- Saudi Arabia

- /

- Gas Utilities

- /

- SASE:2080

Undiscovered Gems in Middle East Stocks for December 2025

Reviewed by Simply Wall St

As most Gulf markets experience gains buoyed by expectations of a U.S. Federal Reserve interest rate cut, investors are keeping a keen eye on the Middle East's economic landscape, where rising oil prices and geopolitical factors also play significant roles. In this environment, identifying promising stocks involves looking for companies that can leverage these macroeconomic conditions to drive growth and resilience in their respective sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 17.65% | 4.48% | 4.46% | ★★★★★★ |

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Payton Industries | NA | 3.44% | 14.24% | ★★★★★★ |

| Terminal X Online | 12.94% | 13.43% | 44.27% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| C. Mer Industries | 76.92% | 13.56% | 68.93% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 32.43% | 3.87% | 6.98% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

ESG Emirates Stallions Group PJSC (ADX:ESG)

Simply Wall St Value Rating: ★★★★★☆

Overview: ESG Emirates Stallions Group PJSC operates in the investment, construction, and real estate sectors across multiple continents including the Middle East, Africa, Asia, Europe, and the Americas with a market capitalization of AED 3.5 billion.

Operations: ESG Emirates Stallions Group PJSC generates revenue primarily from furniture manufacturing, retail and interior fit-out (AED 600.55 million), business process/manpower outsourcing (AED 472.13 million), and landscaping, agriculture, and maintenance (AED 269.24 million). Contracting and consultancy also contribute significantly with AED 267.71 million in revenue. The company exhibits a notable trend in its net profit margin over the periods analyzed.

Emirates Stallions Group PJSC, a notable player in the Middle East's industrial sector, has showcased robust growth with earnings rising by 9.6% over the past year, outpacing the broader industry downturn of 5.8%. The company reported third-quarter sales of AED 357.49 million and net income of AED 65.09 million, reflecting a significant improvement from last year's figures. Despite an impairment loss on property and equipment amounting to AED 873,000, ESG maintains strong financial health with more cash than total debt and high-quality earnings. Recent inclusion in major indices like S&P Pan Arab Composite highlights its growing prominence in the region's market landscape.

- Click to explore a detailed breakdown of our findings in ESG Emirates Stallions Group PJSC's health report.

Learn about ESG Emirates Stallions Group PJSC's historical performance.

National Gas and Industrialization (SASE:2080)

Simply Wall St Value Rating: ★★★★★★

Overview: National Gas and Industrialization Company operates in the exploration, manufacturing, and marketing of various gases and industrial gases within Saudi Arabia and internationally, with a market capitalization of SAR6.16 billion.

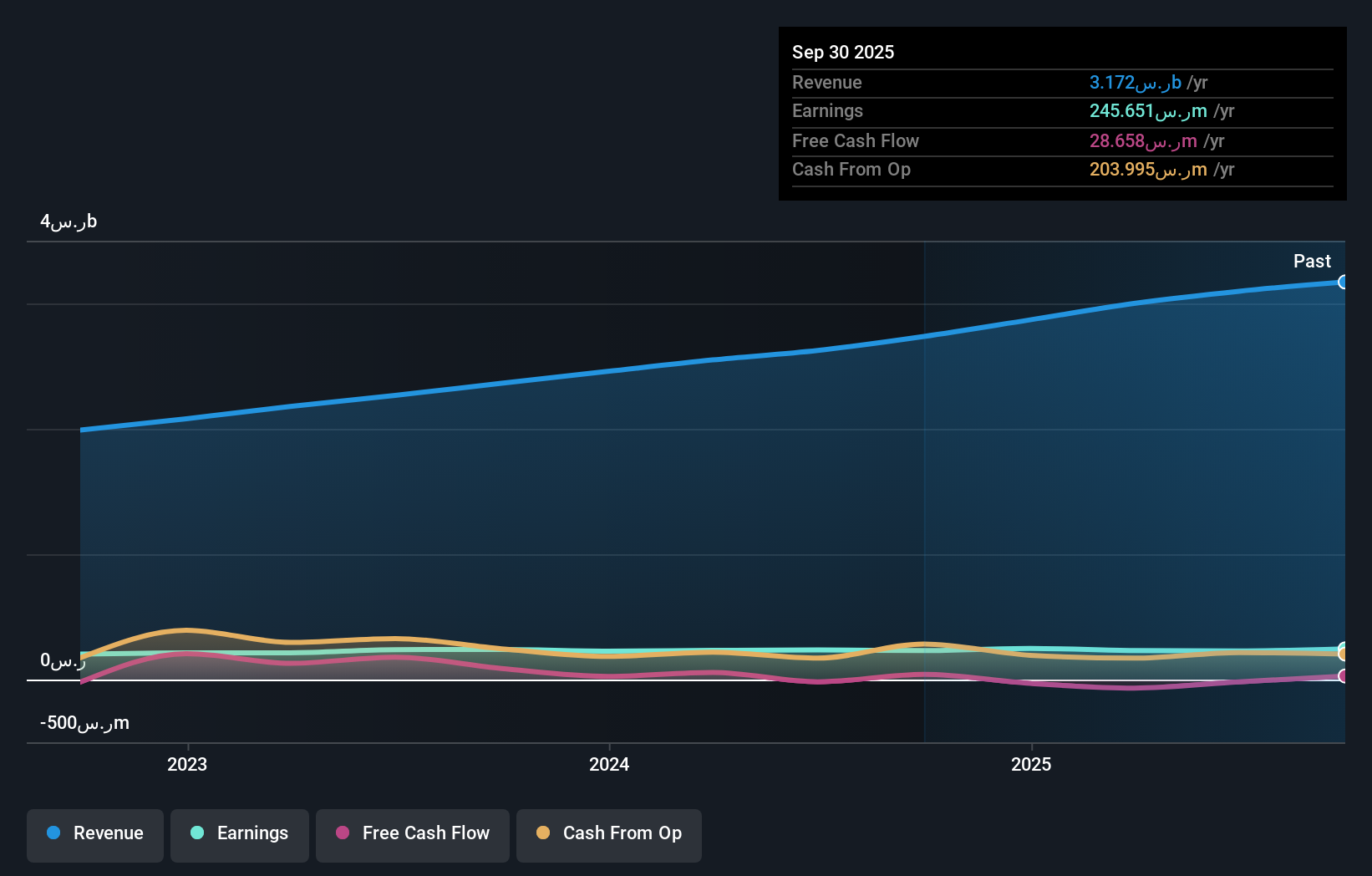

Operations: National Gas and Industrialization Company generates revenue primarily from its operations in the Eastern, Western, and Southern regions of Saudi Arabia, with notable contributions of SAR700.17 million from the Eastern Region and SAR1.53 billion from the Western Region. The company experienced a segment adjustment of SAR3.58 billion in its financials.

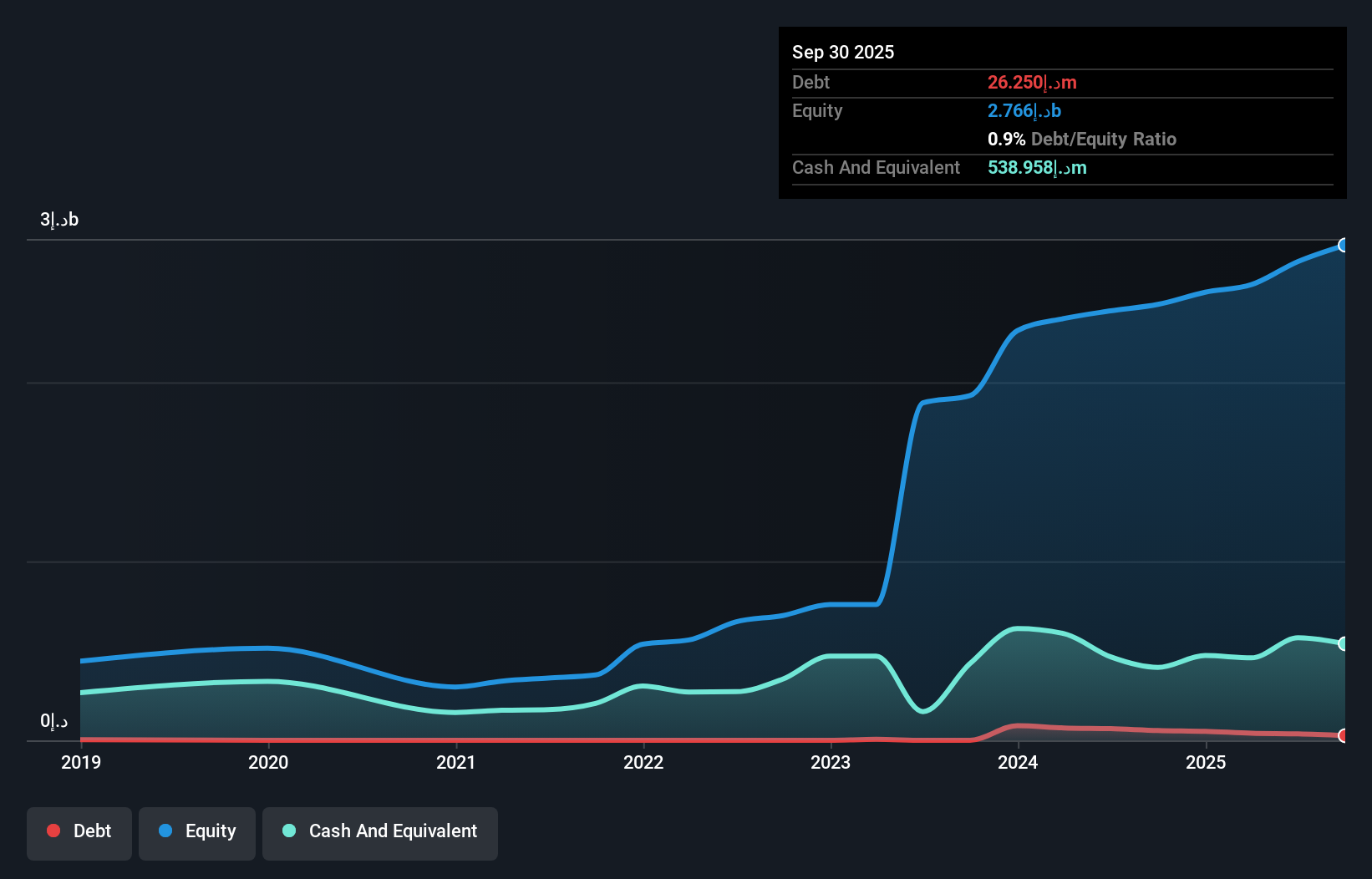

National Gas and Industrialization, a notable player in the Middle East's energy sector, reported robust third-quarter sales of SAR 795.37 million, up from SAR 721.05 million last year. This growth aligns with its earnings increase of 6.2% over the past year, outpacing the industry average by a significant margin. The company's debt to equity ratio has impressively decreased from 5.6% to 1.2% over five years, indicating strong financial management and stability. With net income rising to SAR 69.71 million this quarter and high-quality earnings consistently recorded, it seems well-positioned for future opportunities in the gas utilities market.

Nofoth Food Products (SASE:9556)

Simply Wall St Value Rating: ★★★★★★

Overview: Nofoth Food Products Company operates in Saudi Arabia, focusing on the production and sale of bakery products, with a market capitalization of SAR1.13 billion.

Operations: The company generates revenue through the production and sale of bakery products in Saudi Arabia. It has a market capitalization of approximately SAR1.13 billion.

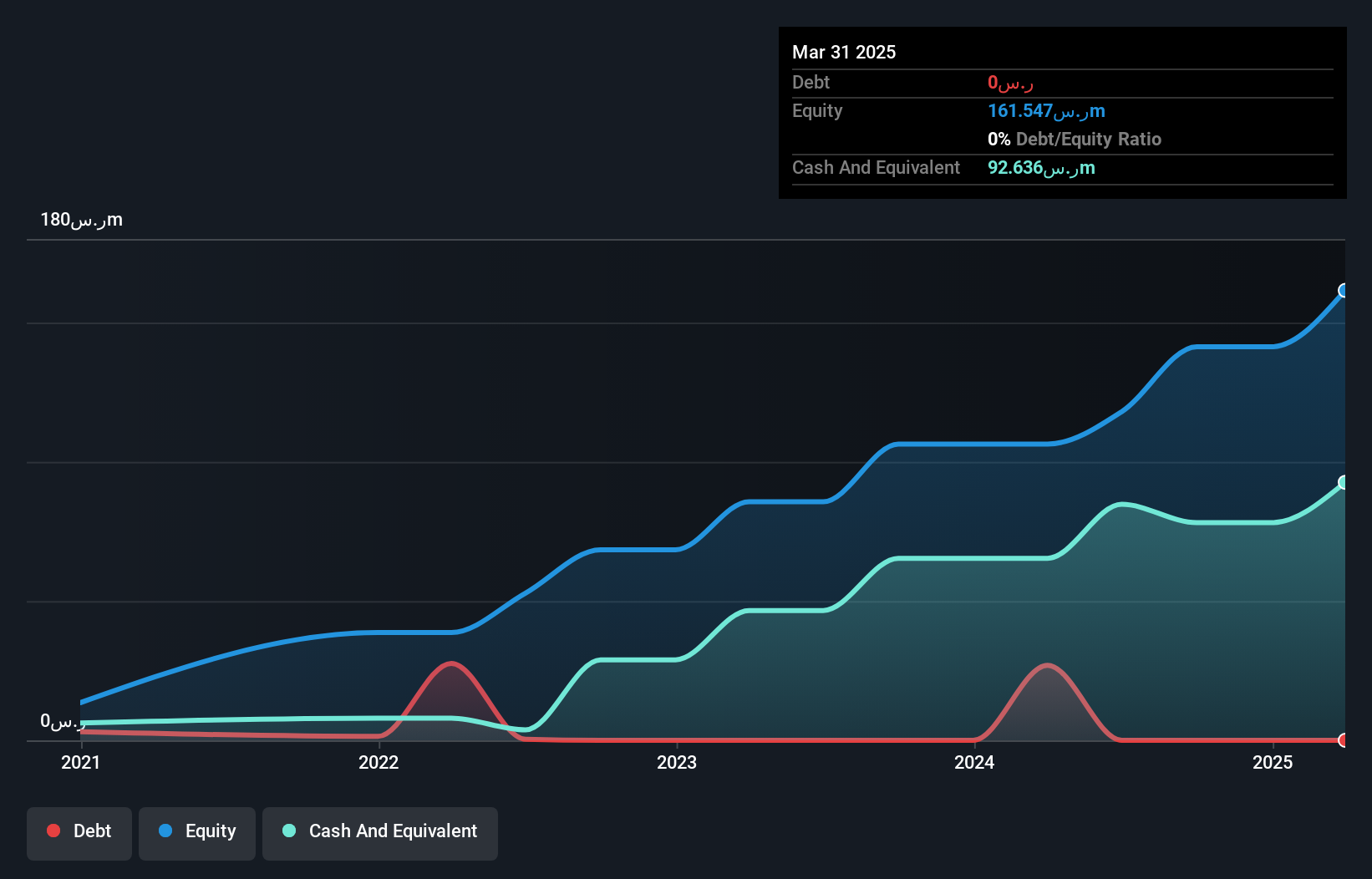

Nofoth Food Products, a small yet promising player in the Middle East food industry, is making waves with its strategic expansion plans. Recently approved to establish a branch in the UAE, this move aligns with its strategy to bolster brand presence across the Gulf region. Financially, Nofoth stands out by trading at 29.8% below estimated fair value and showcasing impressive earnings growth of 19.8% over the past year—outpacing the industry's 7.5%. With no debt on its books and positive free cash flow, Nofoth is well-positioned for sustainable growth while maintaining high-quality non-cash earnings.

- Get an in-depth perspective on Nofoth Food Products' performance by reading our health report here.

Assess Nofoth Food Products' past performance with our detailed historical performance reports.

Where To Now?

- Dive into all 181 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Gas and Industrialization might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2080

National Gas and Industrialization

Engages in exploits, manufactures, and markets various kinds of gas and its derivatives, and industrial gases in the Kingdom of Saudi Arabia and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026