How Lower Fee and Commission Income at Skandinaviska Enskilda Banken (OM:SEB A) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Skandinaviska Enskilda Banken AB (SEB) recently reported that its third-quarter net income fell to SEK 7.68 billion, down from SEK 9.45 billion the previous year, with earnings per share also lower for both the quarter and the nine-month period ending September 30, 2025.

- The primary drivers of the earnings decline were lower net fee, commission, and financial income, offsetting a small increase in net interest income, while SEB maintained low credit costs and a cost-to-income ratio of 41%.

- We’ll explore how decreased net fee and commission income in SEB’s latest earnings may alter the company’s investment narrative and outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Skandinaviska Enskilda Banken Investment Narrative Recap

To be a shareholder in Skandinaviska Enskilda Banken (SEB), you need to believe in the bank’s ability to drive long-term value through growth in fee and commission income, particularly from its Corporate & Investment Banking division, all while maintaining tight cost controls. The latest earnings report shows continued weakness in these revenue streams, which may put pressure on the most important short-term catalyst, customer fee generation, though the impact on the fundamental risk of market-driven revenue volatility remains largely unchanged for now.

Among recent announcements, SEB’s advisory role in TRATON GROUP’s first green finance framework stands out. While not directly tied to the earnings miss, this engagement highlights the bank’s capacity to broaden its service offerings and attract new fee-based opportunities, supporting ongoing efforts to increase non-interest income, a key focus given the importance of growing revenue per client relationships.

In contrast, while cost control remains strong and credit costs are low, the real issue investors should be aware of is...

Read the full narrative on Skandinaviska Enskilda Banken (it's free!)

Skandinaviska Enskilda Banken is projected to deliver SEK82.7 billion in revenue and SEK32.9 billion in earnings by 2028. This outlook assumes annual revenue growth of 1.7% and a SEK0.1 billion decrease in earnings from the current SEK33.0 billion.

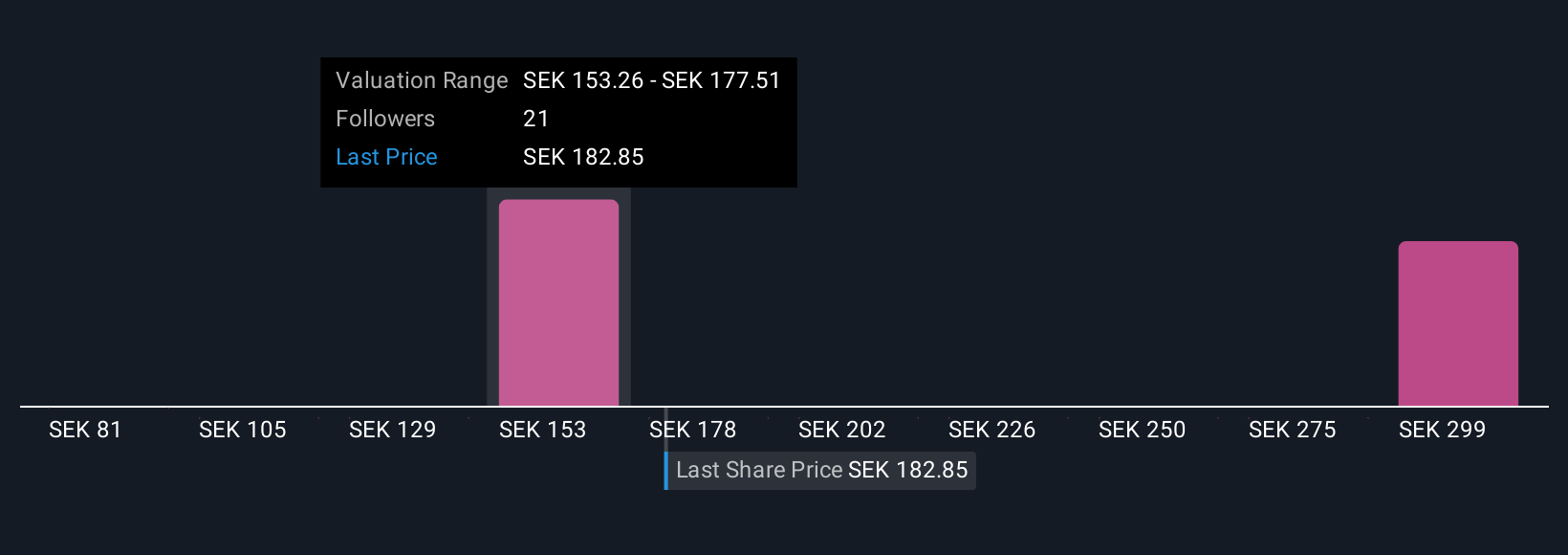

Uncover how Skandinaviska Enskilda Banken's forecasts yield a SEK180.71 fair value, in line with its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community have published fair value estimates for SEB, spanning a wide range from SEK 80.50 up to SEK 328.23. This diversity of opinion comes as falling net fee and commission income challenges expectations for near-term revenue growth, raising important questions about how future results could diverge from consensus.

Explore 3 other fair value estimates on Skandinaviska Enskilda Banken - why the stock might be worth less than half the current price!

Build Your Own Skandinaviska Enskilda Banken Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Skandinaviska Enskilda Banken research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Skandinaviska Enskilda Banken research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Skandinaviska Enskilda Banken's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SEB A

Skandinaviska Enskilda Banken

Provides corporate, retail, investment, and private banking services.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives