Beijer Alma (OM:BEIA B): Valuation Perspectives After Q3 Sales Growth and Profit Decline

Reviewed by Simply Wall St

Beijer Alma (OM:BEIA B) just released its third quarter 2025 earnings, showing a rise in sales compared to last year. However, net income dipped from previous levels. This combination caught the attention of investors and drove a noticeable response in the stock.

See our latest analysis for Beijer Alma.

The Q3 earnings report set the tone for Beijer Alma’s recent momentum, with shares climbing more than 18% over the past month as investors weighed the growth in sales against a dip in profits. Looking at the bigger picture, the stock’s 77% year-to-date share price return and 75% total shareholder return over the last twelve months suggest long-term confidence may be building despite short-term volatility.

If you’re keen to spot what else is drawing strong interest from investors lately, consider expanding your view and discover fast growing stocks with high insider ownership

So with shares already up sharply and strong sales being offset by falling profits, is Beijer Alma trading below its true value, or is the market fully accounting for all its future potential?

Most Popular Narrative: 4.6% Undervalued

Beijer Alma's most widely followed narrative sets a fair value of SEK305, slightly higher than its last close of SEK291. This suggests the market may still be catching up with consensus projections. Optimism may be warranted if the company's strategic expansion and modernization proceed as anticipated.

The ongoing global acceleration in industrial automation and smart manufacturing is increasing demand for precision and engineered components. Beijer Alma's continued expansion, for example, investments in higher-capacity production lines to meet excess demand and diversification into high-value sectors like rail, positions the company to capture elevated order volumes and drive future revenue growth. The global trend toward sustainability and lightweight, energy-efficient components is expected to enhance Beijer Alma's new customer acquisition and pricing power, as evidenced by the company's strong order inflows and factory expansions in segments such as bus windows and rail springs, supporting margin expansion and topline growth.

Want to know what revenue and margin growth assumptions are behind this bullish fair value? The secret: the narrative features bold, multi-year projections and an ambitious rerating in profitability. Discover what’s fueling this calculated optimism and see which future catalysts could turn this slight undervaluation into reality.

Result: Fair Value of SEK305 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy exposure to cyclical end-markets and ongoing challenges with recent acquisitions could threaten Beijer Alma's growth story if these risks continue.

Find out about the key risks to this Beijer Alma narrative.

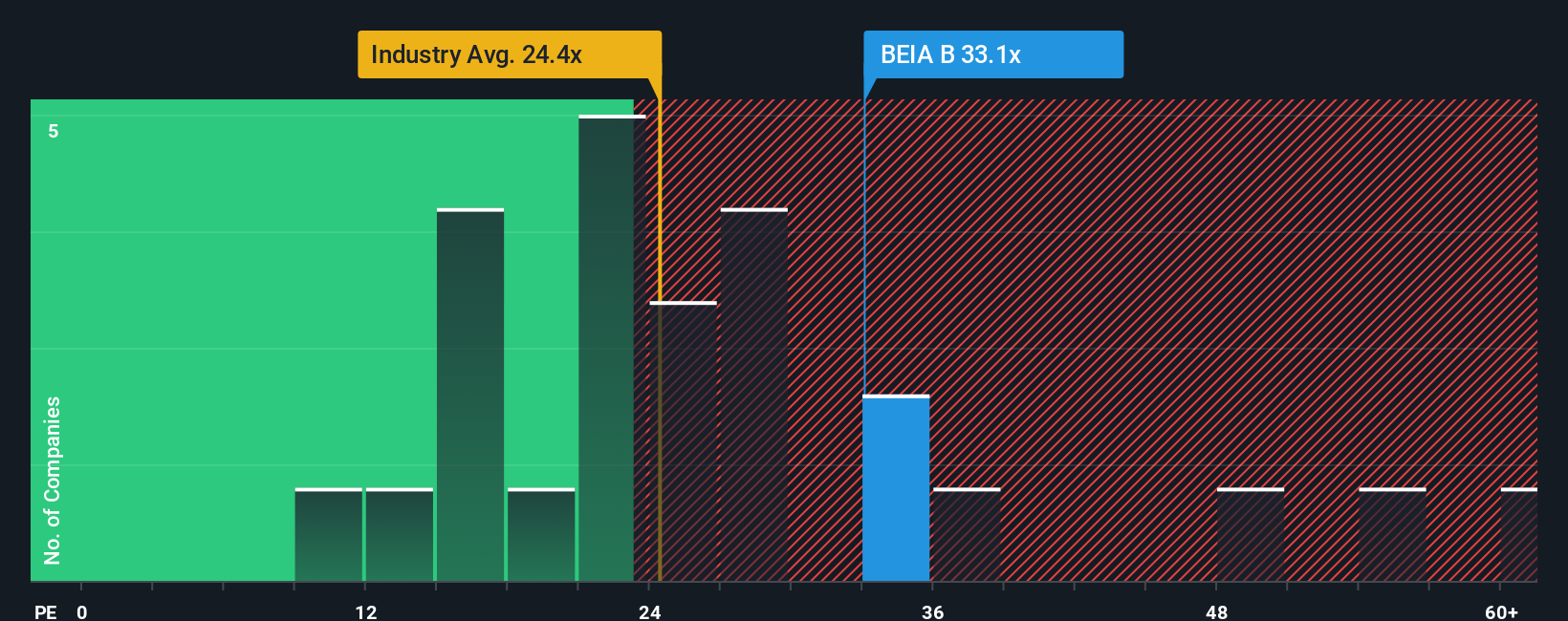

Another View: Market Multiples Raise Questions

Yet, when we look at Beijer Alma's valuation through its price-to-earnings ratio, some caution flags emerge. At 32.7x, the company trades well above both the Swedish Machinery industry average of 24.6x and peers at 27.6x, as well as the fair ratio of 27.7x. This premium could expose investors to downside risk if expectations are not met. Is the current share price running ahead of fundamentals, or is there more upside left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beijer Alma Narrative

If you want a different perspective or believe there's another story behind the numbers, you can create your own narrative using the same data in just a few minutes. Do it your way

A great starting point for your Beijer Alma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Uncover trends, spot value, and get a jump on compelling companies using unique strategies on the Simply Wall Street Screener.

- Unlock stable cash flow potential by checking out these 22 dividend stocks with yields > 3% offering attractive yields and reliable income streams in today’s market.

- Catalyze your portfolio’s innovation with these 26 AI penny stocks that are shaping tomorrow’s industries through machine learning, automation, and advanced analytics.

- Take advantage of overlooked opportunities and hunt for low-priced gems with these 3580 penny stocks with strong financials that combine growth potential and strong financial fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijer Alma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BEIA B

Beijer Alma

Engages in component manufacturing and industrial trading businesses in Sweden, rest of Nordic Region, rest of Europe, North America, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives