- Saudi Arabia

- /

- IT

- /

- SASE:9543

Middle Eastern Dividend Stocks Including Al Wathba National Insurance Company PJSC And Two More

Reviewed by Simply Wall St

In recent months, major Gulf markets have experienced a subdued phase, largely influenced by softer global oil prices and oversupply concerns. Despite these challenges, dividend stocks in the Middle East continue to attract attention for their potential to provide steady income streams amidst fluctuating market conditions. Understanding what makes a good dividend stock is crucial in such an environment; factors like stable earnings, strong cash flow, and a history of consistent payouts can be key indicators of reliability.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.16% | ★★★★★☆ |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.40% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.26% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.66% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.53% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.25% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 7.78% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.35% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.73% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.04% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Al Wathba National Insurance Company PJSC (ADX:AWNIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Wathba National Insurance Company PJSC operates in the general insurance and reinsurance sectors both within the United Arab Emirates and internationally, with a market capitalization of AED724.50 million.

Operations: Al Wathba National Insurance Company PJSC generates revenue from its motor insurance segment, amounting to AED256.71 million.

Dividend Yield: 5.7%

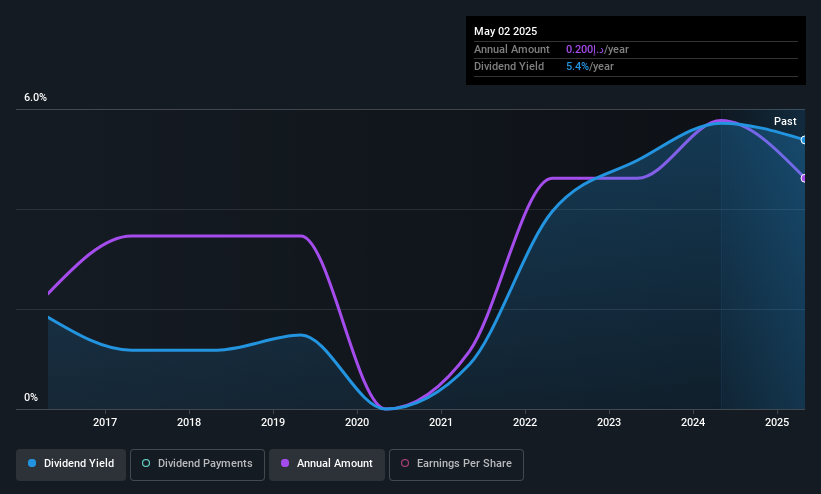

Al Wathba National Insurance Company PJSC's dividend payments have been volatile over the past decade, yet they are well-covered by both earnings and cash flows, with a low payout ratio of 26.7% and a cash payout ratio of 46.2%. Despite offering a lower yield (5.71%) compared to top-tier AE market payers, its price-to-earnings ratio (4.7x) suggests good value relative to the market average (11.8x). Recent leadership changes may influence future strategic growth and dividend stability.

- Dive into the specifics of Al Wathba National Insurance Company PJSC here with our thorough dividend report.

- Our valuation report here indicates Al Wathba National Insurance Company PJSC may be overvalued.

SABIC Agri-Nutrients (SASE:2020)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SABIC Agri-Nutrients Company is involved in the production, conversion, manufacturing, marketing, and trade of agri-nutrients and chemical products across several countries including Singapore, the United States, India, and Saudi Arabia with a market cap of SAR57.22 billion.

Operations: SABIC Agri-Nutrients Company's revenue primarily comes from agri-nutrients, contributing SAR12.36 billion, with an additional SAR542.49 million generated from petrochemicals.

Dividend Yield: 5.8%

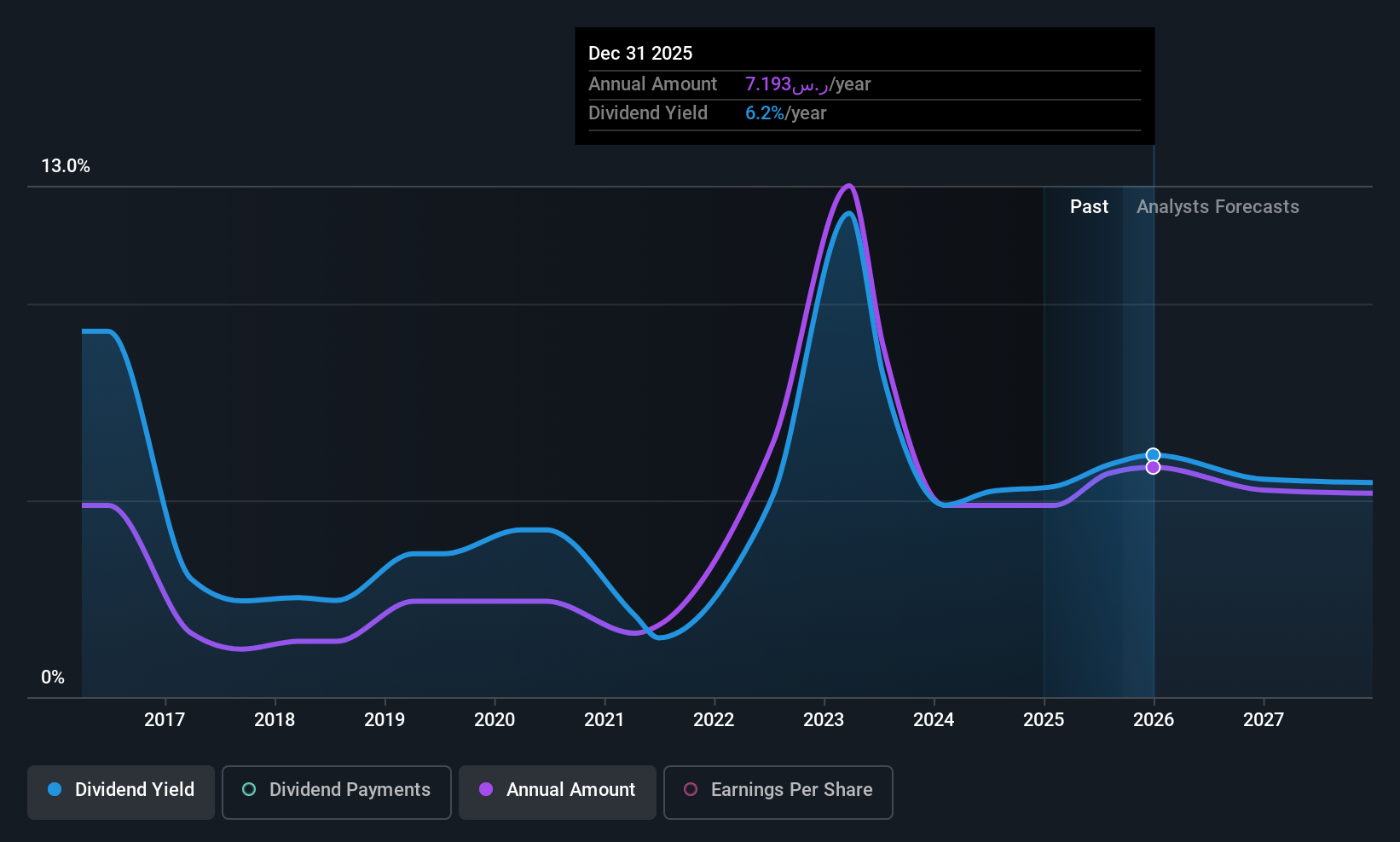

SABIC Agri-Nutrients has shown growth in dividend payments over the past decade, but its track record is unstable and volatile. With a payout ratio of 72.1%, dividends are covered by earnings and cash flows (78.7% cash payout). The dividend yield is among the top 25% in Saudi Arabia, and its price-to-earnings ratio (13.3x) indicates good value compared to the market average. Recent earnings reports show significant profit increases, though future earnings are expected to decline slightly.

- Click to explore a detailed breakdown of our findings in SABIC Agri-Nutrients' dividend report.

- According our valuation report, there's an indication that SABIC Agri-Nutrients' share price might be on the cheaper side.

Saudi Networkers Services (SASE:9543)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Saudi Networkers Services Company specializes in the implementation, establishment, maintenance, operation, installation, and management of telecommunication networks in Saudi Arabia and Algeria with a market cap of SAR462 million.

Operations: Saudi Networkers Services Company generates revenue primarily from its Computer Services segment, amounting to SAR586.10 million.

Dividend Yield: 5.6%

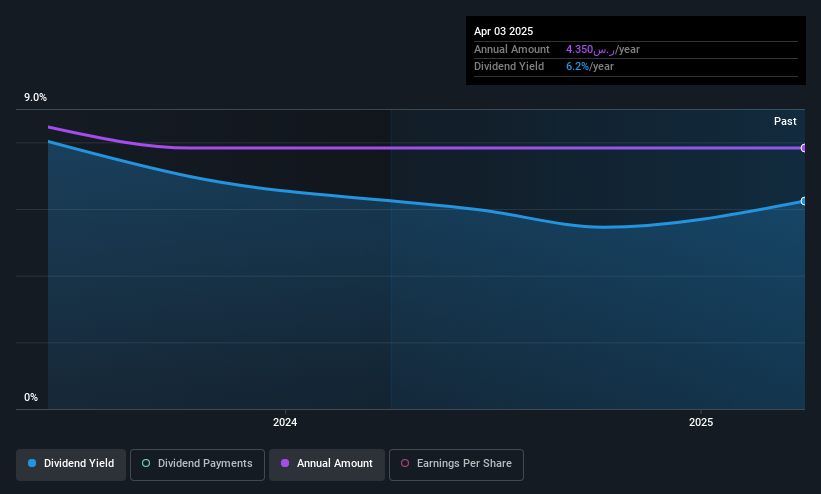

Saudi Networkers Services offers a compelling dividend yield of 5.65%, ranking in the top 25% within the Saudi Arabian market, with dividends well-covered by earnings and cash flows (payout ratios: 72.5% and 70.3%). Although dividends have been stable, they have only been paid for three years. The recent board changes, including forming an Audit Committee, might enhance governance but do not directly impact dividend reliability or growth potential at this stage.

- Click here to discover the nuances of Saudi Networkers Services with our detailed analytical dividend report.

- Our valuation report unveils the possibility Saudi Networkers Services' shares may be trading at a premium.

Next Steps

- Take a closer look at our Top Middle Eastern Dividend Stocks list of 63 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9543

Saudi Networkers Services

Engages in the implementing, establishing, maintaining, operating, installing, and managing of telecommunication networks in the Kingdom of Saudi Arabia and Algeria.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives