- Saudi Arabia

- /

- Basic Materials

- /

- SASE:9514

Even With A 26% Surge, Cautious Investors Are Not Rewarding Mohammed Hasan AlNaqool Sons Co.'s (TADAWUL:9514) Performance Completely

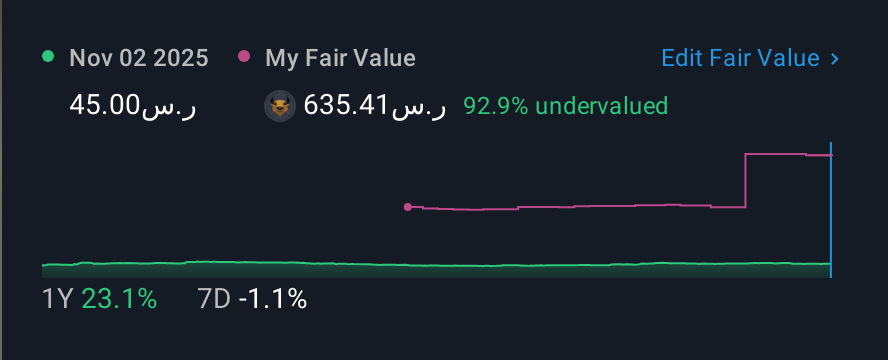

Despite an already strong run, Mohammed Hasan AlNaqool Sons Co. (TADAWUL:9514) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 31%.

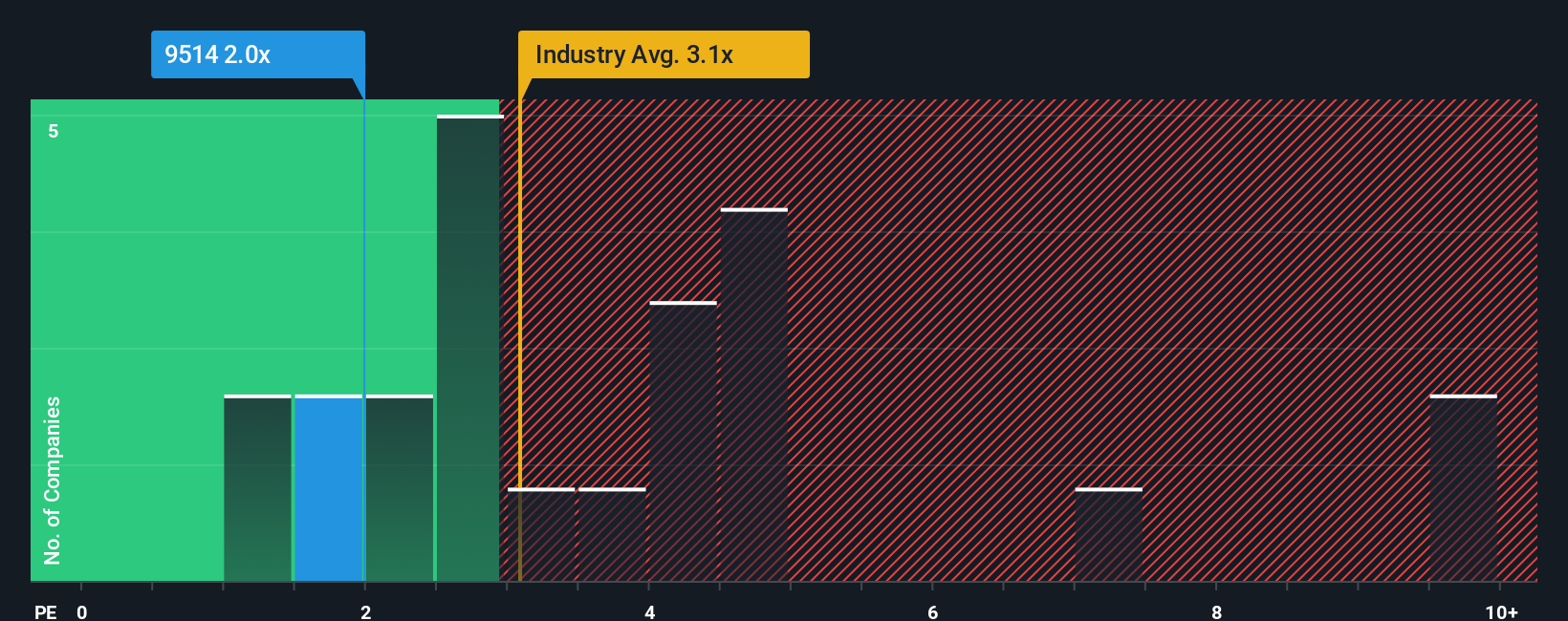

Although its price has surged higher, when close to half the companies operating in Saudi Arabia's Basic Materials industry have price-to-sales ratios (or "P/S") above 3.1x, you may still consider Mohammed Hasan AlNaqool Sons as an enticing stock to check out with its 2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Mohammed Hasan AlNaqool Sons

What Does Mohammed Hasan AlNaqool Sons' Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Mohammed Hasan AlNaqool Sons has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Mohammed Hasan AlNaqool Sons' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Mohammed Hasan AlNaqool Sons would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 64% gain to the company's top line. The latest three year period has also seen an excellent 33% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 4.1% shows it's noticeably more attractive.

In light of this, it's peculiar that Mohammed Hasan AlNaqool Sons' P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Mohammed Hasan AlNaqool Sons' stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We're very surprised to see Mohammed Hasan AlNaqool Sons currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Mohammed Hasan AlNaqool Sons (1 is a bit unpleasant!) that you should be aware of before investing here.

If you're unsure about the strength of Mohammed Hasan AlNaqool Sons' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9514

Mohammed Hasan AlNaqool Sons

Engages in the production and sale of ready-made concrete and concrete blocks.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives