- Sweden

- /

- Aerospace & Defense

- /

- OM:MILDEF

MilDef Group AB (publ) (STO:MILDEF) Stock's 27% Dive Might Signal An Opportunity But It Requires Some Scrutiny

MilDef Group AB (publ) (STO:MILDEF) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 44% in the last year.

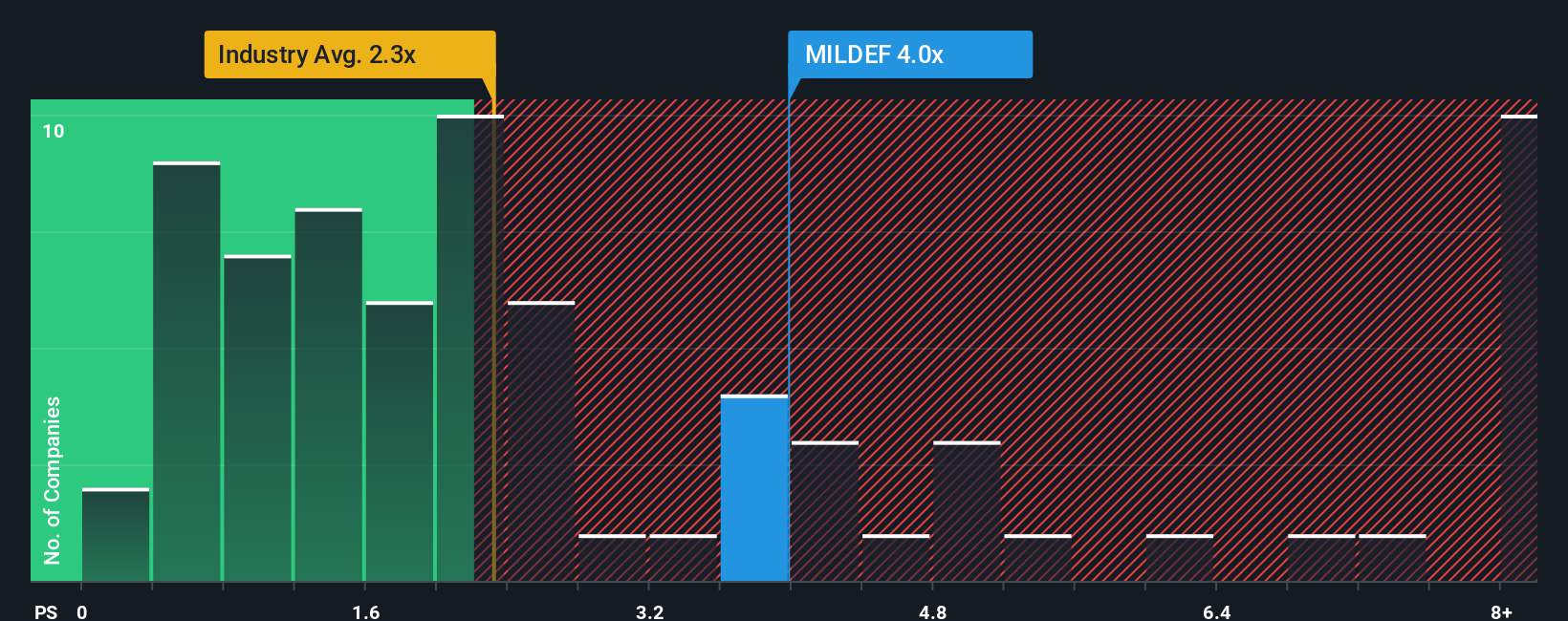

In spite of the heavy fall in price, there still wouldn't be many who think MilDef Group's price-to-sales (or "P/S") ratio of 4x is worth a mention when the median P/S in Sweden's Aerospace & Defense industry is similar at about 3.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for MilDef Group

How Has MilDef Group Performed Recently?

MilDef Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think MilDef Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is MilDef Group's Revenue Growth Trending?

MilDef Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 48%. The strong recent performance means it was also able to grow revenue by 169% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 64% as estimated by the three analysts watching the company. With the industry only predicted to deliver 22%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that MilDef Group is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Following MilDef Group's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, MilDef Group's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about this 1 warning sign we've spotted with MilDef Group.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:MILDEF

MilDef Group

Develops, manufactures, and sells rugged IT solutions in Sweden, Norway, Finland, Denmark, the United Kingdom, Germany, Switzerland, the United States, Australia, and internationally.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives