Electrolux Professional (OM:EPRO B): Assessing Valuation Following Weaker Q3 and Nine-Month 2025 Earnings Results

Reviewed by Simply Wall St

Electrolux Professional (OM:EPRO B) released its third quarter and nine-month 2025 results, showing lower sales and net income compared to last year. These earnings give investors a fresh look at recent business challenges and trends.

See our latest analysis for Electrolux Professional.

Following the earnings update, Electrolux Professional’s share price has seen some notable moves. A 1-day gain of just over 1% was quickly offset by a 7-day slide, though an 8% rise over the past month shows momentum remains in flux. Still, looking longer term, the total shareholder return is down almost 10% in the past year, but those holding steady over three and five years have seen impressive gains of 66% and 95% respectively, highlighting the stock’s resilience through cycles even as recent volatility reflects shifting market sentiment.

If you’re weighing what’s next or seeking new opportunities, this could be a great moment to discover fast growing stocks with high insider ownership.

With the shares currently trading at a sizable discount to analysts’ targets, investors now face a key question: is this an undervalued opportunity, or is the market already pricing in any future growth?

Most Popular Narrative: 11.7% Undervalued

According to the prevailing analyst narrative, Electrolux Professional’s fair value stands well above its last close. This suggests that the market may be overlooking potential upside. The story is framed by growth catalysts and business transformation.

Substantial investment in R&D (now approximately 5% of sales, up from around 3% three years ago) and the upcoming launch of new, higher-value, energy-efficient, and connected products is expected to expand gross margins and net earnings. This aligns with increased customer focus on sustainability and efficiency.

A revenue surge is being driven by new technologies, an emphasis on recurring income, and the goal of achieving sector-leading profit margins. The narrative’s fair value is based on ambition and confident projections. Interested in which financial leap could significantly shift sentiment? Explore the critical assumption and form your own judgment.

Result: Fair Value of $75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency volatility or rising operational costs could jeopardize Electrolux Professional’s margin improvement narrative and undermine expected future earnings growth.

Find out about the key risks to this Electrolux Professional narrative.

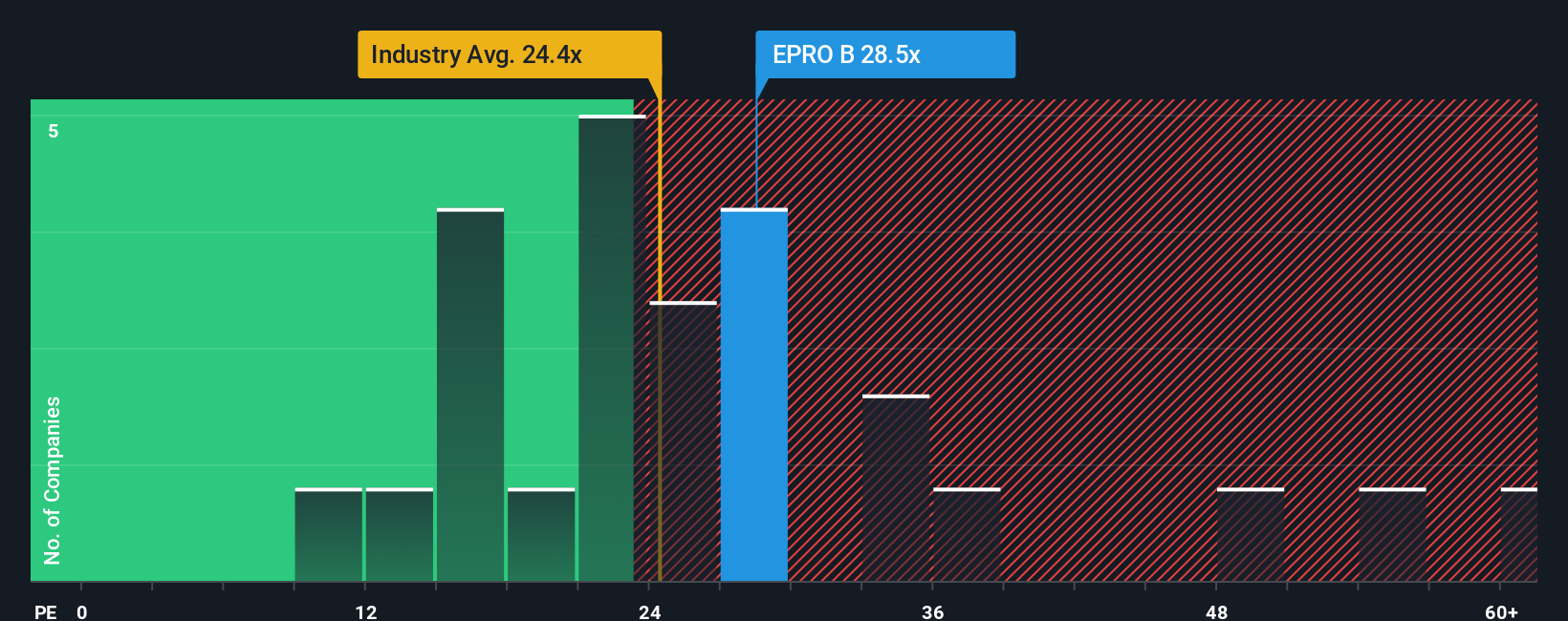

Another View: Market Multiples Tell a Different Story

Taking a closer look at Electrolux Professional’s valuation using earnings multiples, we see a less optimistic take. Its price-to-earnings ratio stands at 28.4x, which is higher than both its industry average of 24.6x and a fair ratio of 26x. This suggests investors may be attaching a growth premium that is not yet proven, or pricing in future potential ahead of reality. Could the market be overestimating what comes next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Electrolux Professional Narrative

If you see things differently or want to dive deeper yourself, you can easily build your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Electrolux Professional.

Looking for more investment ideas?

Expand your investment approach and seize unique growth opportunities by using the Simply Wall Street Screener. Missing out could mean overlooking the next big winner.

- Grow your portfolio’s future potential by checking out these 26 AI penny stocks as these stocks harness artificial intelligence to disrupt entire industries.

- Boost your passive income prospects with these 22 dividend stocks with yields > 3%, which delivers yields above 3% and steady cash returns.

- Capitalize on early-stage opportunities by viewing these 3580 penny stocks with strong financials, combining solid financials with compelling growth stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electrolux Professional might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EPRO B

Electrolux Professional

Provides food service, beverage, and laundry products and solutions to restaurants, hotels, healthcare, educational, and other service facilities.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives