- Italy

- /

- Electric Utilities

- /

- BIT:EVISO

eVISO And 2 Promising Small Caps In Europe

Reviewed by Simply Wall St

The European markets have recently faced downward pressure, with the pan-European STOXX Europe 600 Index dropping by 1.54% amid geopolitical concerns and economic uncertainties. Despite these challenges, small-cap stocks continue to attract attention as potential growth opportunities due to their capacity for innovation and agility in adapting to changing market conditions. In this context, identifying promising small-cap companies like eVISO can offer unique insights into untapped investment potential within Europe's dynamic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

eVISO (BIT:EVISO)

Simply Wall St Value Rating: ★★★★★★

Overview: eVISO S.p.A. operates a platform utilizing artificial intelligence for the commodities market, primarily in Italy, with a market capitalization of €232.66 million.

Operations: eVISO S.p.A. generates revenue through its AI-driven platform focused on the commodities market in Italy, with a market capitalization of €232.66 million.

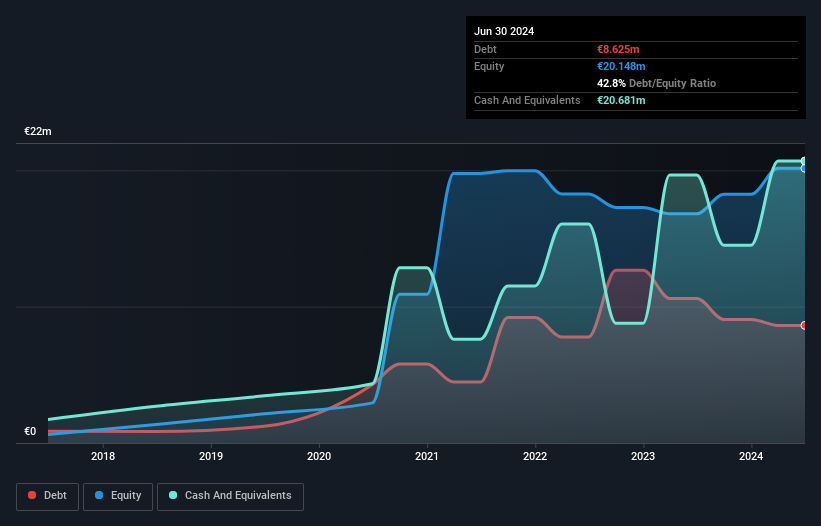

eVISO, a dynamic player in the European market, has shown impressive earnings growth of 178% over the past year, outpacing the Electric Utilities industry average. The company's debt to equity ratio improved significantly from 109.1% to 44.7% over five years, indicating stronger financial health. Trading at approximately 15% below its estimated fair value suggests potential for investors seeking undervalued opportunities. Recent announcements reveal that for the half-year ending December 31, 2024, eVISO's sales jumped to €170 million from €109 million year-over-year while net income rose to €3.51 million from €2.41 million, reflecting robust performance and promising future prospects with forecasted earnings growth of around 32%.

- Get an in-depth perspective on eVISO's performance by reading our health report here.

Gain insights into eVISO's past trends and performance with our Past report.

Plejd (NGM:PLEJD)

Simply Wall St Value Rating: ★★★★★★

Overview: Plejd AB (publ) is a technology company that specializes in developing smart lighting control products and services, operating in Sweden, Norway, Finland, the Netherlands, Germany, and other international markets with a market cap of SEK7.38 billion.

Operations: Plejd generates revenue primarily from its electronic security devices segment, amounting to SEK839.34 million. The company's market capitalization stands at approximately SEK7.38 billion.

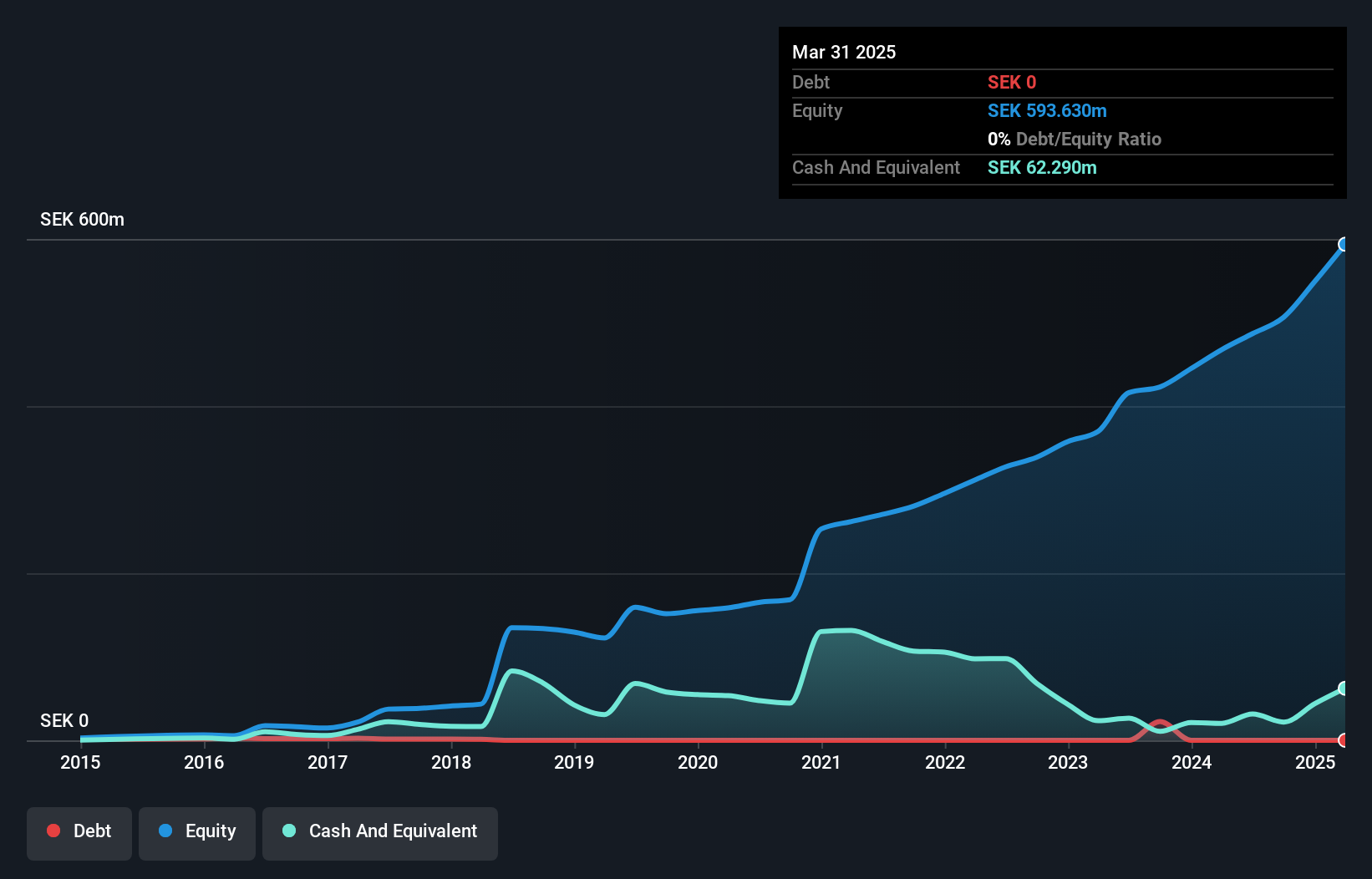

Plejd shines as a nimble player in the electrical industry, boasting impressive earnings growth of 130.1% over the past year, outpacing its sector's -44.9%. This Swedish company is debt-free, which underscores its financial health and stability. Plejd's recent quarterly results reveal sales of SEK 253 million and net income of SEK 45 million, both significantly higher than last year's figures. With basic earnings per share doubling to SEK 4.02 from SEK 2.03, it seems poised for further growth with forecasted annual earnings expansion at 28%. However, recent insider selling could be a point to watch closely.

- Click here to discover the nuances of Plejd with our detailed analytical health report.

Evaluate Plejd's historical performance by accessing our past performance report.

Burkhalter Holding (SWX:BRKN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Burkhalter Holding AG, with a market cap of CHF1.34 billion, operates through its subsidiaries to deliver electrical engineering services mainly to the construction industry in Switzerland.

Operations: Burkhalter Holding generates revenue primarily from electrical engineering services, amounting to CHF1.16 billion.

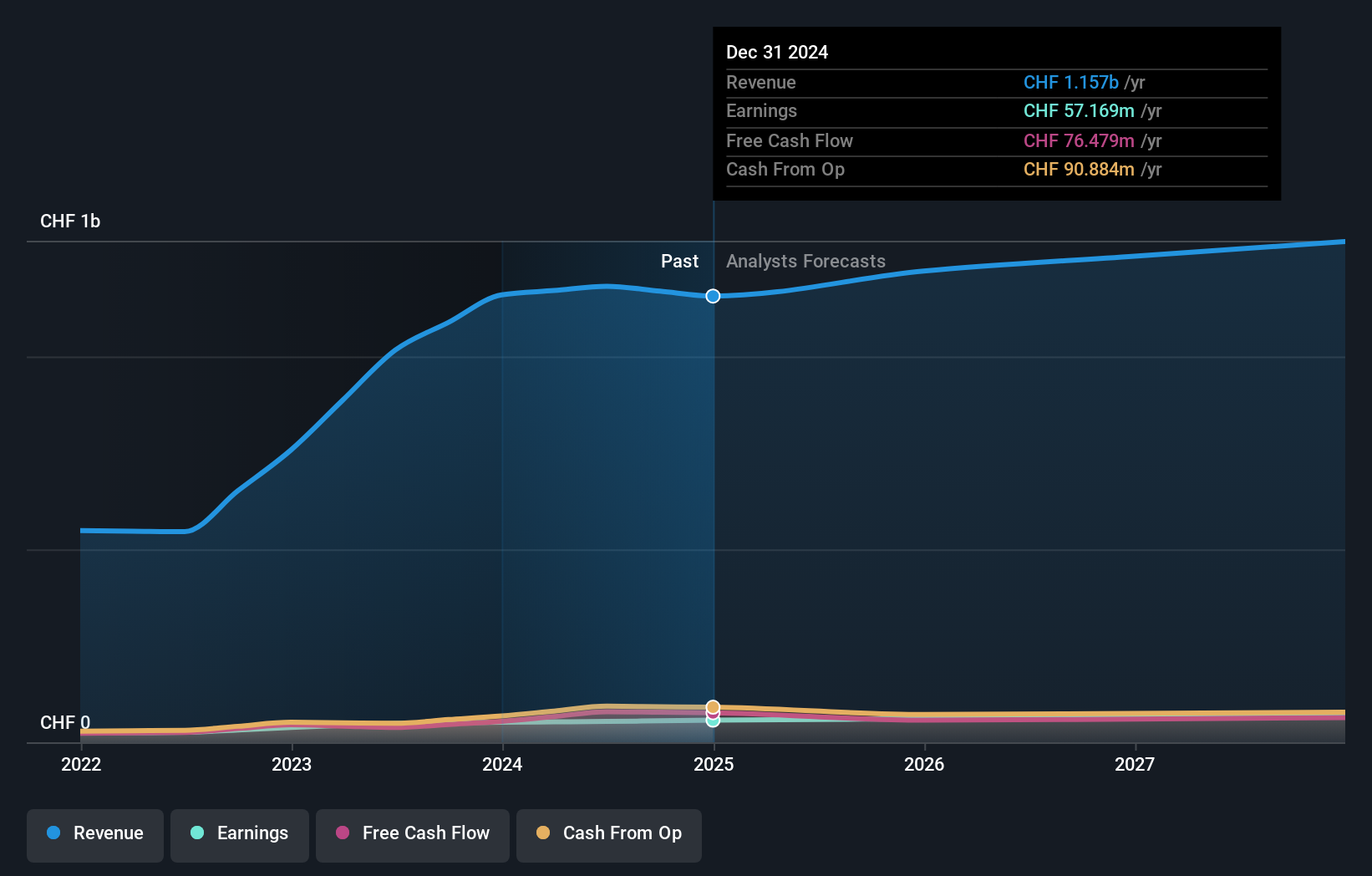

Burkhalter Holding, a notable player in the construction sector, has delivered impressive results with earnings growth of 10.2% over the past year, surpassing the industry average of 5.6%. The company's net income rose to CHF 57.17 million from CHF 51.87 million last year, reflecting its robust financial health. Trading at nearly 10% below fair value estimates suggests potential upside for investors seeking value opportunities. Despite an increased debt-to-equity ratio from 14.8% to 37.5% over five years, Burkhalter's interest payments are well-covered by EBIT at an impressive multiple of 58x, indicating solid financial management and stability in operations.

- Delve into the full analysis health report here for a deeper understanding of Burkhalter Holding.

Examine Burkhalter Holding's past performance report to understand how it has performed in the past.

Where To Now?

- Reveal the 335 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:EVISO

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives