- Sweden

- /

- Trade Distributors

- /

- OM:BEIJ B

Earnings Beat and GMG Partnership Could Be a Game Changer for Beijer Ref (OM:BEIJ B)

Reviewed by Sasha Jovanovic

- Beijer Ref reported third-quarter earnings with sales of SEK 9.73 billion and net income of SEK 732 million, both higher than the prior year, while also posting an increase in year-to-date financial results through September 2025.

- Additionally, GMG announced an agreement for Beijer Ref to offer its proprietary THERMAL-XR® ENHANCE heat transfer coating in Australia, potentially strengthening Beijer Ref's sustainability profile and product offering in the HVAC-R market.

- We'll assess how the earnings improvements and expansion of GMG’s heat transfer coating could influence Beijer Ref’s growth outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Beijer Ref Investment Narrative Recap

To be a shareholder in Beijer Ref, you really need to believe in the company's ability to capitalize on the accelerating transition to sustainable HVAC-R solutions and maintain profitable growth amidst regulatory shifts. The recent quarterly earnings improvement reinforces the view that Beijer Ref is executing well on revenue and earnings expansion, while the THERMAL-XR® ENHANCE collaboration in Australia offers a meaningful extension of its green portfolio. However, neither event appears significant enough to shift the most important immediate catalyst, successful rollout and scaling of new low-GWP refrigerant products in key regions, or to materially reduce its biggest current risk from inventory management and ongoing refrigerant transitions.

Among recent announcements, the launch of Beijer Ref's offer of GMG’s THERMAL-XR® ENHANCE at 73 Australian branches is particularly relevant, since it underscores the momentum behind sustainable product initiatives that could support continued growth and differentiation, especially as regulations tighten and customers seek more energy-efficient cooling solutions. While relevant, this move complements but does not replace the crucial importance of executing inventory and supply chain transitions smoothly as lower-GWP product rollouts intensify in the months ahead.

But with continued industry and regulatory change, investors should also be aware of the contrast between expanding green innovations and lingering risks related to inventory write-downs and supply chain...

Read the full narrative on Beijer Ref (it's free!)

Beijer Ref's narrative projects SEK43.9 billion revenue and SEK3.5 billion earnings by 2028. This requires 5.5% yearly revenue growth and a SEK1.1 billion earnings increase from SEK2.4 billion today.

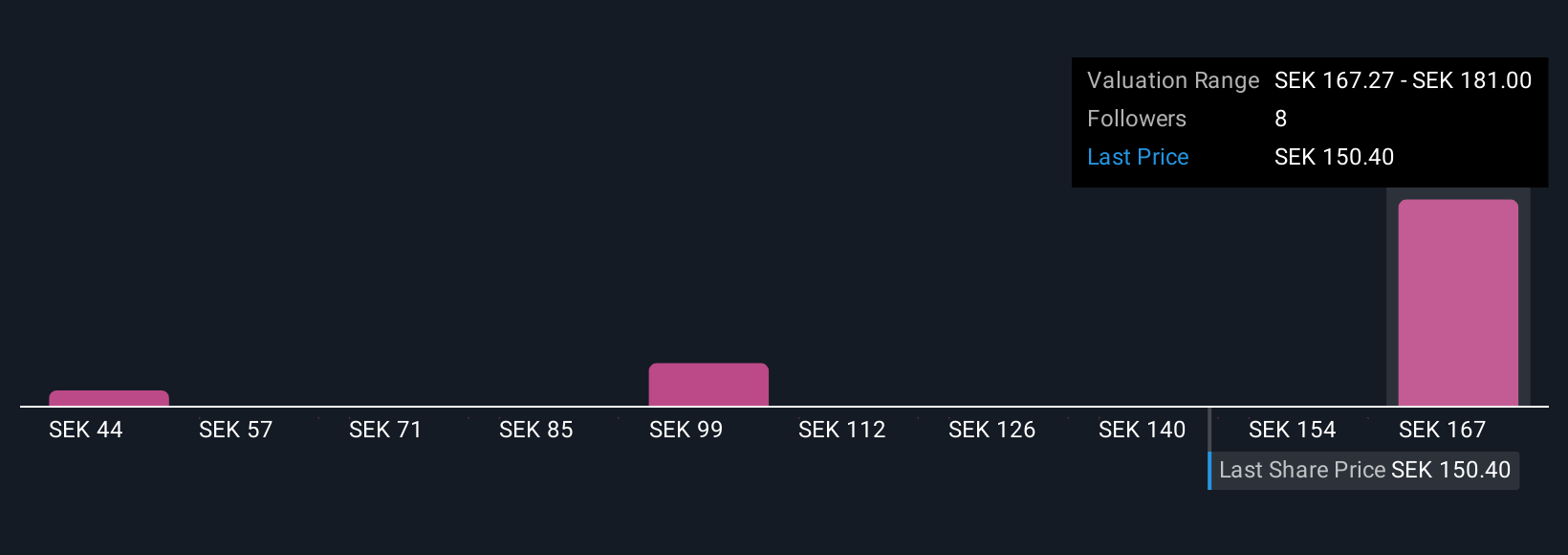

Uncover how Beijer Ref's forecasts yield a SEK181.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members assign Beijer Ref fair values from SEK43.68 up to SEK181, based on three unique forecasts. While investor opinions vary widely, many keep a close eye on execution risks as new environmental regulations accelerate, which could influence the company’s performance in the quarters ahead.

Explore 3 other fair value estimates on Beijer Ref - why the stock might be worth less than half the current price!

Build Your Own Beijer Ref Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beijer Ref research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Beijer Ref research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beijer Ref's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijer Ref might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BEIJ B

Beijer Ref

Provides commercial and industrial refrigeration, heating, and air conditioning products worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives