- Poland

- /

- Telecom Services and Carriers

- /

- WSE:CBF

Exploring Electrolux Professional And 2 Other Undiscovered European Gems

Reviewed by Simply Wall St

Amidst concerns over U.S. trade tariffs and monetary policy uncertainties, the pan-European STOXX Europe 600 Index has seen a decline of 1.23%, reflecting broader market apprehensions about economic growth in the region. Despite these challenges, opportunities remain for discerning investors to identify promising stocks that demonstrate resilience and potential for growth in such volatile environments. In this context, exploring companies like Electrolux Professional can reveal hidden gems that offer unique value propositions and strategic advantages in navigating current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -1.57% | -8.96% | ★★★★☆☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 410.88% | 4.14% | 7.22% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.33% | -13.11% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Electrolux Professional (OM:EPRO B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Electrolux Professional AB (publ) offers a range of food service, beverage, and laundry products and solutions to various service sectors including restaurants, hotels, healthcare, and educational facilities with a market cap of SEK20.00 billion.

Operations: Electrolux Professional's revenue primarily comes from its Food & Beverage segment, generating SEK7.59 billion, and its Laundry segment, contributing SEK4.99 billion.

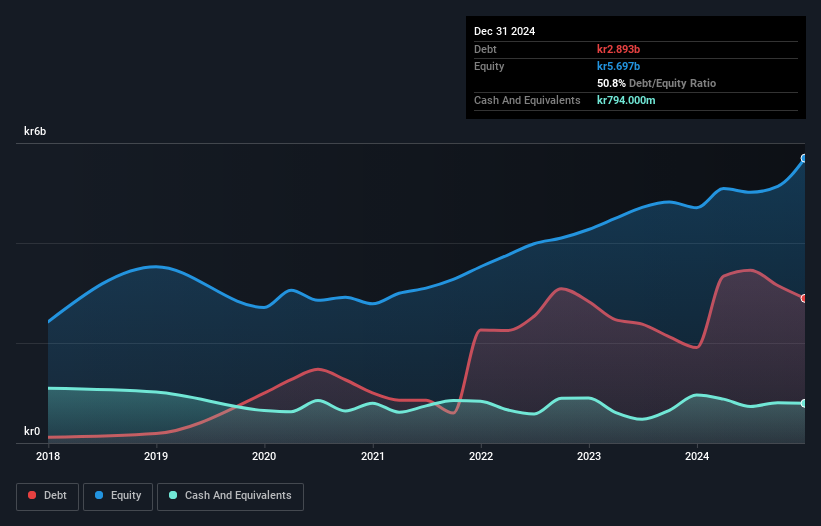

Electrolux Professional, with its focus on innovation and sustainability, recently showcased new electric steamers aimed at reducing energy use. The company's earnings rose by 3.6% last year, outpacing the Machinery industry's growth of 1.2%. Trading at a significant discount to estimated fair value, it offers good relative value compared to peers. However, debt to equity has climbed from 36.8% to 50.8% over five years but remains manageable with well-covered interest payments (9.2x EBIT). With a planned R&D investment of 5%, Electrolux is set for future growth despite European market challenges and tariff uncertainties impacting costs.

Cosmo Pharmaceuticals (SWX:COPN)

Simply Wall St Value Rating: ★★★★★★

Overview: Cosmo Pharmaceuticals N.V. is engaged in the development and commercialization of products for gastroenterology, dermatology, and healthtech globally, with a market cap of CHF890.55 million.

Operations: Cosmo Pharmaceuticals generates revenue primarily from its pharmaceuticals segment, amounting to €185.36 million.

Cosmo Pharmaceuticals, a nimble player in the pharmaceuticals sector, has shown impressive growth with earnings surging by 542% last year. The company boasts a robust balance sheet, with its debt to equity ratio plummeting from 38.9% to a mere 0.1% over five years and interest payments comfortably covered by EBIT at 154 times. Trading significantly below estimated fair value at CHF103.37, Cosmo's strategic focus on AI and digital health innovations positions it for continued expansion in lucrative markets like endoscopy and dermatology, despite potential regulatory challenges that could influence short-term profitability dynamics.

Cyber_Folks (WSE:CBF)

Simply Wall St Value Rating: ★★★★★★

Overview: Cyber_Folks S.A. is a technology company focused on business digitization and enterprise support in Poland and internationally, with a market cap of PLN2.20 billion.

Operations: Cyber_Folks generates revenue through its technology services aimed at business digitization and enterprise support. The company has a market cap of PLN2.20 billion.

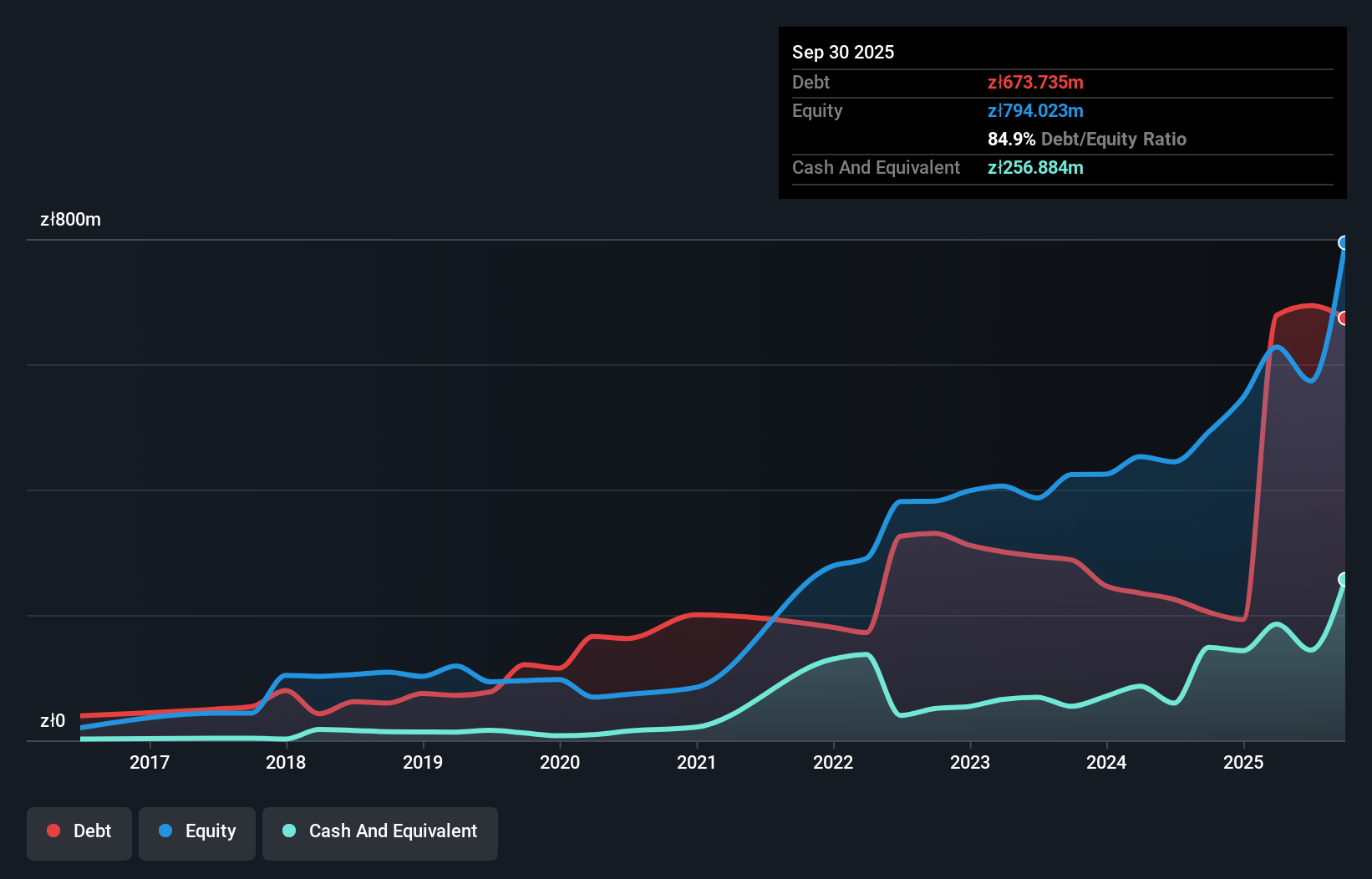

Cyber_Folks, a promising player in the European market, reported robust financials with sales reaching PLN 657.04 million and net income at PLN 116.78 million for the year ending December 2024. This impressive performance is underpinned by high-quality earnings and a substantial earnings growth of 129.8%, outpacing the Telecom sector's average. The company’s interest payments are comfortably covered by EBIT at a ratio of 6.8 times, indicating strong operational efficiency. With its debt to equity ratio reduced from 118.5% to a satisfactory 35.2% over five years, Cyber_Folks demonstrates prudent financial management while trading significantly below estimated fair value, suggesting potential upside for investors.

- Navigate through the intricacies of Cyber_Folks with our comprehensive health report here.

Gain insights into Cyber_Folks' historical performance by reviewing our past performance report.

Summing It All Up

- Click here to access our complete index of 361 European Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CBF

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026