much as 58% more than the current price!

Build Your Own Nolato Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nolato research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nolato research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nolato's overall financial health at a glance.

No Opportunity In Nolato?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nolato might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NOLA B

Nolato

Develops, manufactures, and sells plastic, silicone, and thermoplastic elastomer products in Europe, Asia, North America, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives