Munters Group (OM:MTRS) Is Up 16.0% After Securing $215 Million US Hyperscale Data Center Order

Reviewed by Sasha Jovanovic

- Munters Group recently announced it has received several orders from a US hyperscale client for custom-designed Computer Room Air Handlers valued at approximately US$215 million, with deliveries scheduled from late 2026 through early 2028.

- This multi-year contract represents a substantial expansion of Munters Group’s presence in the US data center market and highlights significant industry demand for advanced cooling solutions.

- We'll explore how the major hyperscale order underscores Munters Group's strengthening position in the fast-growing data center cooling industry.

Find companies with promising cash flow potential yet trading below their fair value.

Munters Group Investment Narrative Recap

To be a Munters Group shareholder, you need to believe in the ability of digital infrastructure growth, especially data centers, to offset margin pressures in other segments. The hyperscale US order can boost visibility for Data Center Technologies, but ongoing high leverage and margin compression in core businesses remain the key catalysts and risks to watch. The short-term outlook will hinge on whether execution on large-scale projects enhances earnings quality without exacerbating financial risk.

Of the recent announcements, the SEK 1 billion green bond issuance in September 2025 stands out. This move supports funding capacity for major orders like the new US deal, while signaling a commitment to sustainability initiatives, an area often cited as a driver for premium pricing and customer demand, and therefore a catalyst for future growth.

Yet, in contrast to this growth momentum, investors should be aware that persistent margin and cash flow pressure from regional mix shifts could...

Read the full narrative on Munters Group (it's free!)

Munters Group's outlook forecasts SEK18.7 billion in revenue and SEK1.5 billion in earnings by 2028. This implies a 4.6% annual revenue growth rate and a SEK684 million increase in earnings from the current SEK816 million.

Uncover how Munters Group's forecasts yield a SEK185.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

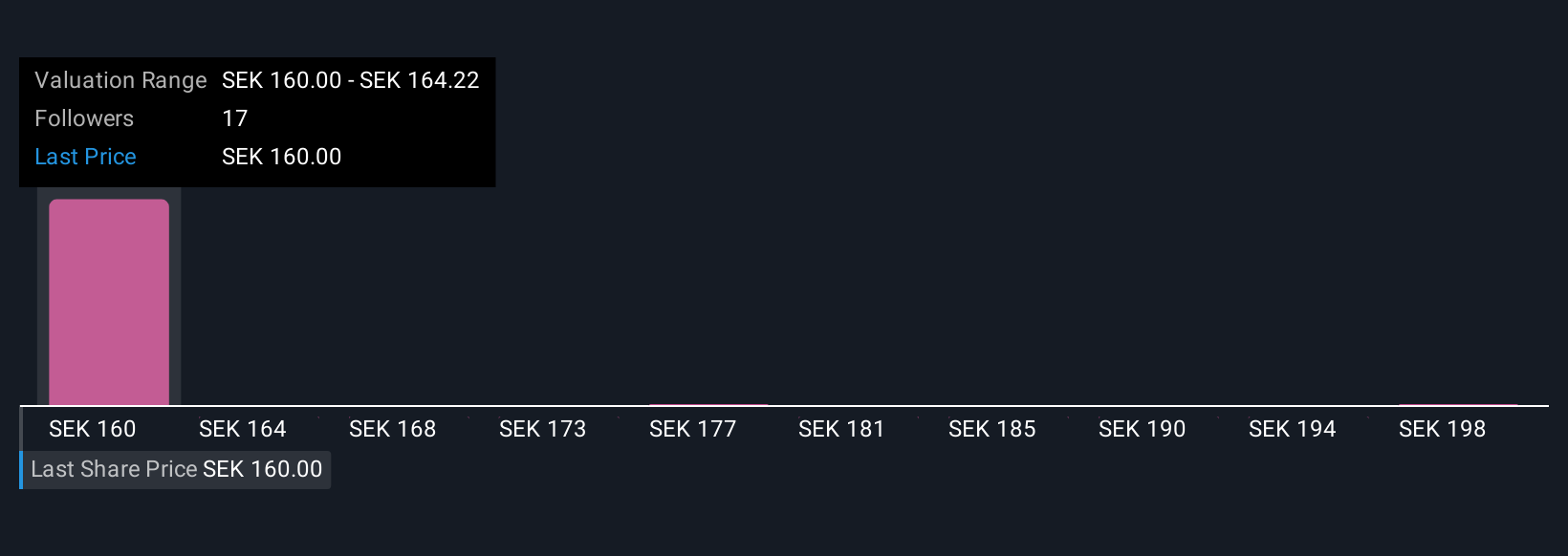

The Simply Wall St Community’s fair value estimates for Munters Group range from SEK163.00 to SEK202.22, with four unique viewpoints. While earnings are expected to grow rapidly, ongoing high leverage could still limit returns for shareholders, take a look at the range of perspectives yourself.

Explore 4 other fair value estimates on Munters Group - why the stock might be worth as much as 15% more than the current price!

Build Your Own Munters Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Munters Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Munters Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Munters Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MTRS

Munters Group

Provides climate solutions in the Americas, Europe, the Middle East, Africa, and Asia.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives