- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:1322

Al Masane Al Kobra Mining And 2 Other Hidden Middle East Gems With Strong Foundations

Reviewed by Simply Wall St

The Middle East stock markets have recently experienced a positive trend, with most Gulf indices closing higher amid expectations of a U.S. rate cut and robust non-oil economic activity bolstering investor sentiment. In this environment, identifying stocks with strong foundations becomes crucial, as they are often well-positioned to capitalize on favorable macroeconomic conditions and deliver sustainable growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Payton Industries | NA | 5.14% | 14.54% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 55.06% | 42.78% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 16.16% | 34.64% | 61.21% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 7.00% | 41.89% | 59.39% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

| Mobiltel Iletisim Hizmetleri Sanayi ve Ticaret | 21.21% | 19.59% | -34.35% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Al Masane Al Kobra Mining (SASE:1322)

Simply Wall St Value Rating: ★★★★★★

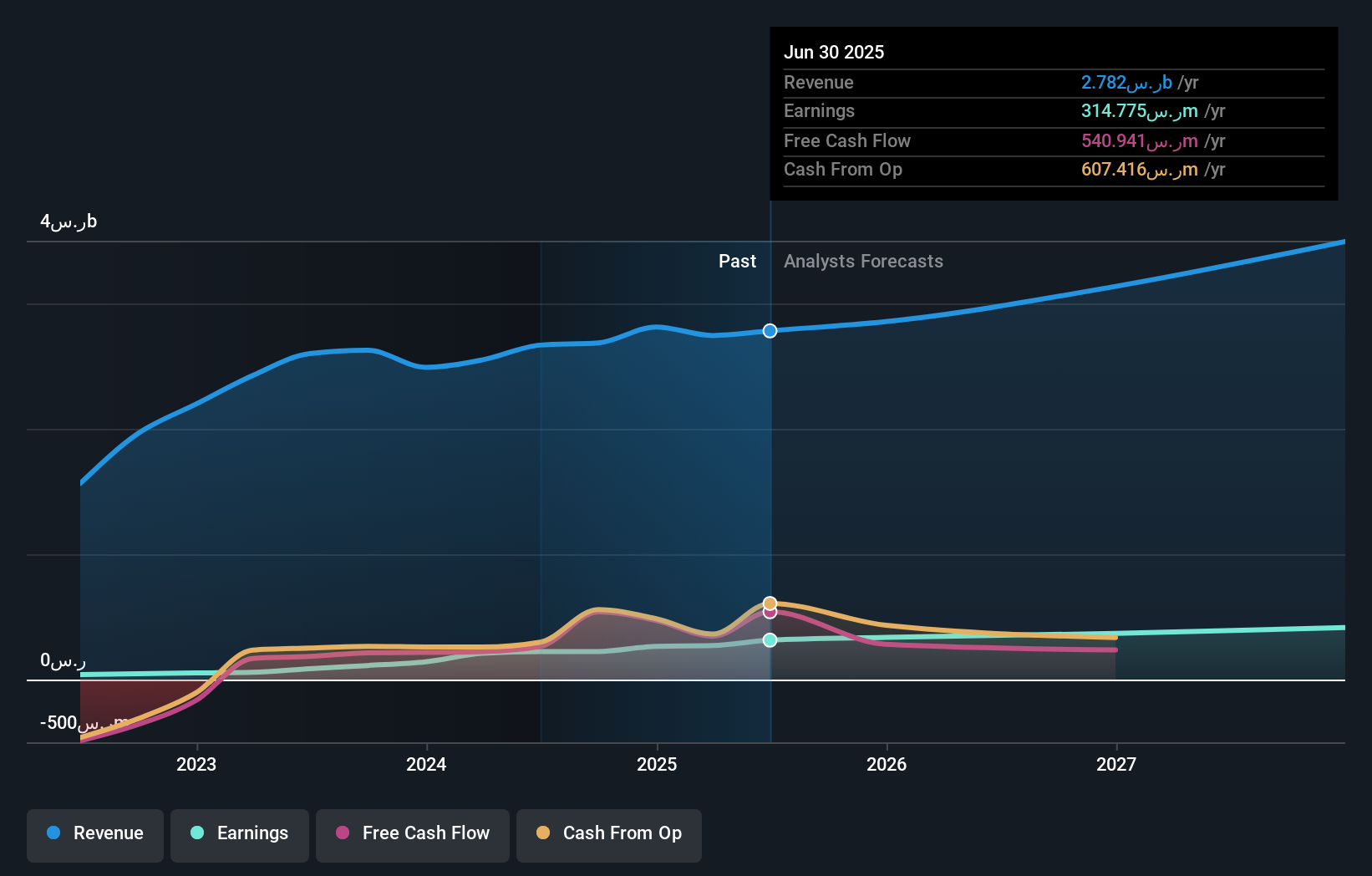

Overview: Al Masane Al Kobra Mining Company operates in the Kingdom of Saudi Arabia, focusing on the production of non-ferrous metal ores and precious metals, with a market capitalization of SAR6.74 billion.

Operations: Al Masane Al Kobra Mining generates revenue primarily through the sale of non-ferrous metal ores and precious metals. The company's financial performance is highlighted by a net profit margin of 36.5%, reflecting its profitability in the mining sector.

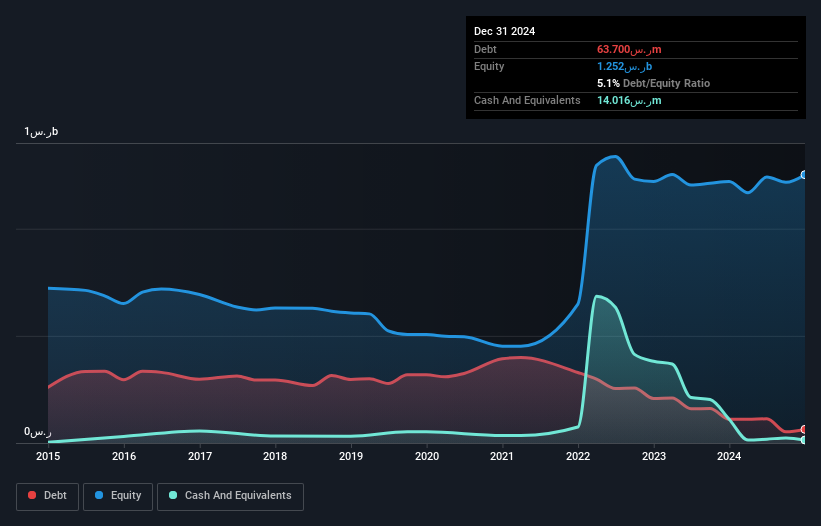

Al Masane Al Kobra Mining, a promising player in the Middle East, has shown impressive financial health and growth. Over the past year, its earnings surged by 75.9%, outpacing the industry average of 4%. With a price-to-earnings ratio of 26.9x, it offers good value compared to the sector's average of 32.5x. The company's debt to equity ratio improved significantly from 75.1% to just 9.2% over five years, indicating strong financial management. Recent dividend announcements further highlight its commitment to shareholder returns with SAR110 million distributed for H1 2025 at SAR1.25 per share starting October 21st.

Al-Babtain Power and Telecommunications (SASE:2320)

Simply Wall St Value Rating: ★★★★★☆

Overview: Al-Babtain Power and Telecommunications Company, along with its subsidiaries, manufactures lighting poles, power transmission towers, accessories, and communication towers in the United Arab Emirates, Saudi Arabia, and the Egyptian Arabic Republic with a market cap of SAR4.32 billion.

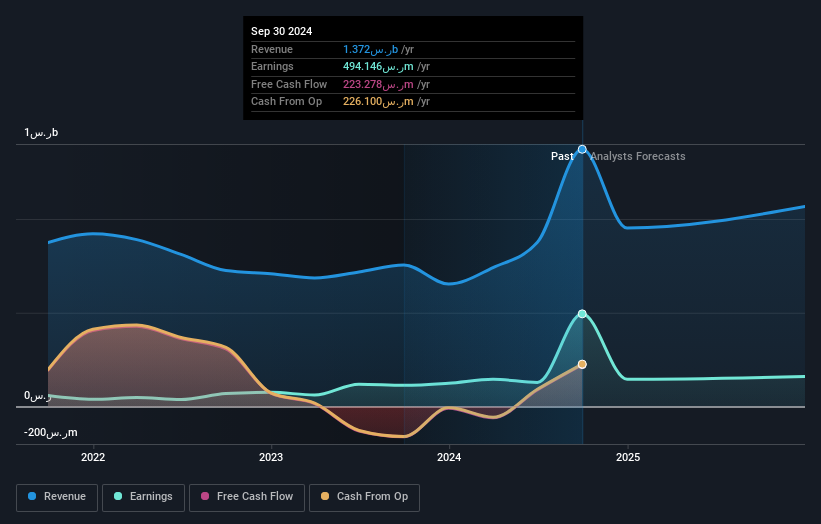

Operations: The company's primary revenue streams include the Towers and Metal Structures Sector, generating SAR1.26 billion, followed by the Solar Energy Sector at SAR595.90 million. The Columns and Lighting segment contributes SAR534.91 million, while the Design, Supply and Installation sector adds SAR394.57 million to overall revenues.

Al-Babtain Power and Telecommunications, a dynamic player in the Middle East, showcases impressive growth with earnings surging 40.8% over the past year, outpacing its industry peers. The company's net income for Q2 2025 jumped to SAR 97.75 million from SAR 54.32 million a year prior, while sales rose to SAR 687.49 million from SAR 650.1 million. With a price-to-earnings ratio of 13.7x, Al-Babtain offers good value compared to the SA market average of 19.2x and maintains strong interest coverage at an EBIT of 5.6 times its debt payments despite a high net debt-to-equity ratio of 68%.

- Click to explore a detailed breakdown of our findings in Al-Babtain Power and Telecommunications' health report.

Learn about Al-Babtain Power and Telecommunications' historical performance.

Saudi Reinsurance (SASE:8200)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Saudi Reinsurance Company offers a range of reinsurance products across the Kingdom of Saudi Arabia, the Middle East, Africa, Asia, and internationally, with a market capitalization of SAR5.38 billion.

Operations: The company's primary revenue streams are from Property and Casualty, generating SAR1.28 billion, and Life and Health reinsurance segments, contributing SAR48.85 million. The net profit margin is not specified in the provided data.

Saudi Re has demonstrated impressive growth, with earnings surging 279% over the past year, outpacing the insurance industry's -19%. The debt to equity ratio shifted from 0% to 2.7% in five years, indicating a cautious approach to leveraging. Despite substantial shareholder dilution recently, the company remains profitable with high-quality earnings and robust interest coverage at 46.8 times EBIT. A favorable price-to-earnings ratio of 11x compared to the SA market's 19x suggests good value prospects. Recent approval for capital increase through bonus shares and employee incentives reflects strategic expansion efforts amid a forecasted revenue growth of around 21% annually.

- Take a closer look at Saudi Reinsurance's potential here in our health report.

Gain insights into Saudi Reinsurance's past trends and performance with our Past report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 205 companies within our Middle Eastern Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1322

Al Masane Al Kobra Mining

Engages in the production of non-ferrous metal ores and precious metals in Kingdom of Saudi Arabia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives