- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:2240

The three-year earnings decline has likely contributed toZamil Industrial Investment's (TADAWUL:2240) shareholders losses of 50% over that period

Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, you risk returning less than the market. Unfortunately, that's been the case for longer term Zamil Industrial Investment Company (TADAWUL:2240) shareholders, since the share price is down 50% in the last three years, falling well short of the market decline of around 3.7%. More recently, the share price has dropped a further 14% in a month.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Zamil Industrial Investment

Given that Zamil Industrial Investment didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Zamil Industrial Investment grew revenue at 12% per year. That's a fairly respectable growth rate. Shareholders have seen the share price fall at 14% per year, for three years. So the market has definitely lost some love for the stock. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

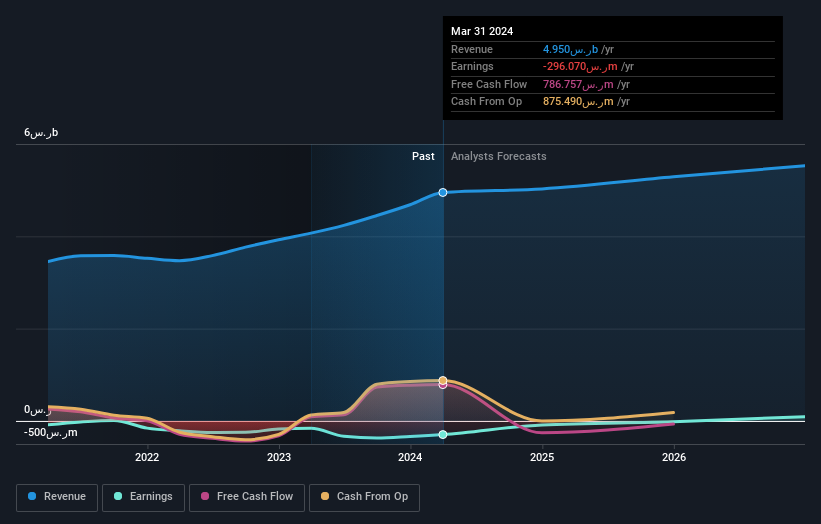

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Zamil Industrial Investment stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 7.4% in the twelve months, Zamil Industrial Investment shareholders did even worse, losing 15%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 5% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Zamil Industrial Investment better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Zamil Industrial Investment you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zamil Industrial Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2240

Zamil Industrial Investment

Engages in the design and engineering, manufacturing, and fabrication of construction materials, pre-engineering steel buildings, steel structures, air conditions, and climate control systems for commercial, industrial, and residential applications, as well as for telecom and broadcasting towers, process equipment, fiberglass, rockwool and engineering plastic foam insulation, and solar power projects.

Reasonable growth potential and fair value.