- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4191

3 Undiscovered Gems in the Middle East with Strong Potential

Reviewed by Simply Wall St

As the Middle East markets experience upward momentum, buoyed by expectations of a Federal Reserve rate cut and strong performances in the UAE's real estate and banking sectors, investors are increasingly looking for opportunities within this dynamic region. In such an environment, identifying stocks with solid fundamentals and growth potential becomes crucial for those seeking to capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Mackolik Internet Hizmetleri Ticaret | 14.04% | 29.58% | 34.64% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 54.80% | 42.62% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★☆☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.16% | -34.78% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Ipek Dogal Enerji Kaynaklari Arastirma ve Üretim (IBSE:TRENJ)

Simply Wall St Value Rating: ★★★★★☆

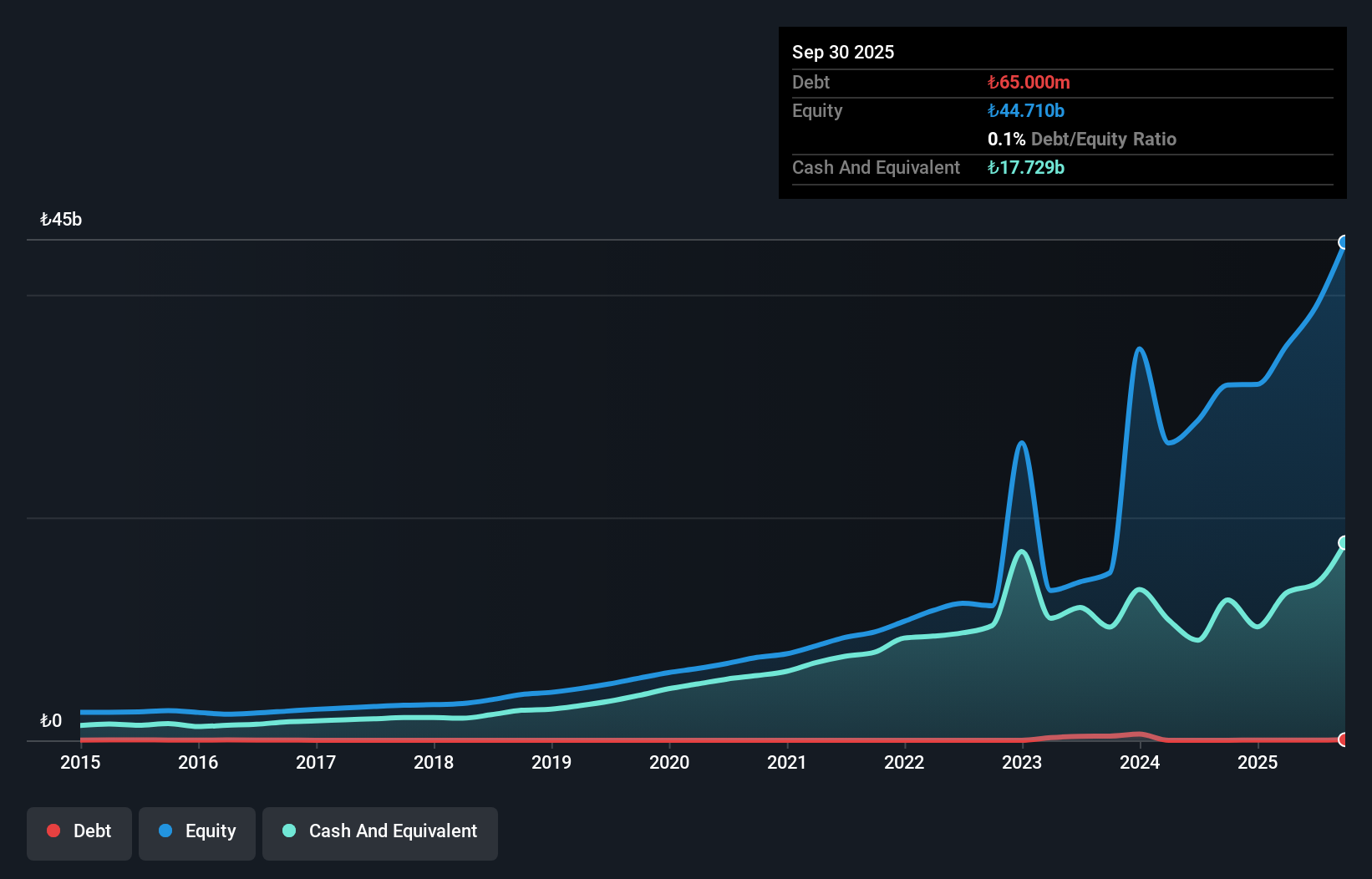

Overview: Ipek Dogal Enerji Kaynaklari Arastirma ve Üretim A.S. operates in Turkey focusing on the research, development, and production of oil, natural gas, and energy resources with a market capitalization of TRY20.90 billion.

Operations: Ipek Dogal Enerji generates revenue primarily from its mining segment, amounting to TRY12.80 billion. The company experiences a segment adjustment of TRY-354.19 million in its financial reporting.

Ipek Dogal Enerji, a small cap player in the Middle East energy sector, has shown impressive financial resilience with earnings growth of 20% over the past year, outpacing the oil and gas industry's -45.4%. The company reported a significant increase in third-quarter sales to TRY 5.66 billion from TRY 2.69 billion last year, while net income hit TRY 783 million compared to a loss previously. Despite earnings declining by an average of 29.5% annually over five years, its current valuation is attractive at nearly 88% below estimated fair value, suggesting potential for future appreciation if trends continue positively.

Abdullah Saad Mohammed Abo Moati for Bookstores (SASE:4191)

Simply Wall St Value Rating: ★★★★★★

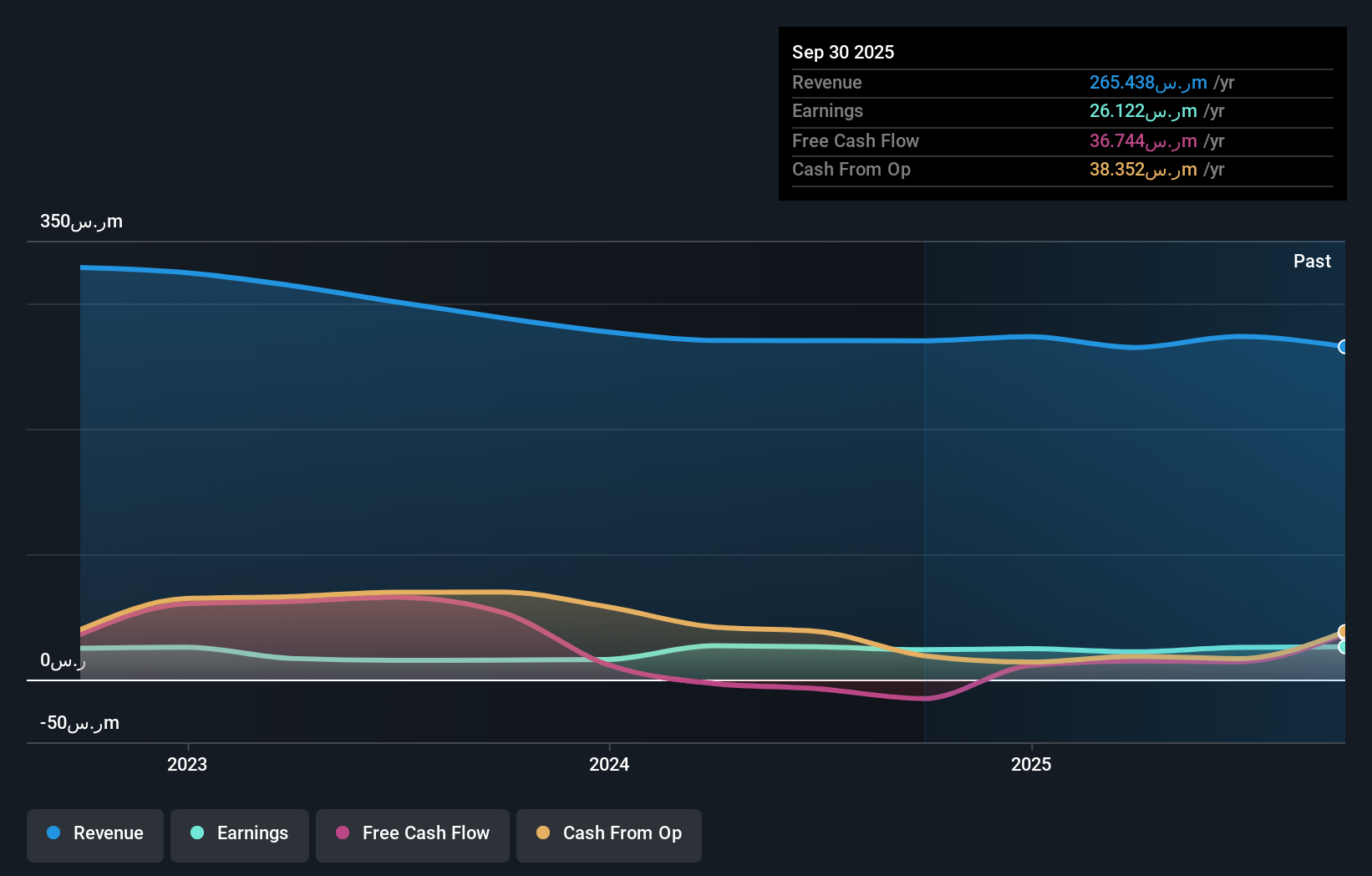

Overview: Abdullah Saad Mohammed Abo Moati for Bookstores Company operates in the retail and wholesale trading of stationery, computers, and accessories in Saudi Arabia with a market cap of SAR946 million.

Operations: Abo Moati generates revenue primarily through retail and wholesale trading of stationery, computers, and accessories in Saudi Arabia. The company's market cap stands at SAR946 million.

Abo Moati, a prominent player in the Middle Eastern specialty retail sector, has shown resilience despite market fluctuations. Over the past year, earnings grew by 9.7%, surpassing industry growth of 4.7%. The company's net debt to equity ratio stands at a satisfactory 16.8%, with interest payments well-covered by EBIT at 5.9 times coverage. Recent financials reveal second-quarter sales of SAR 80.69 million and net income of SAR 11.13 million, up from SAR 10.65 million last year, alongside a dividend announcement of SAR 0.5 per share for eligible shareholders as of December 1, reflecting its commitment to shareholder returns amidst volatility.

Ayalon Insurance (TASE:AYAL)

