- Saudi Arabia

- /

- Real Estate

- /

- SASE:4322

Retal Urban Development Company Just Missed Revenue By 11%: Here's What Analysts Think Will Happen Next

It's been a good week for Retal Urban Development Company (TADAWUL:4322) shareholders, because the company has just released its latest quarterly results, and the shares gained 8.0% to ر.س12.22. Revenues were ر.س488m, 11% below analyst expectations, although losses didn't appear to worsen significantly, with a statutory per-share loss of ر.س0.53 being in line with what the analyst anticipated. This is an important time for investors, as they can track a company's performance in its report, look at what expert is forecasting for next year, and see if there has been any change to expectations for the business. We thought readers would find it interesting to see the analyst latest (statutory) post-earnings forecasts for next year.

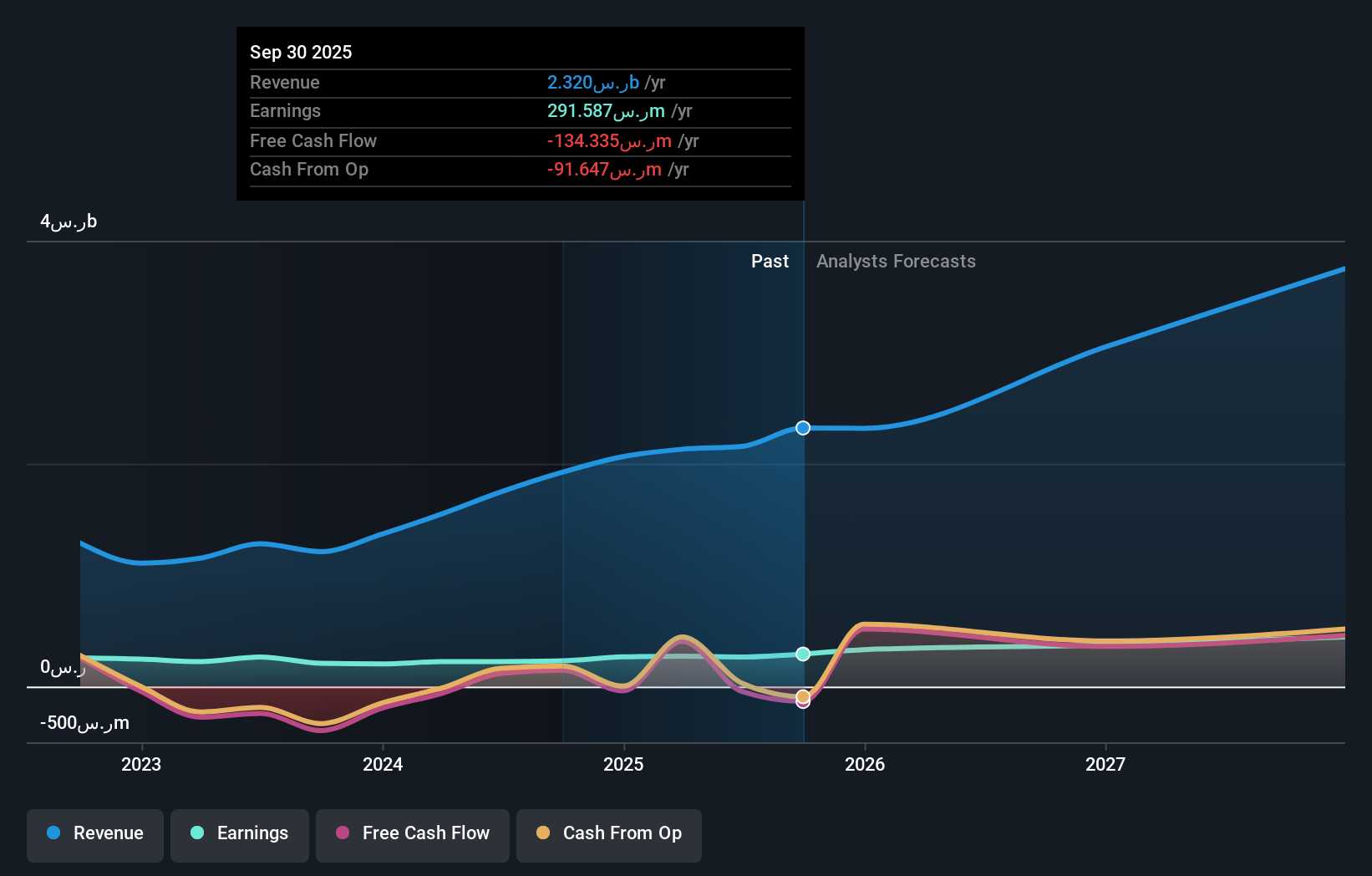

Following last week's earnings report, Retal Urban Development's lone analyst are forecasting 2025 revenues to be ر.س2.32b, approximately in line with the last 12 months. Per-share earnings are expected to climb 13% to ر.س0.66. Yet prior to the latest earnings, the analyst had been anticipated revenues of ر.س2.28b and earnings per share (EPS) of ر.س0.70 in 2025. The analyst seem to have become a little more negative on the business after the latest results, given the minor downgrade to their earnings per share numbers for next year.

See our latest analysis for Retal Urban Development

The consensus price target held steady at ر.س17.85, with the analyst seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. These estimates imply that revenue is expected to slow, with a forecast annualised decline of 0.3% by the end of 2025. This indicates a significant reduction from annual growth of 23% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 7.5% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Retal Urban Development is expected to lag the wider industry.

The Bottom Line

The biggest concern is that the analyst reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Retal Urban Development. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. The consensus price target held steady at ر.س17.85, with the latest estimates not enough to have an impact on their price target.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Retal Urban Development going out as far as 2027, and you can see them free on our platform here.

You still need to take note of risks, for example - Retal Urban Development has 2 warning signs we think you should be aware of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4322

Retal Urban Development

Through its subsidiaries, operates as a real estate developer in the Kingdom of Saudi Arabia.

Reasonable growth potential with acceptable track record.

Market Insights

Community Narratives