As the European market navigates mixed returns with hopes of interest rate cuts from major economies, investors are keenly observing opportunities that may arise from undervalued stocks. In this context, identifying stocks trading below their intrinsic value can be a strategic move, as these equities might offer potential for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Stellantis (BIT:STLAM) | €10.28 | €20.10 | 48.9% |

| Sanoma Oyj (HLSE:SANOMA) | €9.39 | €18.44 | 49.1% |

| Ottobock SE KGaA (XTRA:OBCK) | €69.25 | €138.11 | 49.9% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.465 | €4.88 | 49.4% |

| Mo-BRUK (WSE:MBR) | PLN307.00 | PLN600.79 | 48.9% |

| KB Components (OM:KBC) | SEK41.75 | SEK83.21 | 49.8% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.39 | €0.77 | 49.7% |

| Esautomotion (BIT:ESAU) | €3.10 | €6.14 | 49.5% |

| Allegro.eu (WSE:ALE) | PLN30.70 | PLN60.35 | 49.1% |

| Allcore (BIT:CORE) | €1.345 | €2.68 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

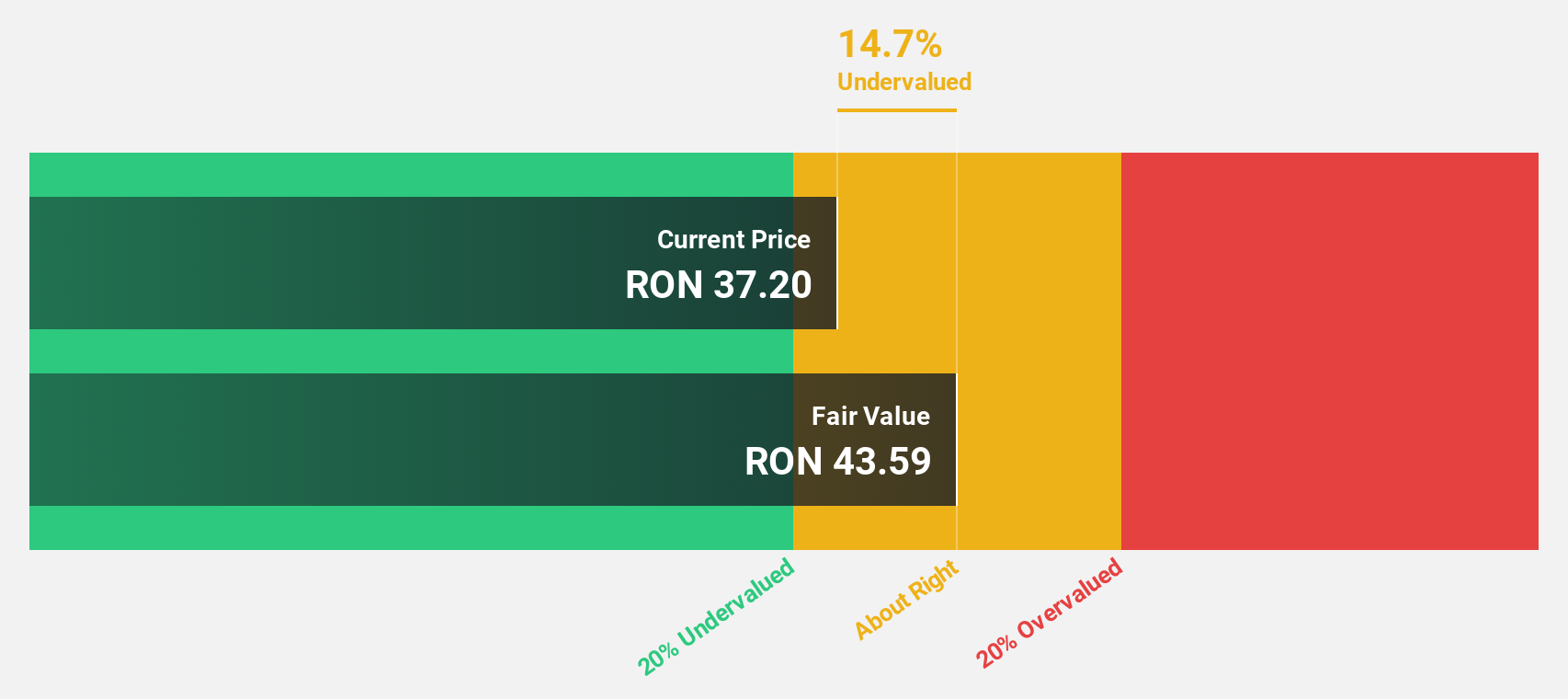

Sphera Franchise Group (BVB:SFG)

Overview: Sphera Franchise Group S.A., along with its subsidiaries, operates quick service and takeaway restaurants and has a market cap of RON1.46 billion.

Operations: The company's revenue is primarily generated from its Kentucky Fried Chicken (KFC) operations at RON1.35 billion, followed by Pizza Hut at RON107.68 million and Taco Bell at RON102.89 million.

Estimated Discount To Fair Value: 28.7%

Sphera Franchise Group appears undervalued, trading at RON 37.85, below its estimated fair value of RON 53.12. Despite a decline in net income to RON 31.16 million for the first nine months of 2025, revenue is projected to grow faster than the Romanian market at 9.6% annually. The company plans strategic expansions with new restaurant openings and forecasts high return on equity in three years, though profit margins have contracted recently and dividends are not well covered by earnings.

- Our earnings growth report unveils the potential for significant increases in Sphera Franchise Group's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Sphera Franchise Group.

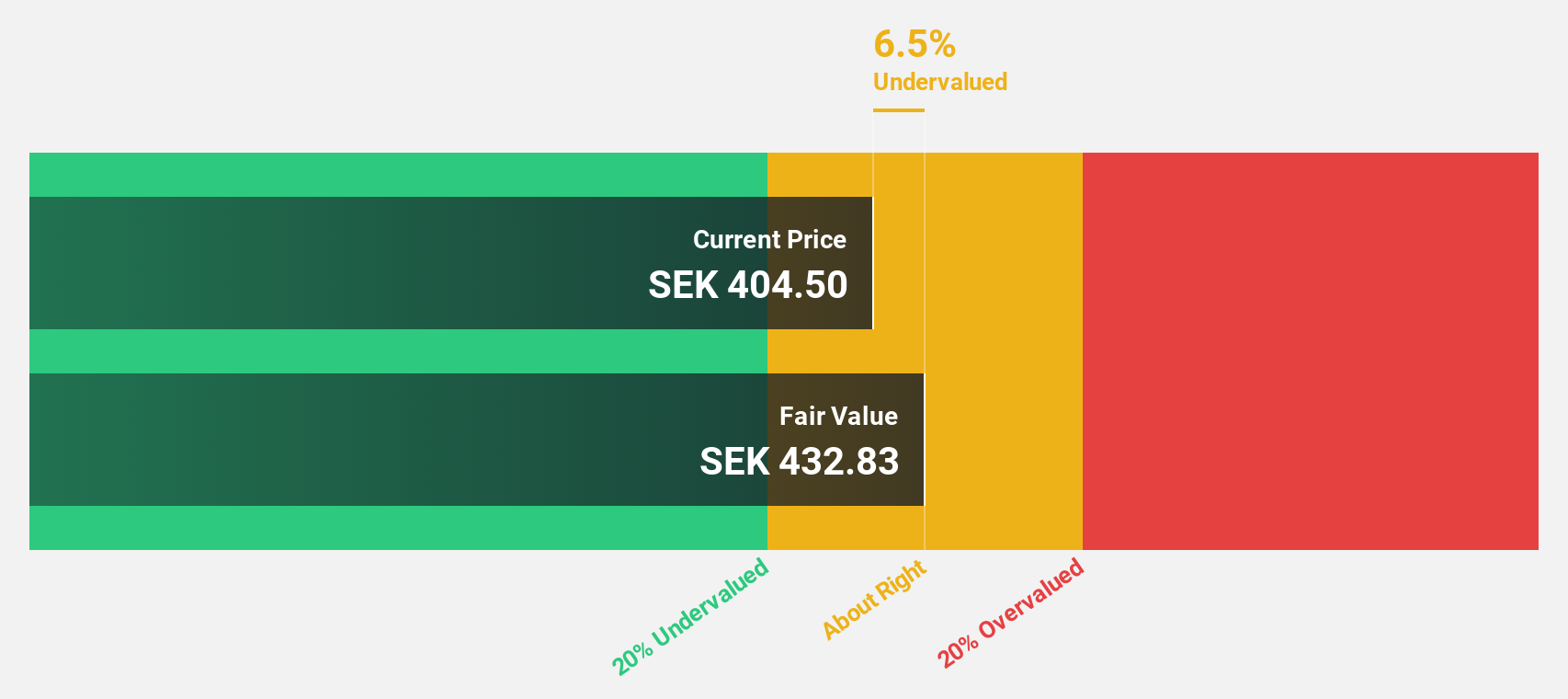

Lime Technologies (OM:LIME)

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region and has a market cap of approximately SEK4.29 billion.

Operations: The company's revenue primarily comes from selling and implementing CRM software systems, amounting to SEK731.63 million.

Estimated Discount To Fair Value: 28.8%

Lime Technologies is trading at SEK 322, significantly undervalued compared to its fair value estimate of SEK 452.55. The company's earnings are expected to grow substantially at 22.2% annually, outpacing the Swedish market's growth rate of 13.5%. Recent Q3 results showed increased sales and net income year-over-year, with a new CEO transition planned for January, ensuring leadership continuity amid strong financial performance and growth forecasts.

- Our expertly prepared growth report on Lime Technologies implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Lime Technologies with our detailed financial health report.

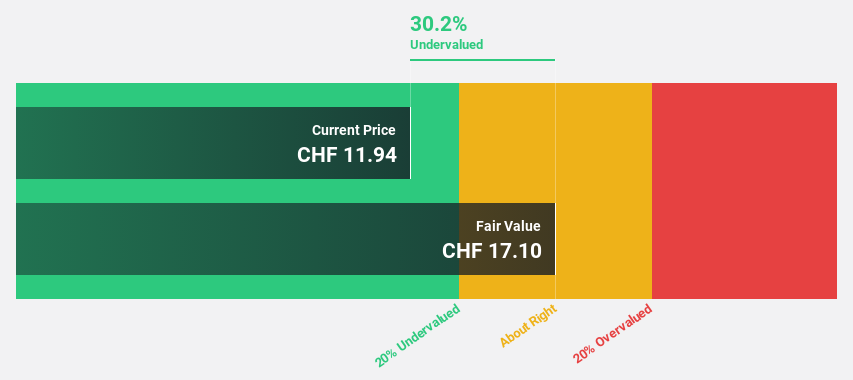

mobilezone holding ag (SWX:MOZN)

Overview: Mobilezone Holding AG, along with its subsidiaries, offers mobile and fixed-line telephony, television, and Internet services for multiple network operators in Germany and Switzerland, with a market cap of CHF523.95 million.

Operations: The company generates revenue from its operations in Germany, amounting to CHF697.27 million, and in Switzerland, totaling CHF265.95 million.

Estimated Discount To Fair Value: 18.2%

mobilezone holding ag is trading at CHF12.14, undervalued compared to its fair value of CHF14.83. Despite negative shareholders' equity and high debt levels, earnings are projected to grow significantly at 21.21% annually, surpassing Swiss market expectations. However, the dividend yield of 7.41% is not well covered by earnings, and recent profit margins have declined from last year due to large one-off items impacting financial results.

- Our growth report here indicates mobilezone holding ag may be poised for an improving outlook.

- Navigate through the intricacies of mobilezone holding ag with our comprehensive financial health report here.

Seize The Opportunity

- Navigate through the entire inventory of 192 Undervalued European Stocks Based On Cash Flows here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LIME

Lime Technologies

Provides software as a service (SaaS) based customer relationship management (CRM) solutions in the Nordic region.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026