Munters Group (OM:MTRS): Valuation Insights Following Major US Battery Order and Q3 Results

Reviewed by Simply Wall St

Munters Group (OM:MTRS) just secured a USD 30 million contract from a US battery cell producer and published its third quarter results. This offers investors fresh insights into sales growth and profit trends.

See our latest analysis for Munters Group.

Munters Group’s latest contract win and quarterly update have arrived during a period of strong momentum for the shares, with a 41.6% share price return over the past month and 20.2% over the past three months. The one-year total shareholder return still sits at -6.4%. Over the longer term, investors have enjoyed a robust 89% total return in three years and 133% over five, reflecting underlying business strength and renewed interest in the sector after recent news.

If strategic moves like Munters’ latest deal have you thinking more broadly about market opportunities, it could be the perfect moment to discover fast growing stocks with high insider ownership

Given Munters’ surge in recent weeks and fresh order wins, investors may wonder if the current share price still offers value or if the market is already anticipating the next phase of growth.

Most Popular Narrative: 4.1% Undervalued

With Munters Group’s estimated fair value at SEK 169 per share, which is just ahead of the latest closing price of SEK 162, narrative followers see modest upside ahead, underpinned by sector tailwinds and robust profit expectations.

Enhanced focus on sustainability and energy efficiency, including innovation in green manufacturing, smart facilities (Amesbury flagship), and product leadership (for example, chillers 20% more efficient than competitors), is expected to drive incremental customer demand and enable premium pricing, boosting both revenue and net margin over time.

Want to see what powers this optimistic valuation? The narrative is built on aggressive profit margin expansion, recurring revenues, and long-term sector dominance. If you’re curious about which ambitious financial targets and market assumptions justify this price, the full story reveals the bold predictions that drive Munters’ fair value.

Result: Fair Value of $169 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased competition in the AI infrastructure supply chain and reliance on a few large clients could introduce volatility to Munters' growth outlook.

Find out about the key risks to this Munters Group narrative.

Another View: Multiplied Expectations

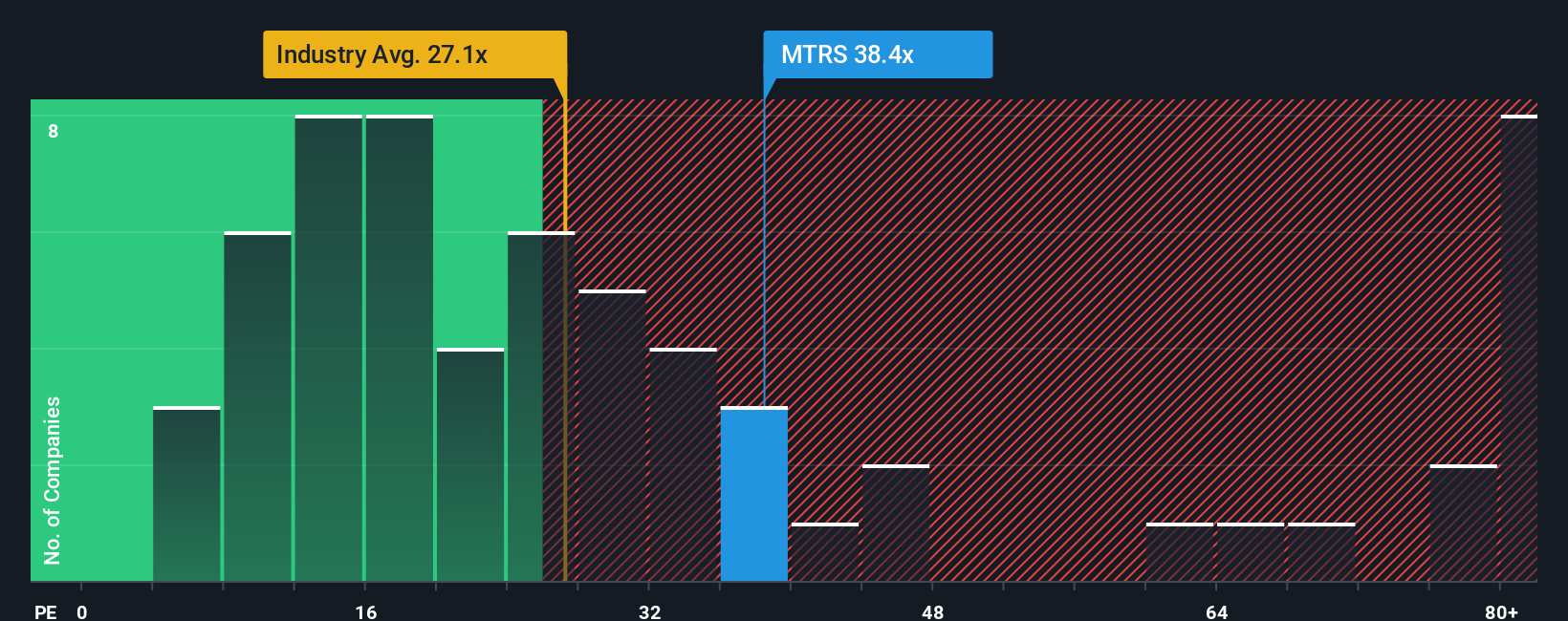

While our fair value estimate suggests Munters is undervalued, a look at the price-to-earnings ratio paints a different picture. Munters trades at 37.7 times earnings, noticeably higher than both the European Building industry average of 27.3x and the peer average of 25x. Although its ratio is below the market's fair ratio of 44.6x, this elevated multiple means investors are already paying up for future growth, which could limit upside if momentum slows. Will the company's execution justify this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Munters Group Narrative

If you want to dig into the numbers and challenge these views, you can assemble your own perspective in just a few minutes: Do it your way

A great starting point for your Munters Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Even More Opportunities?

Smart investors never stop searching for the next standout idea. Use Simply Wall Street’s Screener to find unique stocks that match your strategy before everyone else does.

- Capture the upside of tomorrow’s biggest tech trends when you jump into these 26 AI penny stocks, featuring AI-driven innovators shaking up every industry.

- Unlock potential high-yield returns and passive income streams by checking out these 22 dividend stocks with yields > 3%, which delivers consistent payouts above the standard market rate.

- Tap into hidden value and seek bargain opportunities with these 833 undervalued stocks based on cash flows, positioned for rebound and long-term growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MTRS

Munters Group

Provides climate solutions in the Americas, Europe, the Middle East, Africa, and Asia.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives