- Germany

- /

- Food and Staples Retail

- /

- XTRA:RDC

European Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Amidst cautious optimism in Europe, the pan-European STOXX Europe 600 Index has shown slight gains as investors navigate U.S. trade policy developments and efforts to resolve the Russia-Ukraine conflict. In this environment, growth companies with high insider ownership can present intriguing opportunities, as such ownership often signals confidence from those closest to the business and may align management's interests with shareholders'.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| TF Bank (OM:TFBANK) | 15.6% | 20% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Truecaller (OM:TRUE B) | 29.7% | 24.8% |

| XTPL (WSE:XTP) | 27.9% | 118% |

| BioArctic (OM:BIOA B) | 33.8% | 38.5% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Smart Eye (OM:SEYE) | 13.7% | 127.8% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 121.1% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 114.3% |

Let's explore several standout options from the results in the screener.

CVC Capital Partners (ENXTAM:CVC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm that focuses on middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts with a market cap of €24.61 billion.

Operations: CVC Capital Partners plc generates revenue through its focus on private equity and venture capital activities, specializing in areas such as middle market secondaries, infrastructure and credit investments, management and leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts.

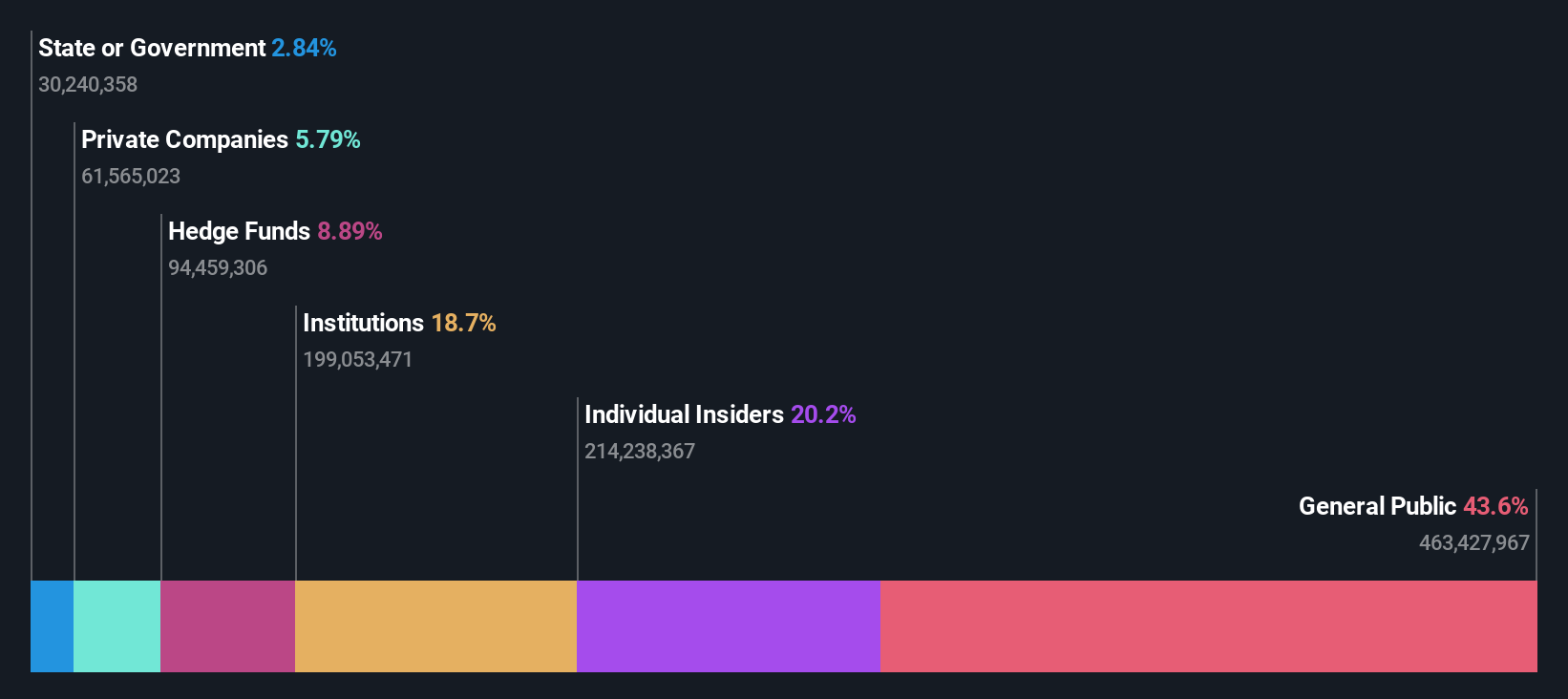

Insider Ownership: 20.2%

CVC Capital Partners is experiencing significant earnings growth, forecasted at 27.44% annually, outpacing the Dutch market's 12.6%. Despite a high debt level, it trades at an attractive valuation, 11.6% below its estimated fair value. Recent M&A activity includes potential acquisitions and divestments in the healthcare and telecommunications sectors. Insider ownership remains strong with no substantial insider trading reported recently, supporting confidence in its strategic direction amidst ongoing market maneuvers.

- Click here to discover the nuances of CVC Capital Partners with our detailed analytical future growth report.

- Our valuation report here indicates CVC Capital Partners may be overvalued.

NIBE Industrier (OM:NIBE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB (publ) is a company that, along with its subsidiaries, develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort and intelligent heating and control across Nordic countries, Europe, North America, and internationally; it has a market cap of approximately SEK83.16 billion.

Operations: The company's revenue segments consist of SEK3.86 billion from Stoves, SEK11.09 billion from Element, and SEK26.04 billion from Climate Solutions.

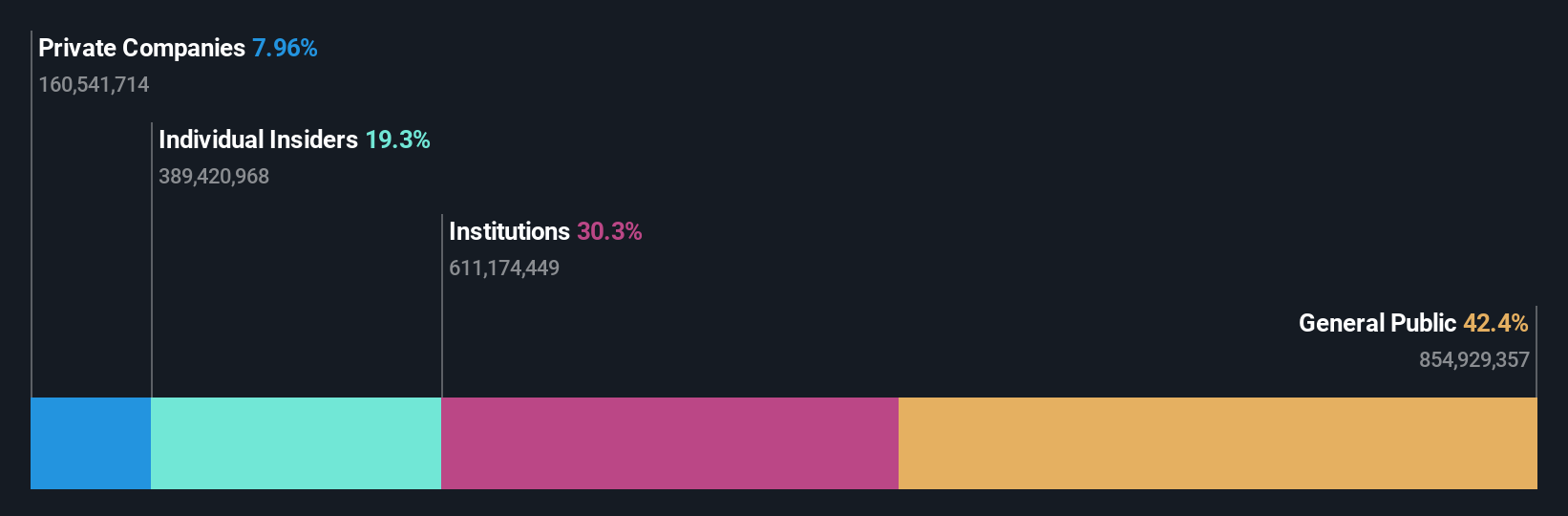

Insider Ownership: 20.2%

NIBE Industrier demonstrates robust earnings growth potential, forecasted at 27.6% annually, surpassing the Swedish market's 9.6%. Despite a recent dip in annual sales to SEK 40.52 billion and reduced profit margins from 10.3% to 2.9%, the company maintains strong insider ownership with no significant insider trading activity reported recently. However, interest payments are not well covered by earnings, and return on equity is expected to remain low at 10.7%.

- Delve into the full analysis future growth report here for a deeper understanding of NIBE Industrier.

- Upon reviewing our latest valuation report, NIBE Industrier's share price might be too optimistic.

Redcare Pharmacy (XTRA:RDC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Redcare Pharmacy NV operates as an online pharmacy across the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market cap of €2.51 billion.

Operations: The company generates revenue from two main segments: DACH, contributing €1.82 billion, and International, contributing €410.50 million.

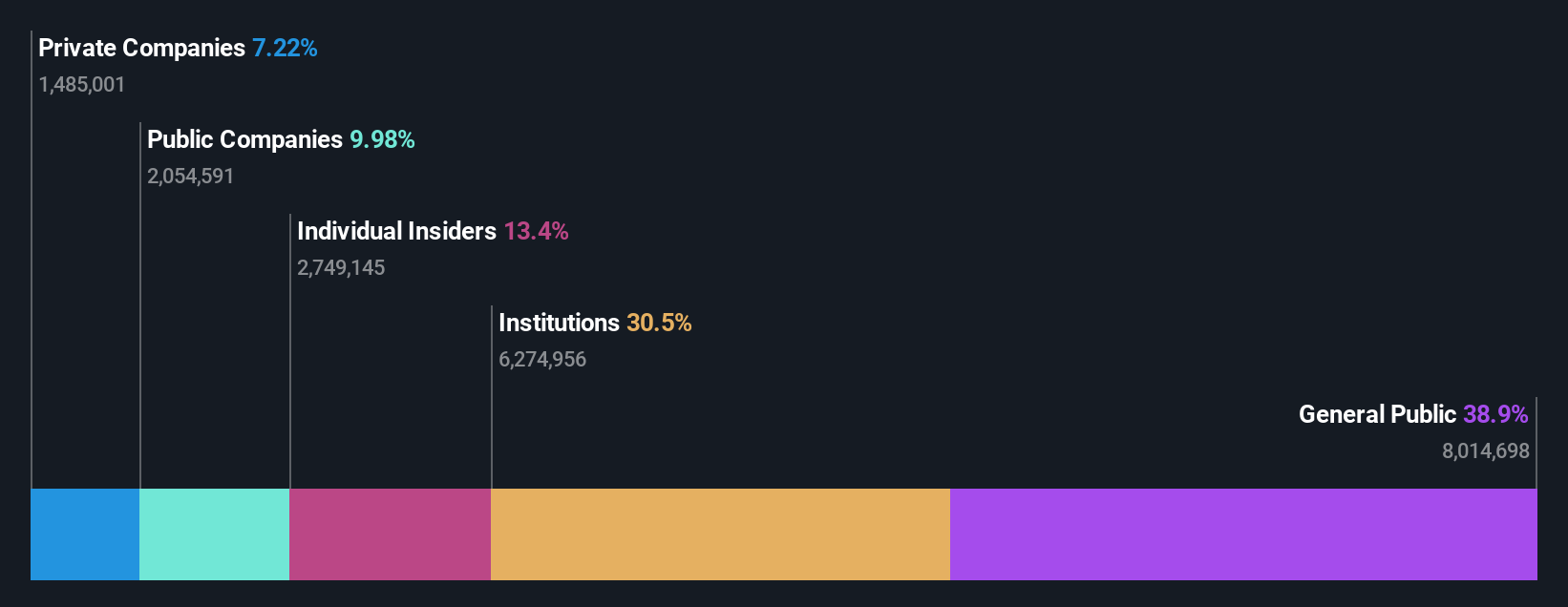

Insider Ownership: 11.7%

Redcare Pharmacy's revenue is forecast to grow at 16.3% annually, outpacing the German market's 5.8%, though slower than the ideal 20%. Earnings are expected to rise by 58.28% yearly, with profitability anticipated within three years, surpassing average market growth. Insider confidence is evident through substantial share purchases over the past three months and no significant sales. Trading significantly below estimated fair value enhances its appeal despite a low future return on equity forecast of 17%.

- Dive into the specifics of Redcare Pharmacy here with our thorough growth forecast report.

- Our valuation report unveils the possibility Redcare Pharmacy's shares may be trading at a premium.

Turning Ideas Into Actions

- Delve into our full catalog of 212 Fast Growing European Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RDC

Redcare Pharmacy

Operates in online pharmacy business in the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives