- Sweden

- /

- Construction

- /

- OM:ELTEL

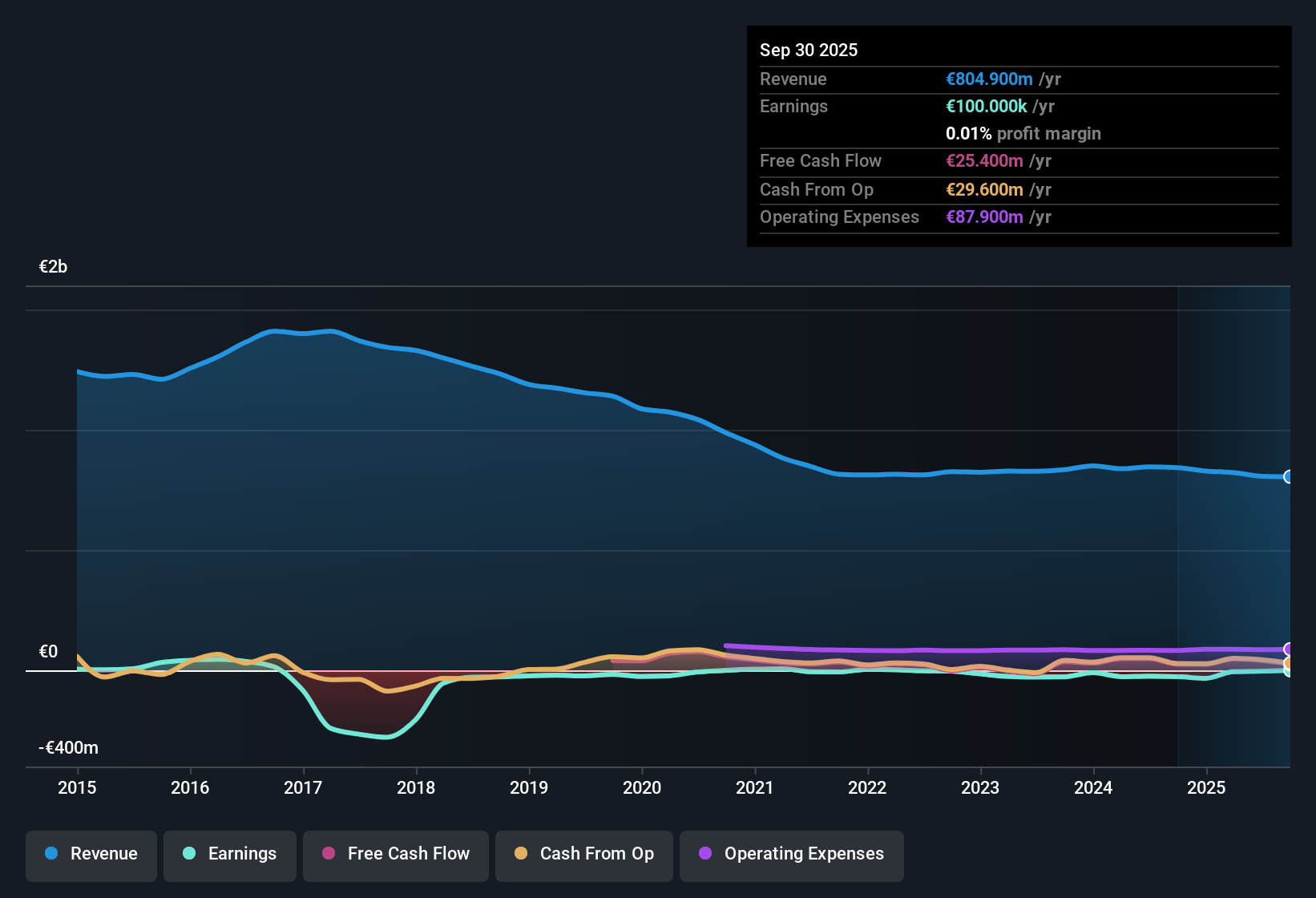

Eltel (OM:ELTEL): Losses Widen by 43.1% Annually, Investors Eye Path to Profitability

Reviewed by Simply Wall St

Eltel (OM:ELTEL) remains unprofitable, with losses widening at an average annual rate of 43.1% over the past five years. While revenue is forecast to grow by 2.6% per year, slower than the Swedish market average of 3.8%, earnings are projected to accelerate sharply at 92.92% per year with expectations for a return to profitability within the next three years. With no major or minor risks noted and strong growth in earnings anticipated, investor focus is likely to center on Eltel’s discounted valuation and outlook for a significant turnaround.

See our full analysis for Eltel.The next section will examine how this latest set of numbers compares to the widely discussed narratives among investors. Some beliefs may be confirmed, while others could be challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Sales Ratio Sits Far Below Peers

- Eltel’s Price-to-Sales ratio is 0.2x, less than half the European Construction industry average of 0.5x and far below the peer group average of 1.6x.

- This strongly supports the narrative that Eltel could draw investor attention as a potential bargain opportunity, given such a low valuation relative to both the industry and direct competitors.

- At this discount, bulls might expect renewed buying interest if management makes meaningful progress on the shift to profitability.

- However, there is a tension here because recent years’ losses have kept sentiment muted even at discounted multiples.

DCF Fair Value Nearly Doubles Current Share Price

- Eltel’s DCF fair value is SEK20.75 per share, while the current market price is SEK8.94. This implies the stock trades at a significant discount to modeled intrinsic value.

- This deep undervaluation adds weight to optimistic cases that see scope for a sharp re-rating if Eltel delivers on its path back to profitability.

- Bulls point to the 92.92% expected annual earnings growth as a major potential driver for upside, provided it is delivered alongside this discount.

- However, actual margin improvement is required to realize this value, so investors focused on timing the turnaround will want to watch for early progress on fundamentals.

No Material Risks Flagged in Data Inputs

- There are no major or minor risks flagged for Eltel in the currently available data.

- It is notable that, despite the lack of identified operational risks, Eltel still trades at a heavy discount. This reflects persistent skepticism around its recent multi-year loss trend and inconsistent net profit margins.

- This could create room for rapid sentiment shifts, as some investors may move quickly if clear signs of sustainable profitability emerge.

- On the other hand, any setback in narrowing losses or failing to deliver on profit guidance could leave the discount in place for longer than bulls hope.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Eltel's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Eltel’s discounted valuation and high earnings growth forecast, its widening multi-year losses and inconsistent margins remain a persistent concern for investors.

If you prefer businesses with a proven record of steady expansion and less uncertainty, find stronger performers through our stable growth stocks screener (2101 results) screener for greater stability and confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eltel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ELTEL

Eltel

Operates as an infrastructure and service provider for critical communication and power networks in Finland, Sweden, Norway, Denmark, Lithuania, Germany, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives