Alfa Laval (OM:ALFA): Evaluating Valuation After Landmark EDF Nuclear Partnership Expansion

Reviewed by Simply Wall St

Alfa Laval (OM:ALFA) just extended its decades-long alliance with EDF to help build France’s next wave of nuclear reactors. The companies are rolling out advanced heat exchanger technology and a standardized approach, which are designed to speed up clean energy projects.

See our latest analysis for Alfa Laval.

Alfa Laval’s latest partnership expansion with EDF arrives on the heels of fresh collaborations in both energy and academia, reflecting a clear focus on strategic growth. The share price is up nearly 9% over the last 90 days as investors have responded to these innovation-driven moves. Its one-year total shareholder return sits just above zero, reinforcing Alfa Laval’s long-term strength and significant 61% total return over three years.

If you’re interested in discovering more companies innovating in heavy industry and capital goods, now is the perfect moment to explore See the full list for free..

But with shares near their all-time highs and future growth already in focus, the question is whether Alfa Laval is now trading at an attractive price for investors or if the market has fully accounted for its next steps.

Most Popular Narrative: 2.1% Undervalued

Alfa Laval’s widely followed narrative places its fair value just above the current share price, drawing a close line between analyst optimism and prevailing market prices.

The strategic shift towards service-oriented offerings is delivering all-time-high service order intake, now above 30% of group sales and 40% in Marine. This is structurally increasing the stable, high-margin, recurring revenue base, thereby supporting long-term margin expansion and greater earnings resilience.

Curious about what’s really driving this edge in fair value? Major profitability upgrades, margin expansion, and a focus on services are just the starting points. Which financial forecasts tipped the balance to a higher price target? You may be surprised by the numbers behind the headline.

Result: Fair Value of $465.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressure and potential delays in major energy transition projects remain key risks that could quickly alter Alfa Laval’s current valuation story.

Find out about the key risks to this Alfa Laval narrative.

Another View: What Do Multiples Say?

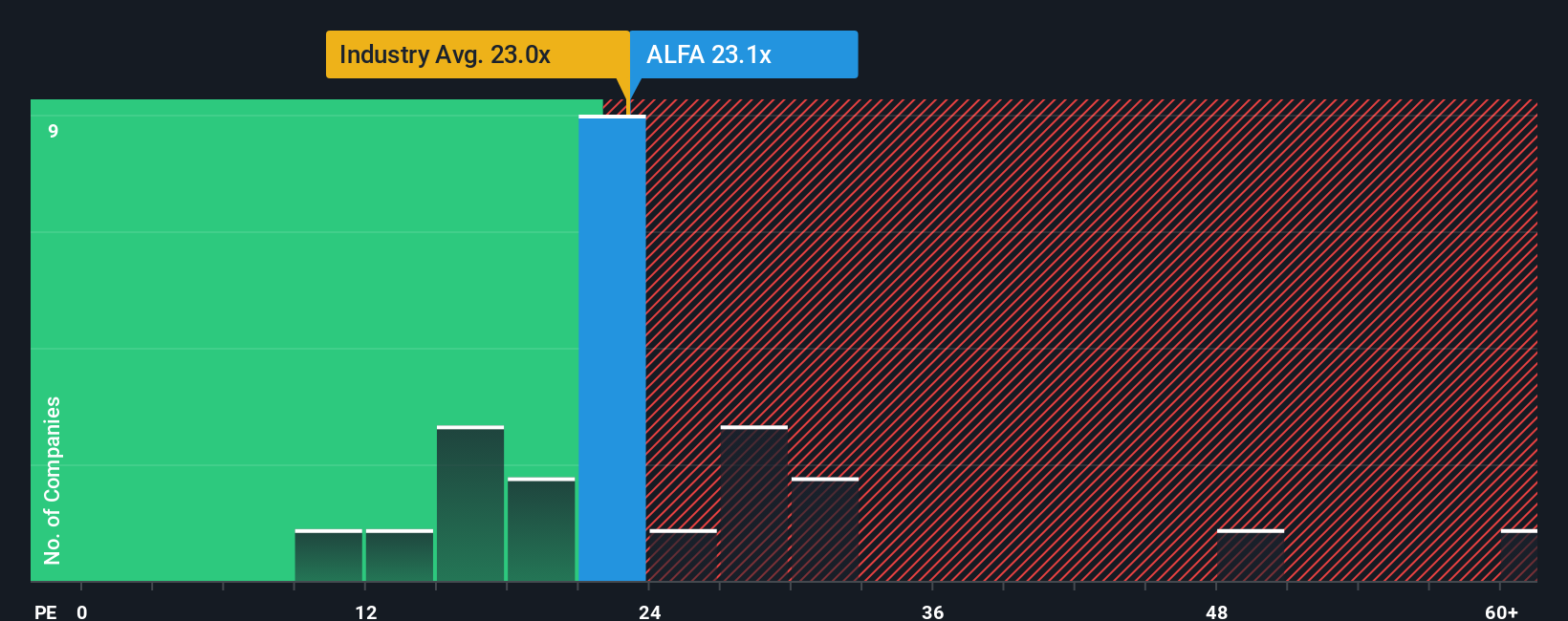

Looking at Alfa Laval’s current valuation through the lens of its price-to-earnings ratio provides a second angle. The company trades at 22.6 times earnings, which is cheaper than the Swedish Machinery industry average of 24.4x and the peer average of 26.2x. However, this is slightly above its fair ratio of 22.3x, suggesting the market could be nearing a ceiling. Does this value gap signal more upside, or is the easy money already made?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alfa Laval Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own story in just a few minutes. So why not Do it your way?

A great starting point for your Alfa Laval research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait to make your next smart move. Let Simply Wall Street’s handpicked stock ideas help you spot the opportunities others might be missing right now.

- Unlock fresh growth potential and get ahead of the market by starting with these 872 undervalued stocks based on cash flows for companies boasting attractive valuations.

- Tap into the rising healthcare technology wave by checking out these 32 healthcare AI stocks that are harnessing advanced AI for the future of medicine.

- Maximize your income strategy with these 15 dividend stocks with yields > 3% offering strong yields and reliable payouts that can strengthen any portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ALFA

Alfa Laval

Provides heat transfer, separation, and fluid handling products and solutions worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives