- Sweden

- /

- Industrials

- /

- OM:IDUN B

Undiscovered Gems in Europe To Watch This December 2025

Reviewed by Simply Wall St

As European markets show resilience with the STOXX Europe 600 Index rising by 2.35% and major single-country indexes also posting gains, investors are keenly observing how subdued inflation and fiscal policies might impact small-cap opportunities across the continent. Against this backdrop, identifying stocks that demonstrate strong fundamentals and potential for growth amidst these economic conditions is crucial for those looking to uncover hidden gems in the European market.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Envirotainer | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

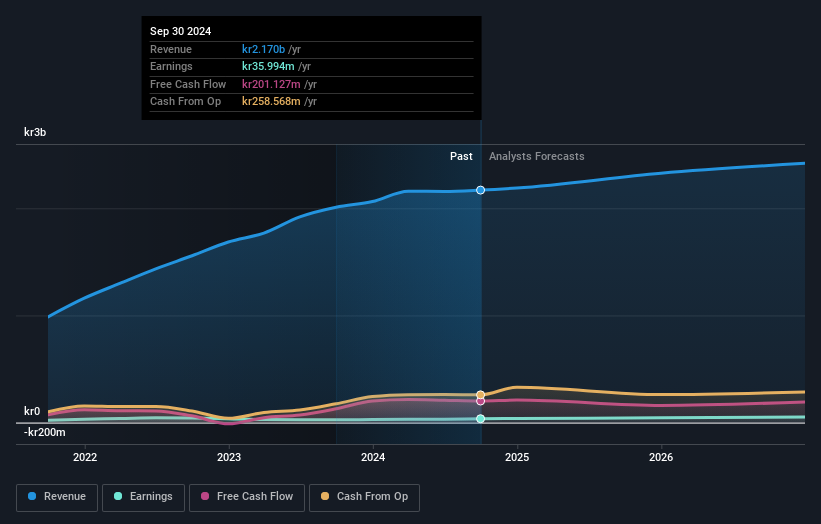

Idun Industrier (OM:IDUN B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Idun Industrier AB (publ) is an investment holding company that focuses on investing in and developing industrial and service businesses across Sweden, the Nordic countries, Europe, and internationally, with a market capitalization of approximately SEK4.05 billion.

Operations: Idun Industrier generates revenue primarily from its Manufacturing segment, contributing SEK1.40 billion, and its Service & Maintenance segment, which adds SEK845.88 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability and operational efficiency.

Idun Industrier, with its high net debt to equity ratio of 84.9%, might raise eyebrows, yet it efficiently covers interest payments with a 3.2x EBIT coverage. The company's earnings growth of 35.1% over the past year outpaces the Industrials industry average of 18.9%, showcasing robust performance. Despite this, its debt has decreased significantly from a whopping 210.8% to a more manageable 120.8% over five years, indicating improved financial health. Recent results reveal sales of SEK521 million for Q3 and net income rising to SEK14 million from SEK7 million last year, reflecting solid operational progress and potential value below estimated fair value by about 25%.

- Unlock comprehensive insights into our analysis of Idun Industrier stock in this health report.

Examine Idun Industrier's past performance report to understand how it has performed in the past.

