Is Alfa Laval and Lund University's Sustainability Partnership Redefining the Investment Case for OM:ALFA?

Reviewed by Sasha Jovanovic

- Alfa Laval and Lund University recently announced a new formalized strategic partnership aimed at fostering interdisciplinary research and enhancing collaboration between academia and industry, with a strong focus on tackling global challenges and sustainability.

- An important aspect is Lund University's reputation for sustainability and research funding, which positions this alliance to drive innovation and measurable progress in areas crucial to both industrial and societal transformation.

- We'll now examine how Alfa Laval's updated financial guidance and robust third-quarter results shape the company's investment narrative in light of this partnership.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Alfa Laval Investment Narrative Recap

Owning Alfa Laval is about believing in its ability to harness innovation, sustainability, and global collaboration to drive long-term growth. While the new partnership with Lund University reinforces Alfa Laval’s commitment to sustainability and research leadership, this alliance does not materially shift the most important short-term catalyst, conversion of energy transition projects into tangible revenue, nor does it offset the main risk of cyclical volatility in key industrial end-markets.

Of recent announcements, Alfa Laval’s raised guidance for annual sales growth appears most relevant. The updated outlook reflects confidence in execution and an expanding market reach, but it remains closely tied to broader trends in energy transition investments, which continue to be the primary driver as well as a source of ongoing uncertainty.

Yet, despite this optimism, investors should not overlook the continuing exposure to cyclical end-markets and how it may...

Read the full narrative on Alfa Laval (it's free!)

Alfa Laval's outlook projects SEK77.3 billion in revenue and SEK9.6 billion in earnings by 2028. This is based on an assumed 4.5% annual revenue growth rate and reflects a SEK1.6 billion increase in earnings from the current SEK8.0 billion.

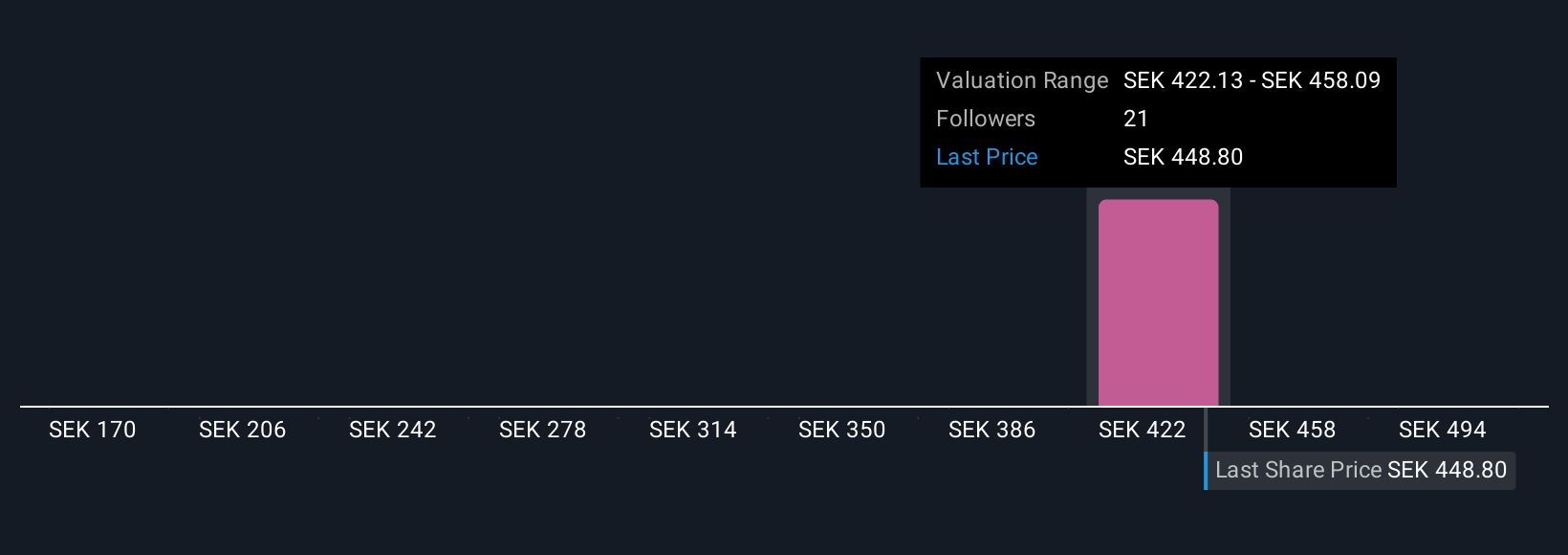

Uncover how Alfa Laval's forecasts yield a SEK452.29 fair value, in line with its current price.

Exploring Other Perspectives

The Simply Wall St Community’s four fair value estimates for Alfa Laval span from SEK390.14 to SEK530 per share, highlighting a broad range of investor views. While many anticipate growth aligned with the company’s raised sales targets, the persistent risk from slow project conversions could impact these expectations, reminding you to compare multiple perspectives before making decisions.

Explore 4 other fair value estimates on Alfa Laval - why the stock might be worth as much as 17% more than the current price!

Build Your Own Alfa Laval Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alfa Laval research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alfa Laval research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alfa Laval's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ALFA

Alfa Laval

Provides heat transfer, separation, and fluid handling products and solutions worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives