- Saudi Arabia

- /

- Capital Markets

- /

- SASE:4084

Undiscovered Gems in Middle East Stocks to Explore November 2025

Reviewed by Simply Wall St

In recent months, major Gulf markets have experienced a subdued performance, largely influenced by soft oil prices and oversupply concerns. Despite these challenges, the Middle East remains a region of potential for investors seeking undiscovered gems that can thrive in fluctuating market conditions. Identifying such stocks requires a keen eye for companies with robust fundamentals and the ability to adapt to economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| C. Mer Industries | 96.50% | 13.91% | 71.62% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 38.36% | 57.78% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Derayah Financial (SASE:4084)

Simply Wall St Value Rating: ★★★★★★

Overview: Derayah Financial Company offers financial and investment services in Saudi Arabia, with a market capitalization of SAR6.95 billion.

Operations: The company generates revenue from its financial and investment services in Saudi Arabia, contributing to its market capitalization of SAR6.95 billion.

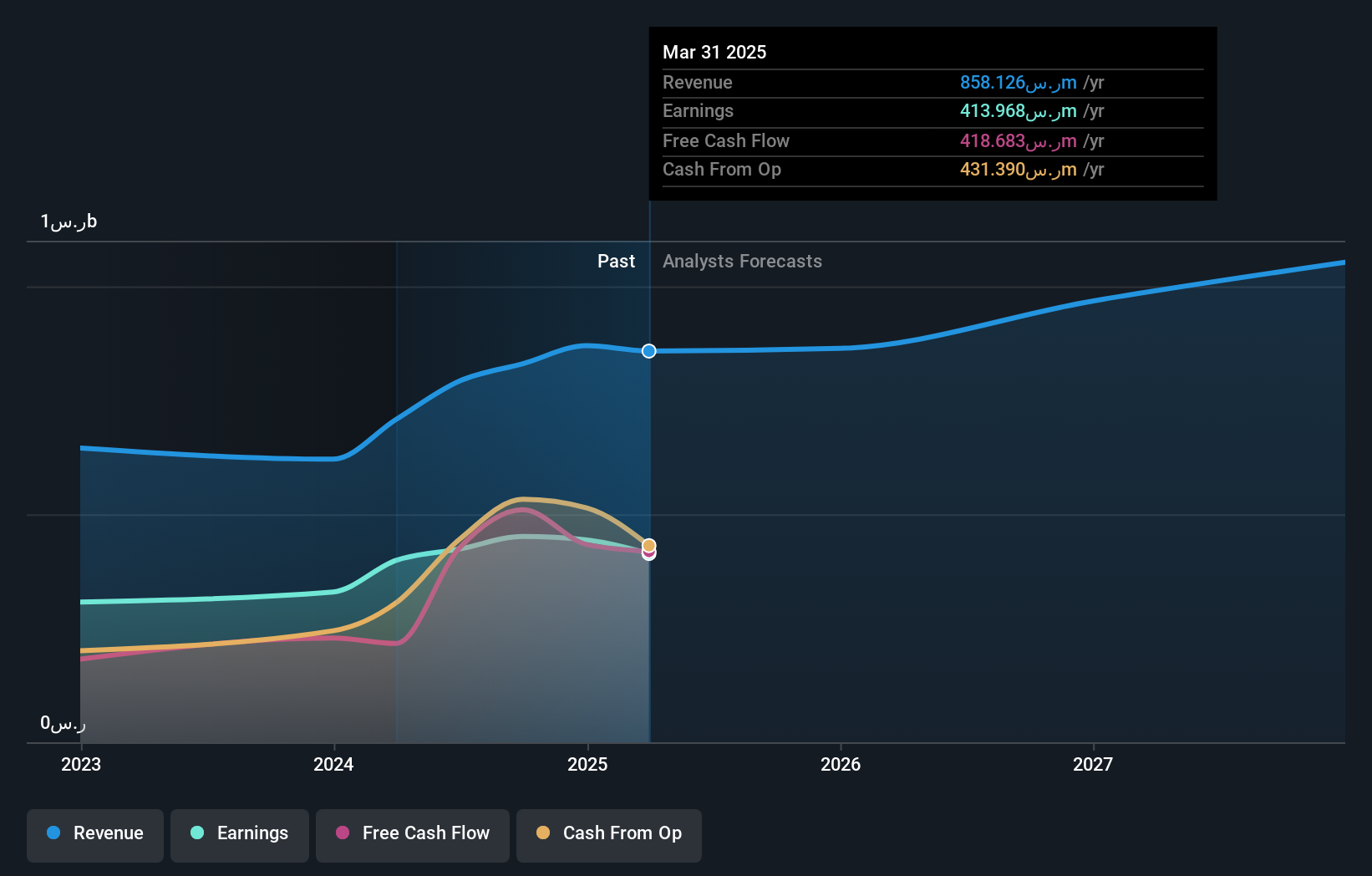

Derayah Financial, a nimble player in the capital markets, showcases a compelling narrative with its price-to-earnings ratio at 16.5x, undercutting the SA market average of 19.2x. Despite facing a challenging year with earnings growth sliding by 6.7%, the company remains profitable and debt-free, easing concerns over cash runway or interest coverage. Recent inclusion in prominent indices like S&P Pan Arab Composite and S&P Global BMI Index enhances its visibility on the global stage. Additionally, Derayah declared a quarterly dividend of SAR 0.33 per share for October 2025, reinforcing its commitment to shareholder returns amidst anticipated revenue growth of nearly 14% annually.

- Click here and access our complete health analysis report to understand the dynamics of Derayah Financial.

Evaluate Derayah Financial's historical performance by accessing our past performance report.

Al Majed for Oud (SASE:4165)

Simply Wall St Value Rating: ★★★★★★

Overview: Al Majed for Oud Company engages in the wholesale and retail trade of perfumes across Saudi Arabia and the Gulf countries, with a market cap of SAR3.57 billion.

Operations: The company's primary revenue stream is derived from the retail trade in perfumes, generating SAR1.03 billion.

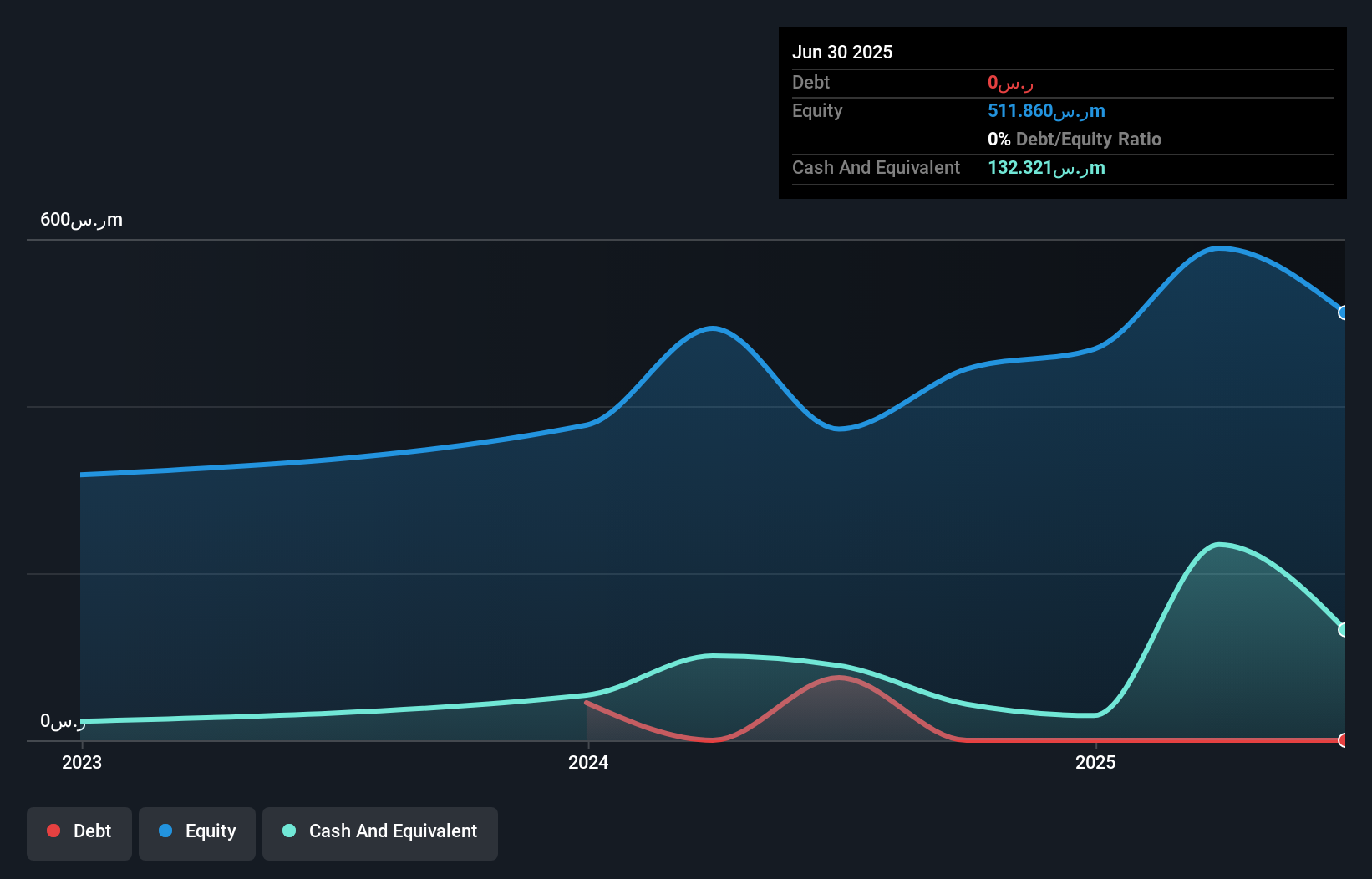

Al Majed for Oud stands out with a solid performance, boasting a 9.3% earnings growth over the past year, surpassing the industry average of 1.1%. With a P/E ratio of 19.5x, it trades attractively below the industry norm of 22.2x, indicating potential value for investors. The company operates debt-free and has maintained high-quality earnings, ensuring financial stability and operational flexibility. Recent strategic moves include aligning its UAE branches under Abu Dhabi Global Market regulations to enhance regional efficiency and presence. These factors position Al Majed for Oud as an intriguing prospect in its sector's landscape.

- Take a closer look at Al Majed for Oud's potential here in our health report.

Explore historical data to track Al Majed for Oud's performance over time in our Past section.

Terminal X Online (TASE:TRX)

Simply Wall St Value Rating: ★★★★★★

Overview: Terminal X Online Ltd. operates an e-commerce platform providing clothing, footwear, fashion accessories, cosmetics, and beauty products for men, women, and teenagers under various brands with a market cap of ₪806.48 million.

Operations: Terminal X generates revenue primarily through its e-commerce platform, with significant contributions from Terminal X at ₪443.24 million and Independent Websites at ₪71.26 million. The company experienced a net profit margin trend worth noting, which may interest investors analyzing profitability metrics over time.

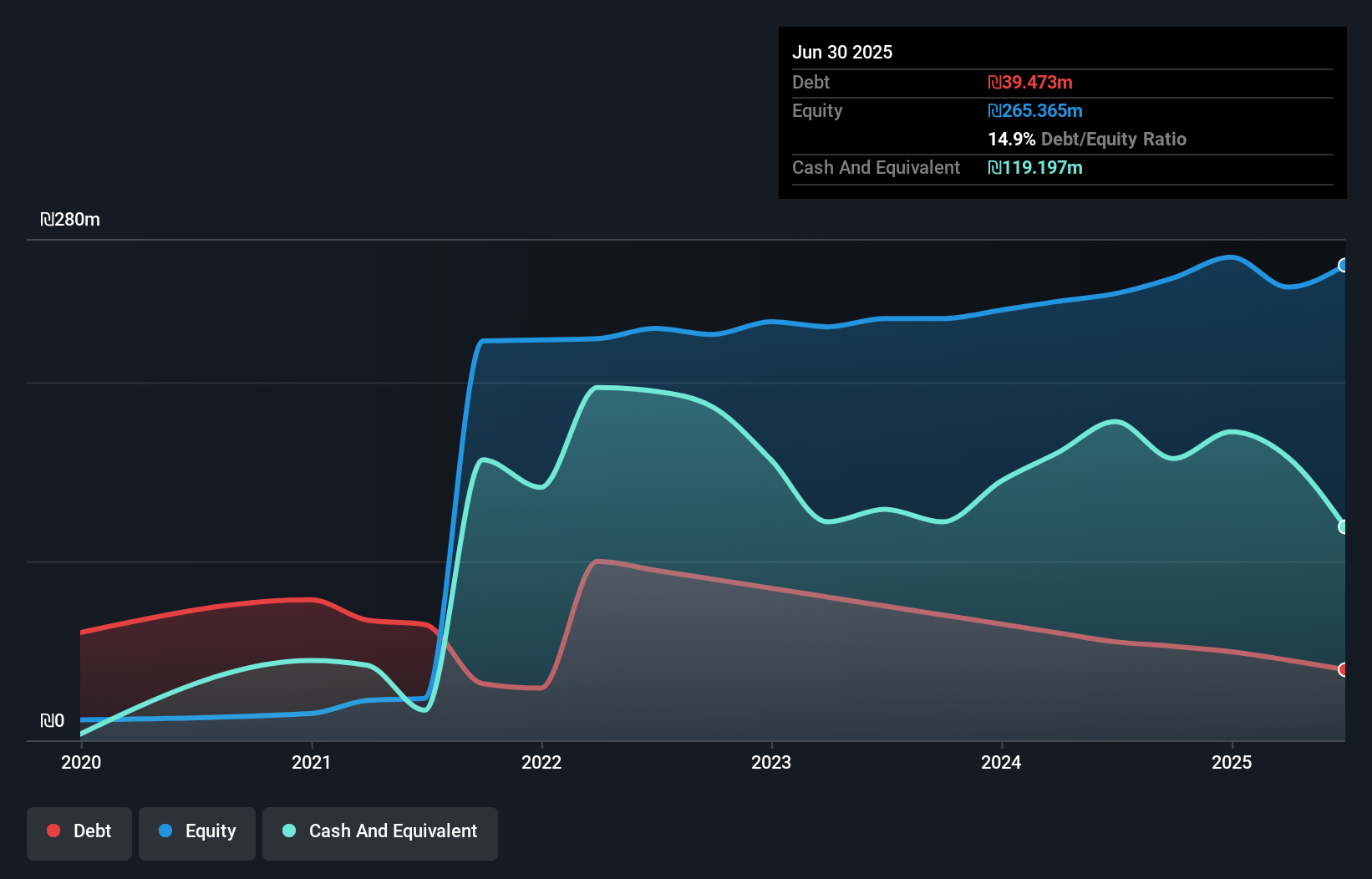

Terminal X Online is showing promising growth, with earnings surging by 182.5% over the past year, outpacing the Multiline Retail industry's -3.9%. The company's debt to equity ratio has impressively decreased from 527.3% to 14.9% over five years, indicating effective financial management and a solid balance sheet position where cash exceeds total debt. Recent earnings announcements reveal sales of ILS 133.65 million for Q2 2025, up from ILS 116.62 million last year, though net income slightly dipped to ILS 6.92 million from ILS 7.31 million previously, suggesting potential areas for operational improvement despite robust revenue growth.

- Dive into the specifics of Terminal X Online here with our thorough health report.

Assess Terminal X Online's past performance with our detailed historical performance reports.

Make It Happen

- Unlock more gems! Our Middle Eastern Undiscovered Gems With Strong Fundamentals screener has unearthed 199 more companies for you to explore.Click here to unveil our expertly curated list of 202 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4084

Derayah Financial

Provides financial and investment services in Saudi Arabia.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives