- Saudi Arabia

- /

- Food

- /

- SASE:4080

Sinad Holding (TADAWUL:4080 shareholders incur further losses as stock declines 11% this week, taking three-year losses to 52%

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the long term shareholders of Sinad Holding Company (TADAWUL:4080) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 52% drop in the share price over that period. The last week also saw the share price slip down another 11%.

If the past week is anything to go by, investor sentiment for Sinad Holding isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Sinad Holding

Given that Sinad Holding didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Sinad Holding grew revenue at 0.2% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. It's likely this weak growth has contributed to an annualised return of 15% for the last three years. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

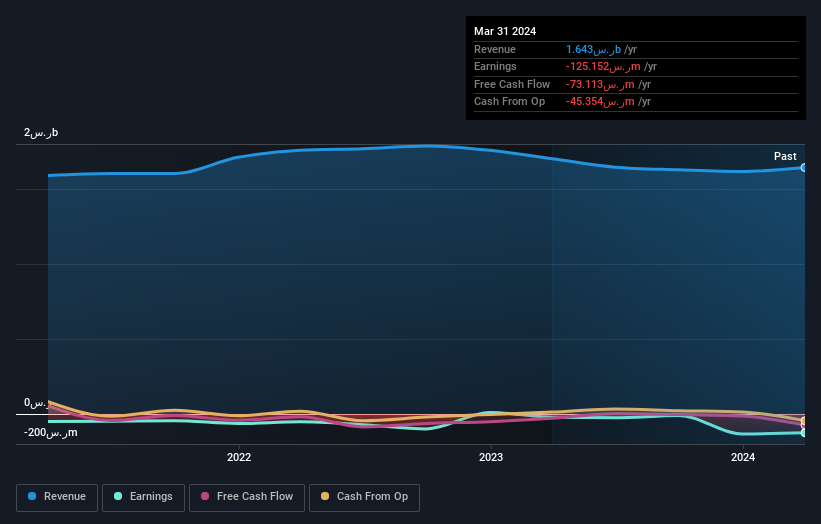

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Sinad Holding shareholders have received a total shareholder return of 0.7% over the last year. Having said that, the five-year TSR of 6% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

But note: Sinad Holding may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4080

Sinad Holding

Engages in manufacture, packaging, wholesale, and retail trade of food products in the Kingdom of Saudi Arabia, Egypt, other Arab countries, and internationally.

Good value with mediocre balance sheet.