Simply Wall St Value Rating: ★★★★★☆

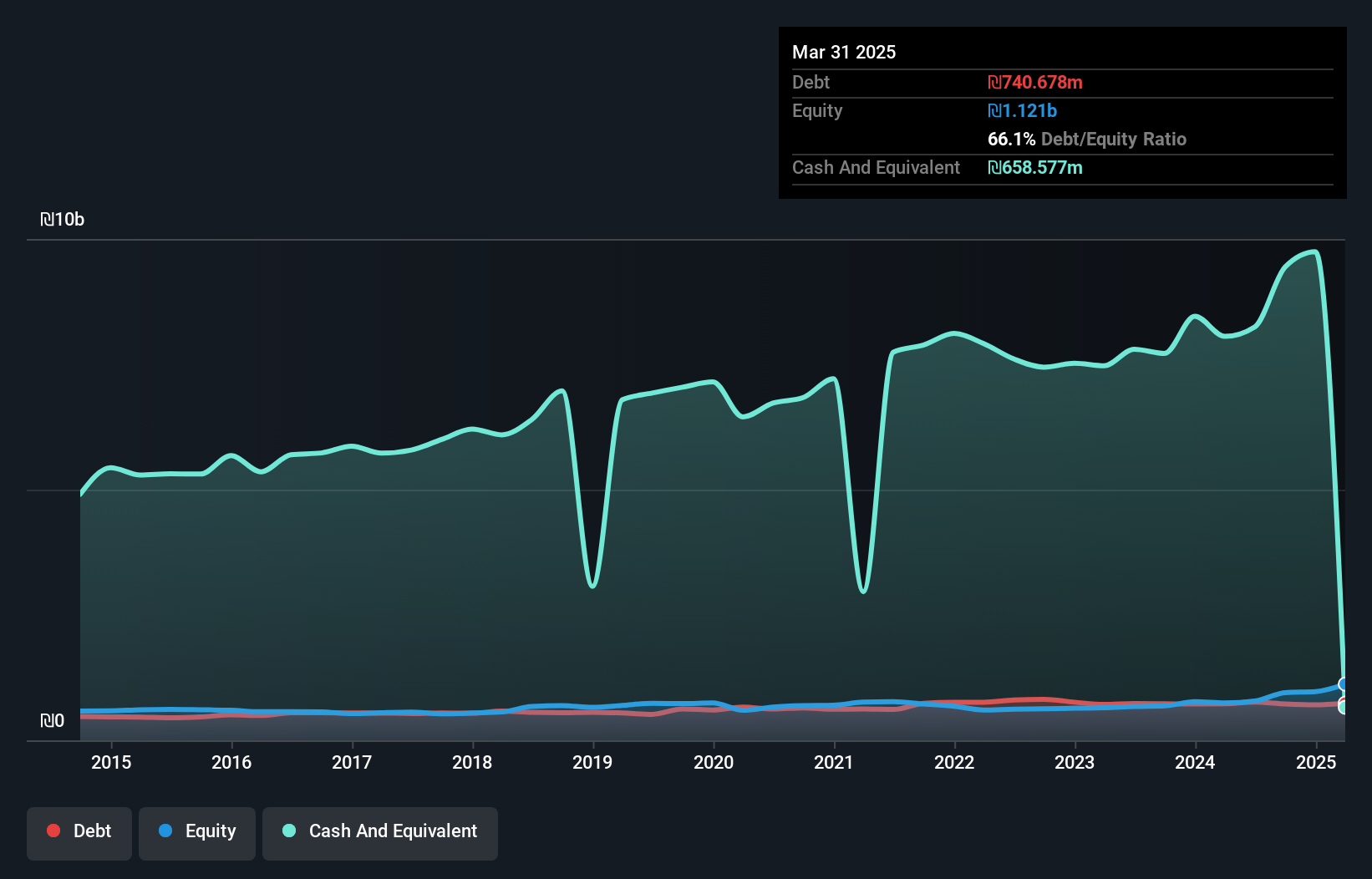

Overview: Ayalon Insurance Company Ltd, with a market cap of ₪2.76 billion, operates in Israel through its subsidiaries offering a range of insurance products.

Operations: Ayalon Insurance generates revenue primarily from its insurance products offered through its subsidiaries in Israel. The company's net profit margin has shown variations, reflecting changes in operational efficiency and market conditions.

Ayalon Insurance stands out with high-quality earnings and a 53% annual growth in profits over the last five years. Despite its earnings growth of 9% lagging behind the industry's 31%, Ayalon's debt-to-equity ratio has impressively decreased from 94% to 47%. The company's interest payments are well-covered by EBIT at a multiple of 6, ensuring financial stability. Recent results show net income for Q3 at ILS 118.87 million, up from ILS 91.5 million the previous year, with basic EPS rising to ILS 4.63 from ILS 3.97, reflecting strong operational performance amidst market volatility.

- Navigate through the intricacies of Ayalon Insurance with our comprehensive health report here.

Assess Ayalon Insurance's past performance with our detailed historical performance reports.

Make It Happen

- Explore the 181 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4191

Abdullah Saad Mohammed Abo Moati for Bookstores

Engages in the retail and wholesale trading of stationery, computers, and other accessories in the Kingdom of Saudi Arabia.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026