- Saudi Arabia

- /

- Consumer Services

- /

- SASE:6019

Middle East Hidden Gems Three Promising Stocks with Solid Potential

Reviewed by Simply Wall St

As Middle Eastern stock markets experience an upswing, buoyed by rising oil prices and potential U.S. Federal Reserve rate cuts, investors are increasingly turning their attention to promising opportunities within the region. In this context, identifying stocks with solid fundamentals and growth potential becomes crucial for navigating these dynamic market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 54.80% | 42.62% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.16% | -34.78% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Almasar Alshamil Education Company JSC (SASE:6019)

Simply Wall St Value Rating: ★★★★★☆

Overview: Almasar Alshamil Education Company JSC is a specialist education services provider in Saudi Arabia with a market capitalization of SAR1.99 billion.

Operations: The company's primary revenue stream is derived from its education segment, generating SAR501.45 million.

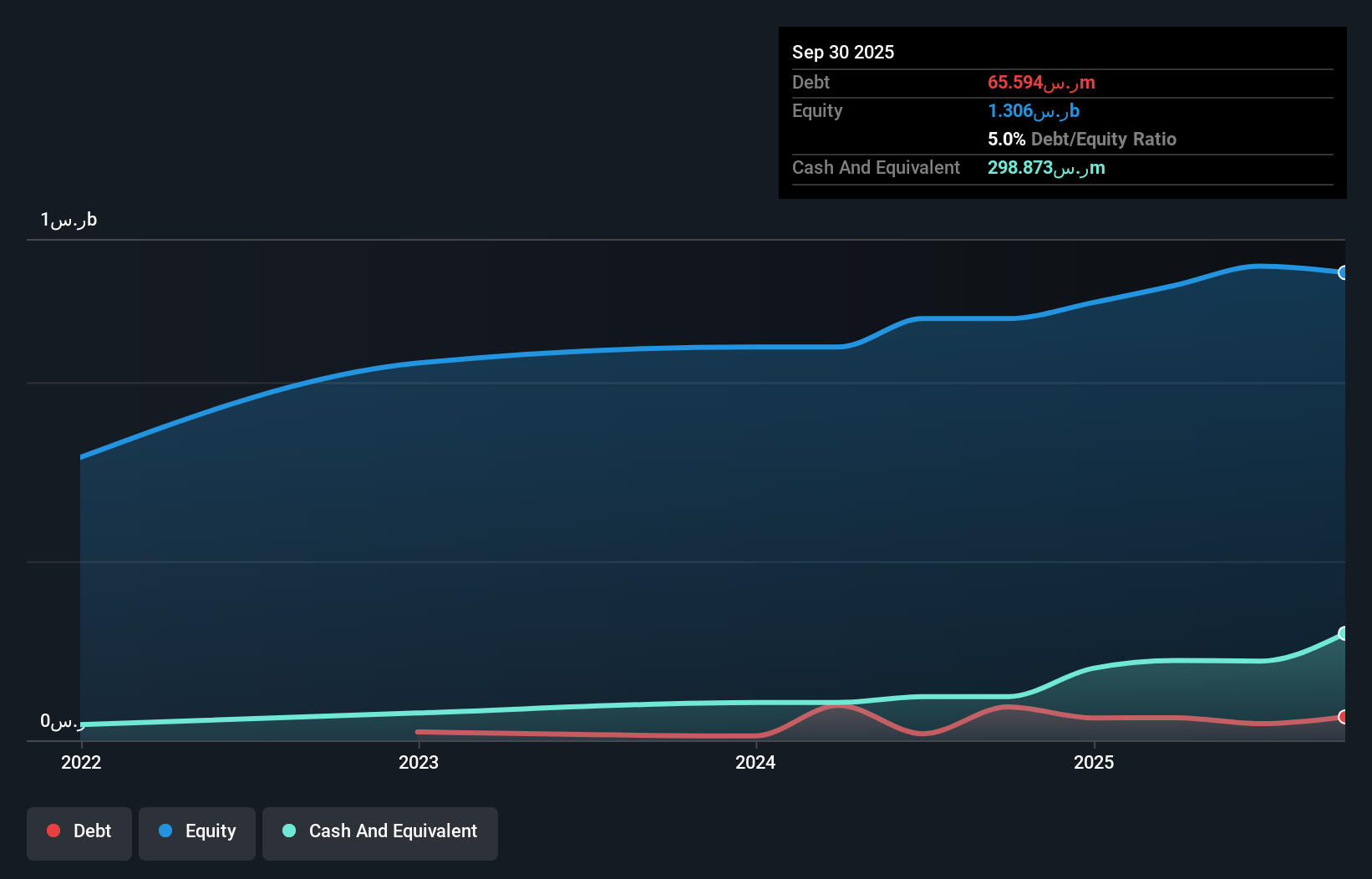

Almasar Alshamil Education Company JSC, a small yet promising player in the education sector, recently completed an IPO raising SAR 599.05 million at SAR 19.5 per share. The company boasts impressive earnings growth of 114% over the past year, outpacing the Consumer Services industry which saw a -6.7% trend. With free cash flow consistently positive and debt levels comfortably covered by EBIT at 24 times interest payments, financial health appears robust. Despite highly illiquid shares, Almasar's high-quality earnings and strong cash position suggest potential for future growth in its niche market segment.

INMAR (SASE:9521)

Simply Wall St Value Rating: ★★★★★☆

Overview: INMAR Company focuses on establishing and owning real estate properties in the Kingdom of Saudi Arabia, with a market capitalization of SAR1.04 billion.

Operations: INMAR generates revenue primarily through its real estate properties in Saudi Arabia. The company has a market capitalization of SAR1.04 billion.

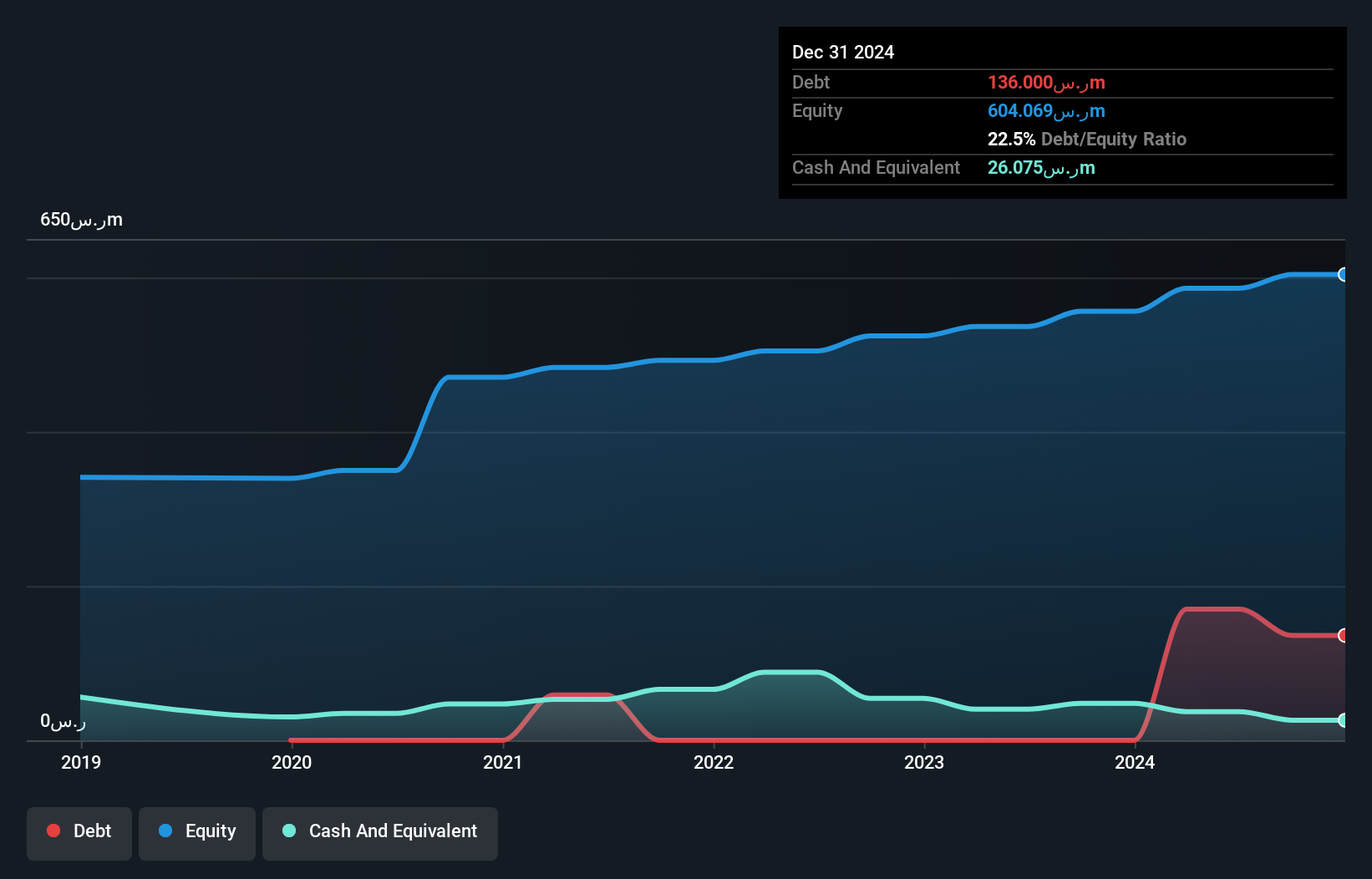

INMAR's recent developments highlight its potential in the real estate sector. The company, which recently rebranded from Enma Al Rawabi, has launched the GVAL Residence project in Riyadh, featuring 42 high-quality residential units. This move aligns with its strategy to tap into premium real estate markets. Financially, INMAR exhibits a satisfactory net debt to equity ratio of 16.3% and impressive earnings growth of 33% over the past year, outpacing industry averages. With interest payments covered 9.6 times by EBIT and trading at a significant discount to estimated fair value, INMAR presents an intriguing opportunity for investors seeking undervalued assets in dynamic markets like the Middle East.

- Take a closer look at INMAR's potential here in our health report.

Gain insights into INMAR's historical performance by reviewing our past performance report.

Ashot Ashkelon Industries (TASE:ASHO)

Simply Wall St Value Rating: ★★★★★★

Overview: Ashot Ashkelon Industries Ltd. specializes in manufacturing and selling aerospace and defense systems and components, with a market cap of ₪1.63 billion.

Operations: Ashot Ashkelon Industries generates revenue through the sale of aerospace and defense systems and components both domestically and internationally. The company operates with a market cap of approximately ₪1.63 billion.

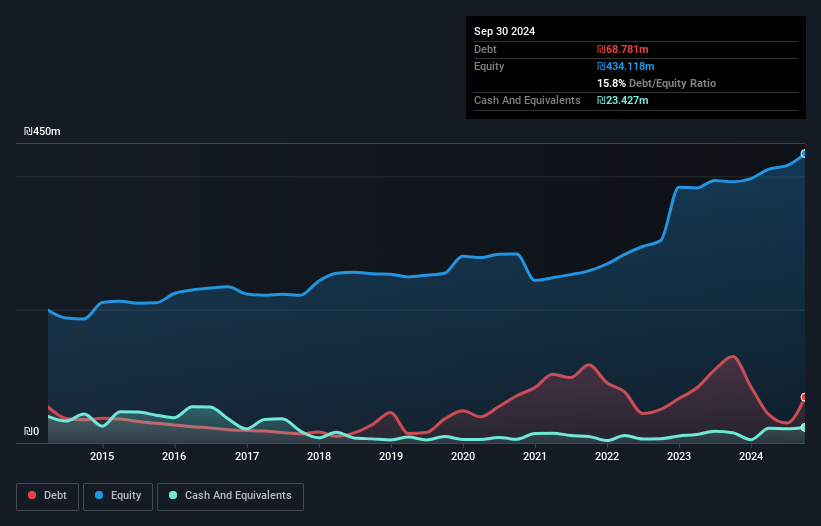

Ashot Ashkelon Industries, a notable player in the Aerospace & Defense sector, has shown impressive financial health with earnings growing by 57% over the past year, outpacing industry peers. The company reported net income of ILS 15.82 million for Q3 2025, up from ILS 11.37 million a year prior, reflecting high-quality earnings. Its debt management is commendable; the net debt to equity ratio stands at a satisfactory 6%, and interest payments are well covered by EBIT at 6.7 times coverage. Additionally, Ashot's inclusion in the S&P Global BMI Index highlights its growing market presence and potential appeal to investors seeking robust growth prospects in emerging markets.

Make It Happen

- Reveal the 182 hidden gems among our Middle Eastern Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:6019

Almasar Alshamil Education Company JSC

Operates as a provider of specialist education services in Saudi Arabia.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026