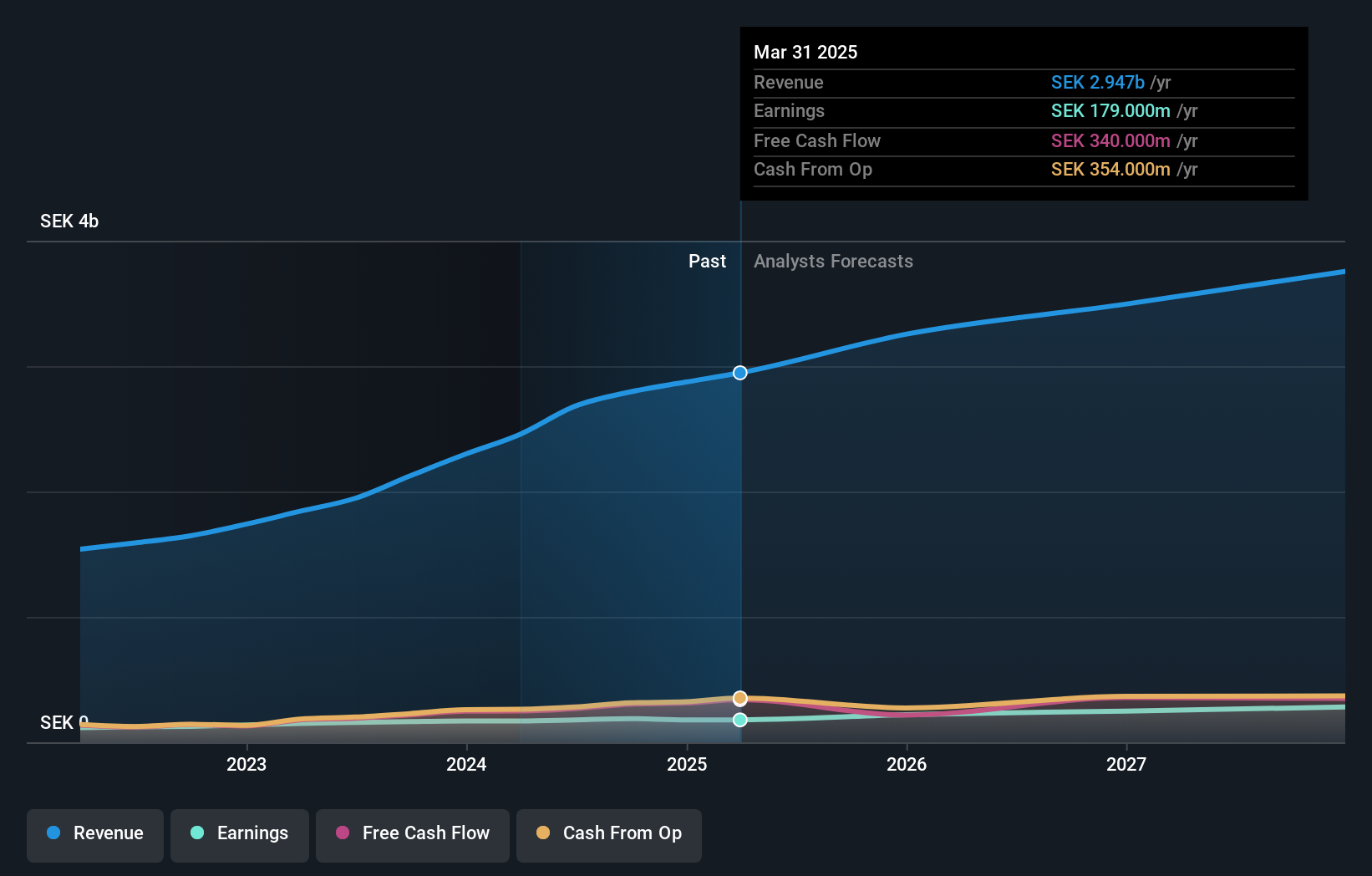

Momentum Group (OM:MMGR B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Momentum Group AB (publ) supplies industrial components and services to the industrial sector across Sweden, Norway, Denmark, Finland, and internationally with a market cap of approximately SEK7.78 billion.

Operations: The company's revenue primarily stems from the Industry segment at SEK1.73 billion and the Infrastructure segment at SEK1.36 billion. The net profit margin trend shows a notable pattern over recent periods, reflecting its financial efficiency in managing costs relative to revenue generation.

Momentum Group's strategic focus on sustainable products and operational efficiency positions it well for growth, despite its high net debt to equity ratio of 57.1%. The company has shown resilience with a stable aftermarket demand and strong cash flow, as evidenced by its Q3 2025 sales of SEK 746 million compared to SEK 694 million the previous year. Earnings are forecasted to grow at a robust rate of 16.62% annually, driven by trends in renovation and energy efficiency upgrades across Europe. With EBIT covering interest payments by a comfortable margin of 10.4 times, Momentum Group seems poised for profitability improvements amidst economic uncertainties.

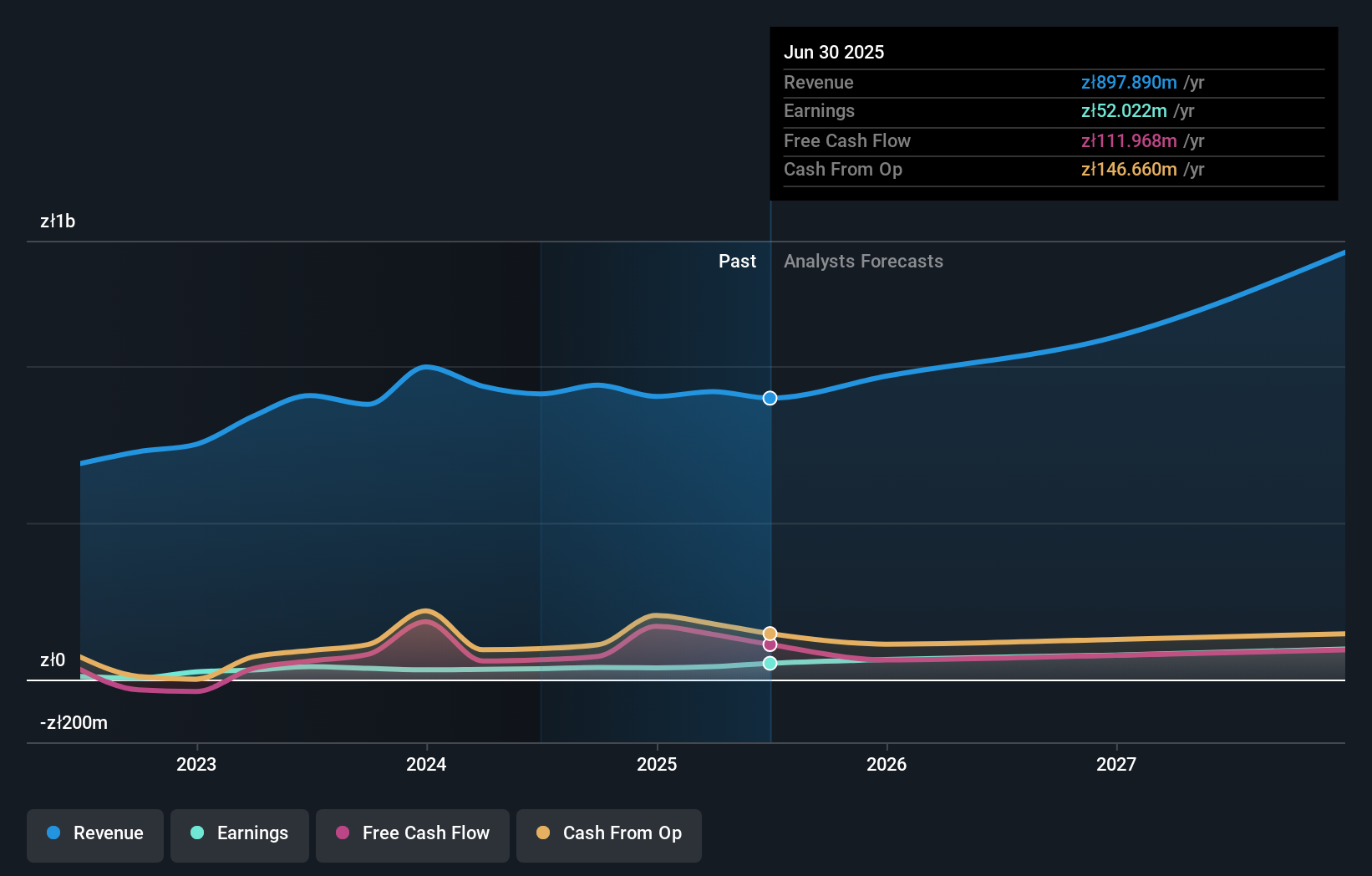

Comp (WSE:CMP)

Simply Wall St Value Rating: ★★★★★★

Overview: Comp S.A. is a technology firm offering IT and network security services and solutions in Poland, with a market capitalization of PLN1.17 billion.

Operations: Comp S.A. generates revenue primarily through its IT and network security services in Poland. The company has a market capitalization of PLN1.17 billion, reflecting its established presence in the technology sector.

CMP has shown impressive financial resilience, reducing its debt to equity ratio from 48.2% to 22.4% over five years, which suggests effective debt management. The company's earnings growth of 55.4% in the past year not only outpaced the IT industry but also highlights its strong performance trajectory. Trading at a value 14.7% below estimated fair value, CMP appears undervalued with potential for appreciation. Recent earnings reports reveal a notable increase in net income for Q3 at PLN 14.13 million compared to PLN 5.51 million last year, indicating significant profitability improvements despite slightly lower revenue figures this quarter and year-to-date.

- Navigate through the intricacies of Comp with our comprehensive health report here.

Assess Comp's past performance with our detailed historical performance reports.

Next Steps

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 313 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:IDUN B

Idun Industrier

An investment holding company, invests in and develops industrial and service businesses in Sweden, rest of Nordic countries, rest of Europe, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026