3 European Stocks Possibly Trading Below Their Estimated Value By Up To 19.3%

Reviewed by Simply Wall St

As European markets navigate a complex landscape of monetary policy decisions and mixed performance across major indices, investors are keenly assessing opportunities amid these fluctuations. In this environment, identifying potentially undervalued stocks becomes crucial, as they may offer significant value when companies' intrinsic worth is not fully reflected in their current market prices.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Witted Megacorp Oyj (HLSE:WITTED) | €1.395 | €2.68 | 48% |

| Talenom Oyj (HLSE:TNOM) | €3.70 | €7.20 | 48.6% |

| Rheinmetall (XTRA:RHM) | €1940.00 | €3793.95 | 48.9% |

| Micro Systemation (OM:MSAB B) | SEK61.60 | SEK121.94 | 49.5% |

| LINK Mobility Group Holding (OB:LINK) | NOK30.80 | NOK59.82 | 48.5% |

| Lingotes Especiales (BME:LGT) | €5.70 | €11.16 | 48.9% |

| Green Oleo (BIT:GRN) | €0.79 | €1.52 | 48% |

| E-Globe (BIT:EGB) | €0.68 | €1.32 | 48.3% |

| cyan (XTRA:CYR) | €2.26 | €4.39 | 48.5% |

| Atea (OB:ATEA) | NOK143.60 | NOK279.28 | 48.6% |

We're going to check out a few of the best picks from our screener tool.

eVISO (BIT:EVISO)

Overview: eVISO S.p.A. develops an artificial intelligence platform for the commodities market in Italy and has a market cap of €217.54 million.

Operations: The company generates revenue through its artificial intelligence platform tailored for the commodities market in Italy.

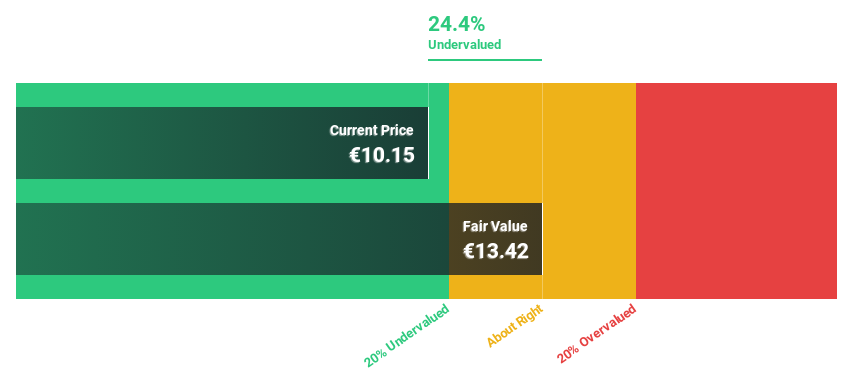

Estimated Discount To Fair Value: 19.3%

eVISO is trading at €9.78, below its estimated fair value of €12.12, indicating potential undervaluation based on discounted cash flow analysis. The company's earnings are expected to grow significantly at 31% annually, outpacing the Italian market's 9.2%. Despite being undervalued by 19.3%, it doesn't meet the threshold for highly undervalued status but remains attractive due to strong profit growth forecasts and a high future return on equity of 31.2%.

- Our earnings growth report unveils the potential for significant increases in eVISO's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of eVISO.

Tinexta (BIT:TNXT)

Overview: Tinexta S.p.A. and its subsidiaries offer digital trust, cybersecurity, and business innovation services across various regions including Italy, France, Spain, the EU, the UK, the UAE, and internationally with a market cap of €681.03 million.

Operations: The company's revenue is derived from three main segments: Cybersecurity (€127.16 million), Digital Trust (€212.13 million), and Business Innovation (€158.62 million).

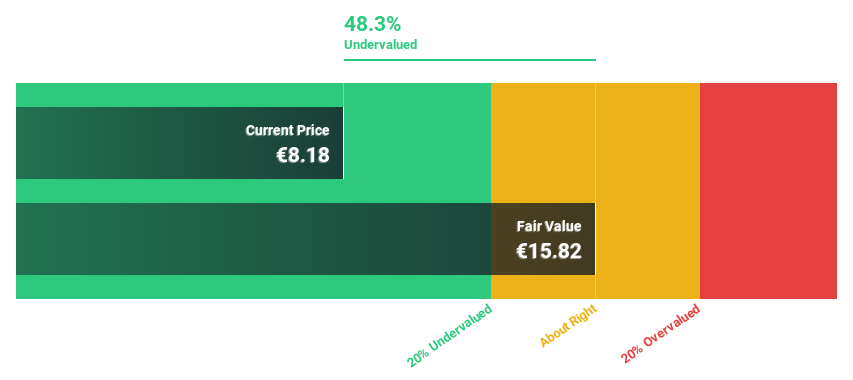

Estimated Discount To Fair Value: 11.6%

Tinexta is currently trading at €14.84, slightly below its estimated fair value of €16.79, suggesting it may be undervalued based on discounted cash flow analysis. Earnings are forecast to grow significantly at 36% annually, surpassing the Italian market's growth rate. Despite this potential, the company has a high debt level and volatile share price. Recent M&A activity involving Advent International and Nextalia SGR could impact future valuation dynamics with a proposed stake acquisition for €290 million.

- According our earnings growth report, there's an indication that Tinexta might be ready to expand.

- Unlock comprehensive insights into our analysis of Tinexta stock in this financial health report.

Teraplast (BVB:TRP)

Overview: Teraplast S.A. and its subsidiaries manufacture and sell construction materials and PVC granules in Romania and internationally, with a market cap of RON1.31 billion.

Operations: Teraplast's revenue is primarily derived from its Installations and Recycling segment at RON736.51 million, followed by Flexible Packaging at RON138.09 million, Granules including Recycled at RON93.93 million, and Carpentry Joinery at RON53.19 million.

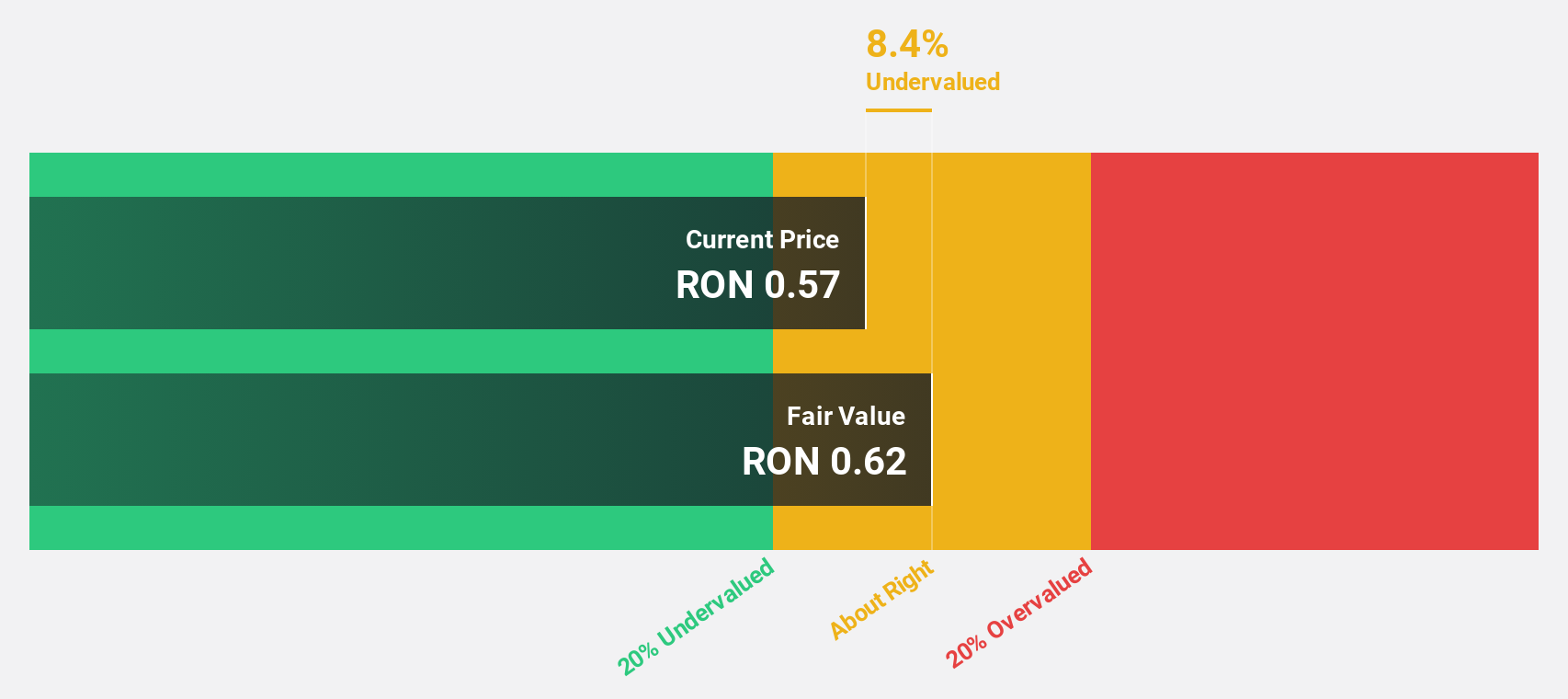

Estimated Discount To Fair Value: 10.7%

Teraplast is trading at RON 0.55, slightly below its estimated fair value of RON 0.61, indicating potential undervaluation based on cash flows. Recent earnings showed a positive turnaround with net income of RON 2.49 million for the first half of 2025, compared to a loss last year. Revenue growth is projected at 11.5% annually, outpacing the broader Romanian market's growth rate but interest payments remain poorly covered by earnings despite expected profitability within three years.

- The analysis detailed in our Teraplast growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Teraplast's balance sheet health report.

Key Takeaways

- Unlock our comprehensive list of 213 Undervalued European Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teraplast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:TRP

Teraplast

Manufactures and sells construction materials and PVC granules in Romania and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives