- Portugal

- /

- Electric Utilities

- /

- ENXTLS:EDP

Is It Too Late to Consider EDP After a 39% Rally in 2025?

Reviewed by Bailey Pemberton

If you are weighing your next move with EDP stock, you are not alone. People are noticing the wild swings and steady climbs this company has posted, and many are wondering if now is the right time to jump in, or maybe to take some profits. Let’s start by looking at what’s happened lately.

Over the last month, EDP’s share price has jumped 13.2%, and year-to-date it is up an impressive 39.3%. That is not a typo, and it handily outpaces many market benchmarks. Even looking further back, the stock has delivered a 25% gain over the past year and a 34.5% return over five years. If you have been holding EDP for a while, those numbers likely feel very rewarding.

So, what is fueling this run? Recent headlines point to renewed optimism around the energy transition in Europe, with EDP well positioned as a leader in clean power generation. Investors also seem to be warming to the company’s international expansion plans, which could open up new markets and revenue streams. All of this has translated into a period of increased demand for the stock, pushing prices higher and possibly causing some to reevaluate the company’s risk profile.

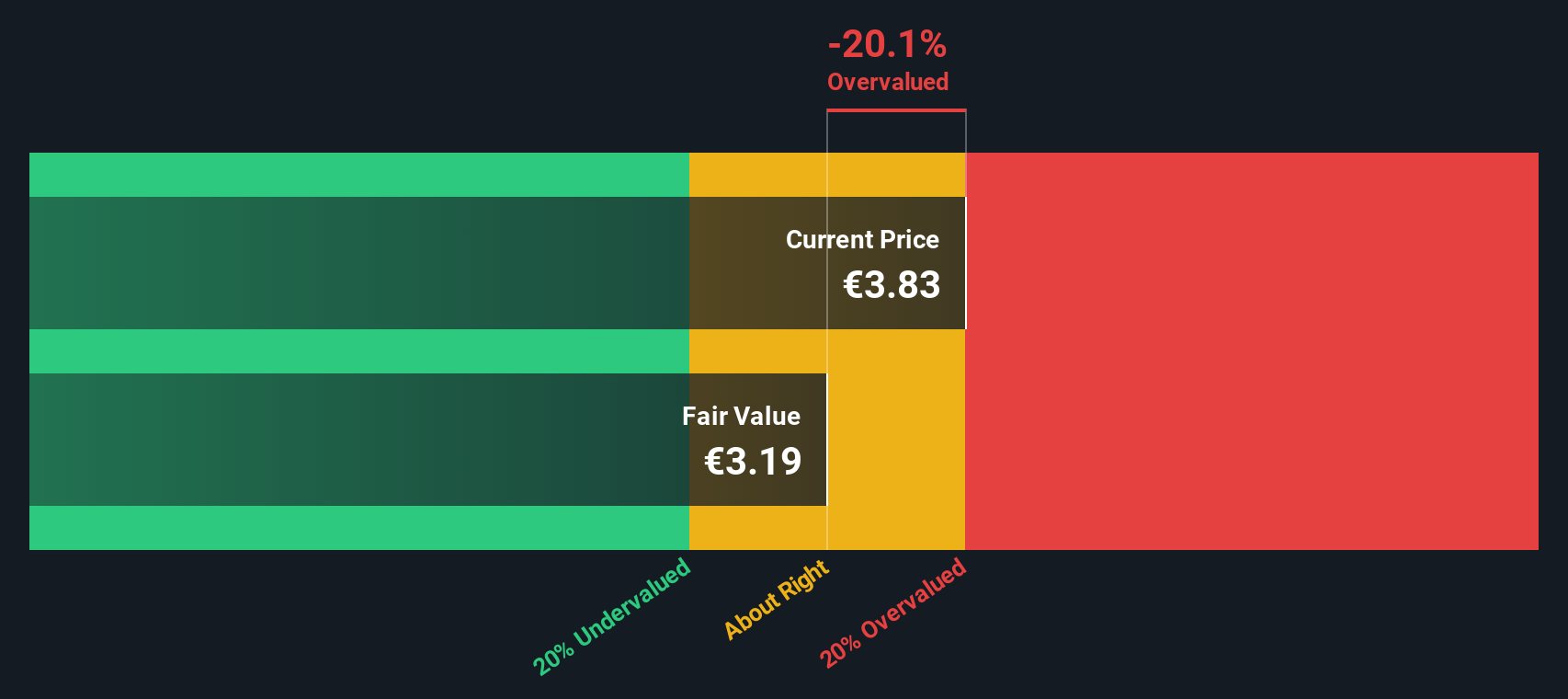

But with such a strong run, is EDP actually undervalued at current levels? According to our most recent assessment, EDP scores a 0 out of 6 on key undervaluation checks. This figure might surprise those focusing only on recent gains. In the next section, let’s dig into the details of these valuation checks and examine how different methods really stack up for EDP, before revealing an even more comprehensive way to assess what the stock is truly worth.

EDP scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: EDP Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates the intrinsic value of a stock based on future dividends, discounting them back to present value. This approach is best suited for companies with a stable and predictable dividend payout, as it captures the ongoing income investors can reasonably expect.

For EDP, the latest figures show a dividend per share of €0.21, with a high payout ratio of 92.8%. The company’s return on equity stands at 8.41%, and using a growth estimate calculated as (1 - Payout Ratio) times ROE, EDP’s dividend is expected to grow at just 0.6% annually. This low growth rate signals that most of EDP’s profits are already returned to shareholders as dividends, which leaves limited scope for significant future increases.

According to the DDM, the fair value per share is €3.30. With the current share price trading substantially above this level, the model indicates EDP is roughly 33.6% overvalued using this methodology. The numbers suggest that, despite an attractive dividend, investors may be paying a premium for the stock relative to the expected return from dividends alone.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests EDP may be overvalued by 33.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: EDP Price vs Earnings

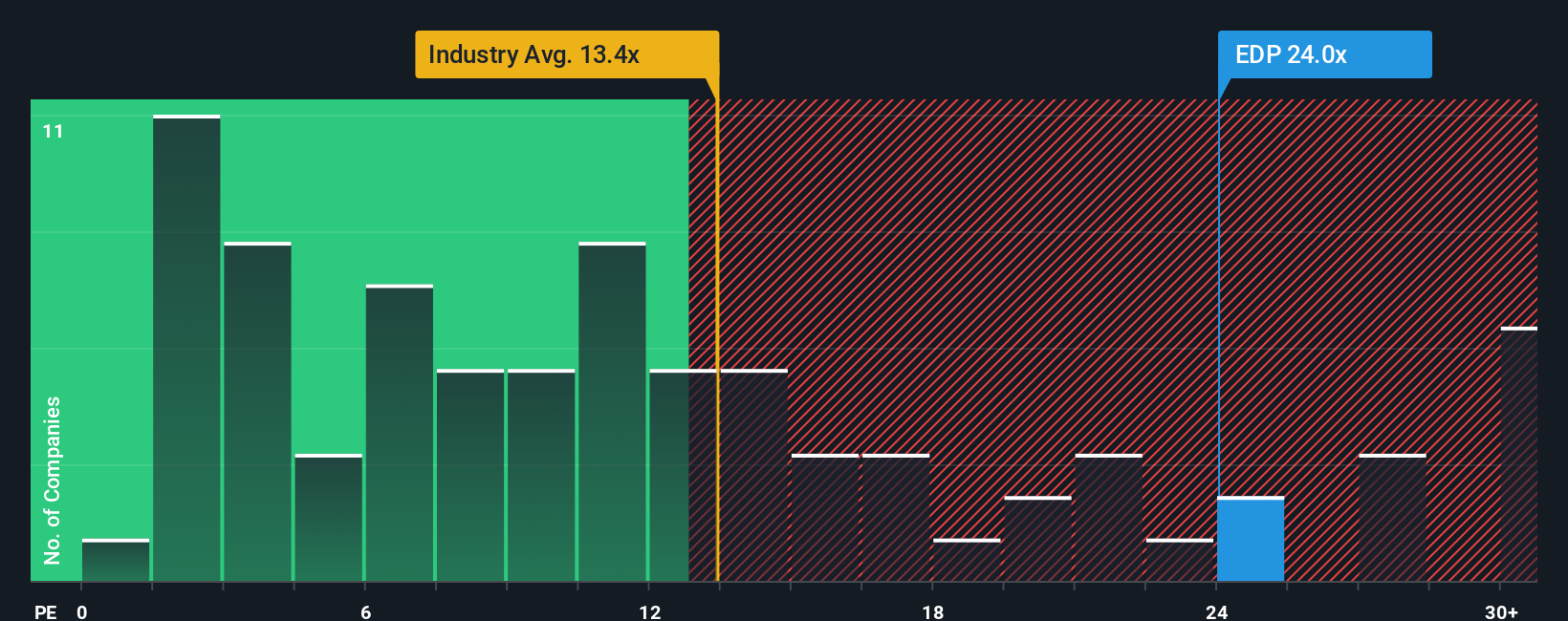

The price-to-earnings (PE) ratio is a popular metric for valuing profitable companies like EDP because it tells you how much investors are willing to pay for each euro of the company’s earnings. Essentially, the PE ratio captures the market’s expectations for future growth and reflects how much risk investors are willing to take for those earnings streams.

Growth prospects and risk can have a significant effect on what is considered a "normal" or "fair" PE ratio. Companies with stronger, more reliable growth or lower risk profiles usually merit higher PE ratios than peers with slower growth or higher uncertainty. This means context matters, and looking at a single company’s PE without perspective can be misleading.

Currently, EDP trades at a PE of 24.4x, which is substantially above the electric utilities industry average of 14.6x and also above the peer average of 15.1x. This suggests that the market is pricing in more optimism for EDP compared to its sector and similar companies.

To get a sharper read, we bring in Simply Wall St’s proprietary "Fair Ratio" metric, which considers factors beyond simple peer or sector averages. It evaluates the right PE for EDP based on its specific earnings growth, industry, profit margins, market capitalization, and company-specific risks. This delivers a more nuanced valuation. For EDP, the Fair Ratio comes in at 21.6x.

Comparing EDP’s actual PE of 24.4x to the Fair Ratio of 21.6x, the current valuation stands a little above fair value, but not dramatically so. The difference is meaningful, but doesn't suggest a glaring disconnect.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your EDP Narrative

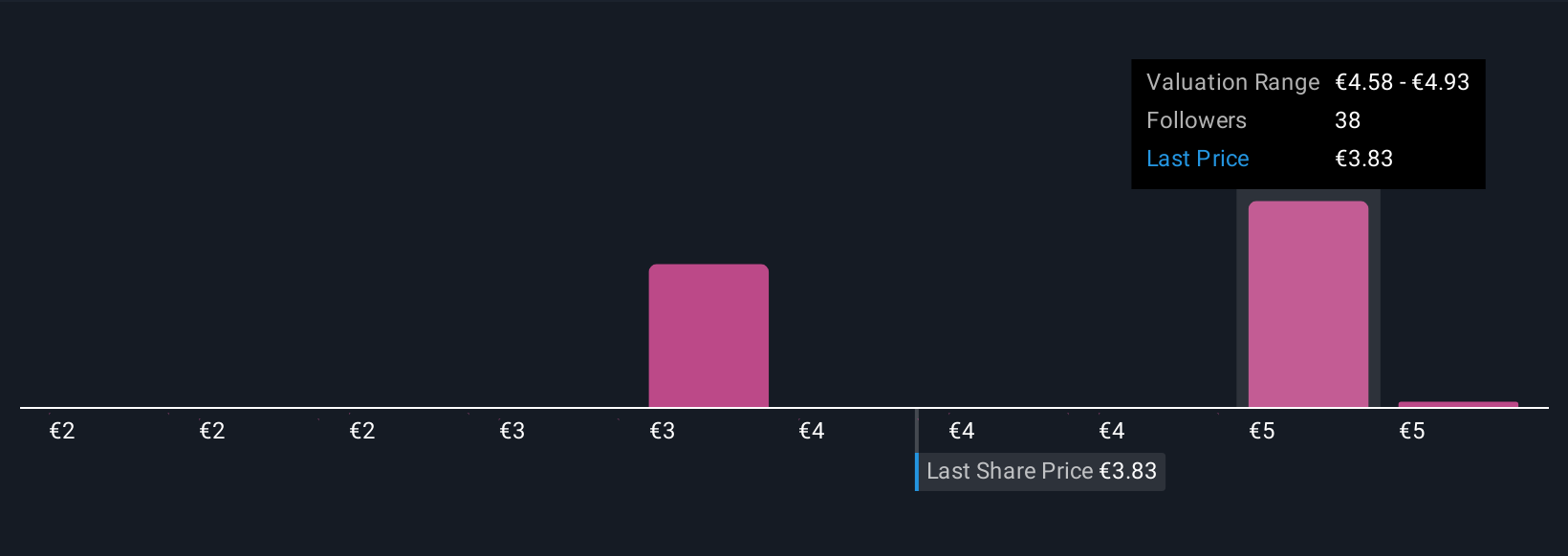

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. In simple terms, a Narrative is your opportunity to frame a company’s story using your own expectations for its future. This means connecting what you believe will happen with its revenue, profit margins, and ultimately, its fair value. Narratives go beyond raw numbers by letting you explain the “why” behind your analysis, so you can see how the company’s business journey lines up with your personal outlook and the investment case it presents.

On Simply Wall St’s Community page, millions of investors use Narratives as a simple yet effective tool to chart their investment logic. Narratives make it easy to compare your calculated Fair Value to the current Price, helping you decide for yourself when it might be time to buy or sell. Even better, your Narrative is always up-to-date and dynamically incorporates new developments such as company news or earnings results.

For example, with EDP, some investors are optimistic, believing strong electricity demand and higher margins will drive the fair value as high as €5.95. Meanwhile, others are more cautious and set their estimates closer to €3.5 due to risks like asset rotation dependency or currency volatility. Narratives give you the freedom to make and adjust your own call, grounded in the story you see playing out for EDP.

Do you think there's more to the story for EDP? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EDP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:EDP

EDP

Engages in the generation, transmission, distribution, and supply of electricity in Portugal, Spain, France, Poland, Romania, Italy, Belgium, the United Kingdom, Greece, Colombia, Brazil, North America, and internationally.

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives