- Spain

- /

- Electrical

- /

- BME:ART

Exploring Arteche Lantegi Elkartea And 2 Promising Small Caps In Europe

Reviewed by Simply Wall St

The European market has experienced a mixed performance recently, with the pan-European STOXX Europe 600 Index showing gains amid trade deal hopes, while concerns about potential U.S. tariffs have tempered investor enthusiasm. Despite these fluctuations, small-cap stocks in Europe continue to present intriguing opportunities for investors seeking growth potential in a dynamic economic landscape. Identifying promising stocks often involves looking for companies with strong fundamentals and innovative strategies that can navigate current market challenges effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Arteche Lantegi Elkartea (BME:ART)

Simply Wall St Value Rating: ★★★★★★

Overview: Arteche Lantegi Elkartea, S.A. specializes in the design, manufacture, integration, and supply of electrical equipment and solutions with an emphasis on renewable energies and smart grids across Spain and international markets, with a market capitalization of approximately €672.41 million.

Operations: Arteche Lantegi Elkartea generates revenue primarily from three segments: Systems Measurement and Monitoring (€321.55 million), Automation of Transmission and Distribution Networks (€79.94 million), and Network Reliability (€45.92 million).

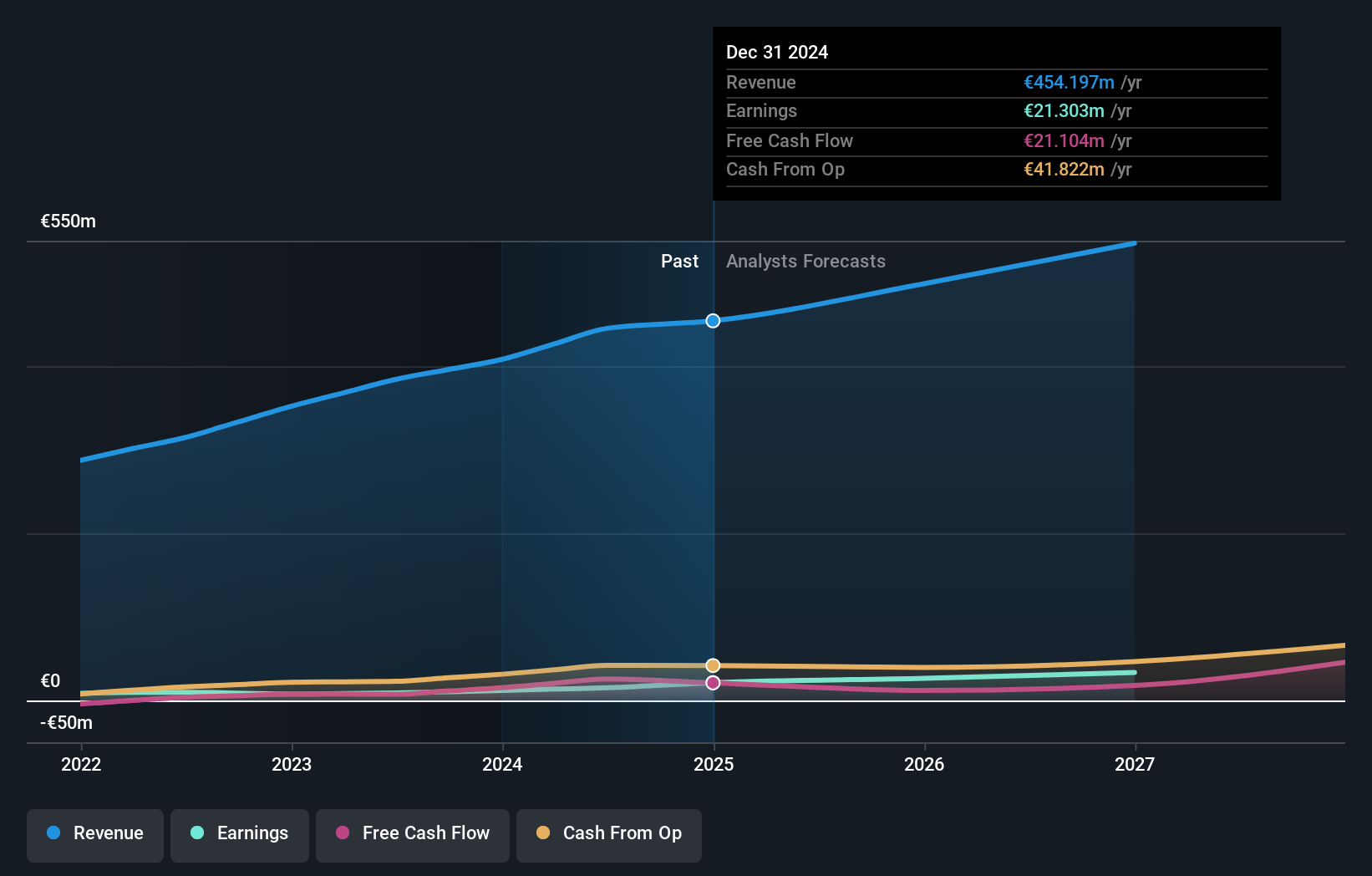

Arteche Lantegi Elkartea's performance paints a promising picture, with earnings surging by 76.6% over the past year, outpacing the Electrical industry's 6.6% growth. The company's net debt to equity ratio stands at a satisfactory 29.9%, showing improved financial health from a previous high of 289.3% five years ago to 137.9%. Arteche's interest payments are well covered by EBIT at 5.6 times, indicating robust operational efficiency and profitability that supports its free cash flow positivity and high-quality earnings profile, setting the stage for potential future growth in its sector.

Caisse Regionale de Credit Agricole Mutuel Toulouse 31 (ENXTPA:CAT31)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caisse Regionale de Credit Agricole Mutuel Toulouse 31 operates as a cooperative bank in France, with a market capitalization of €427.80 million.

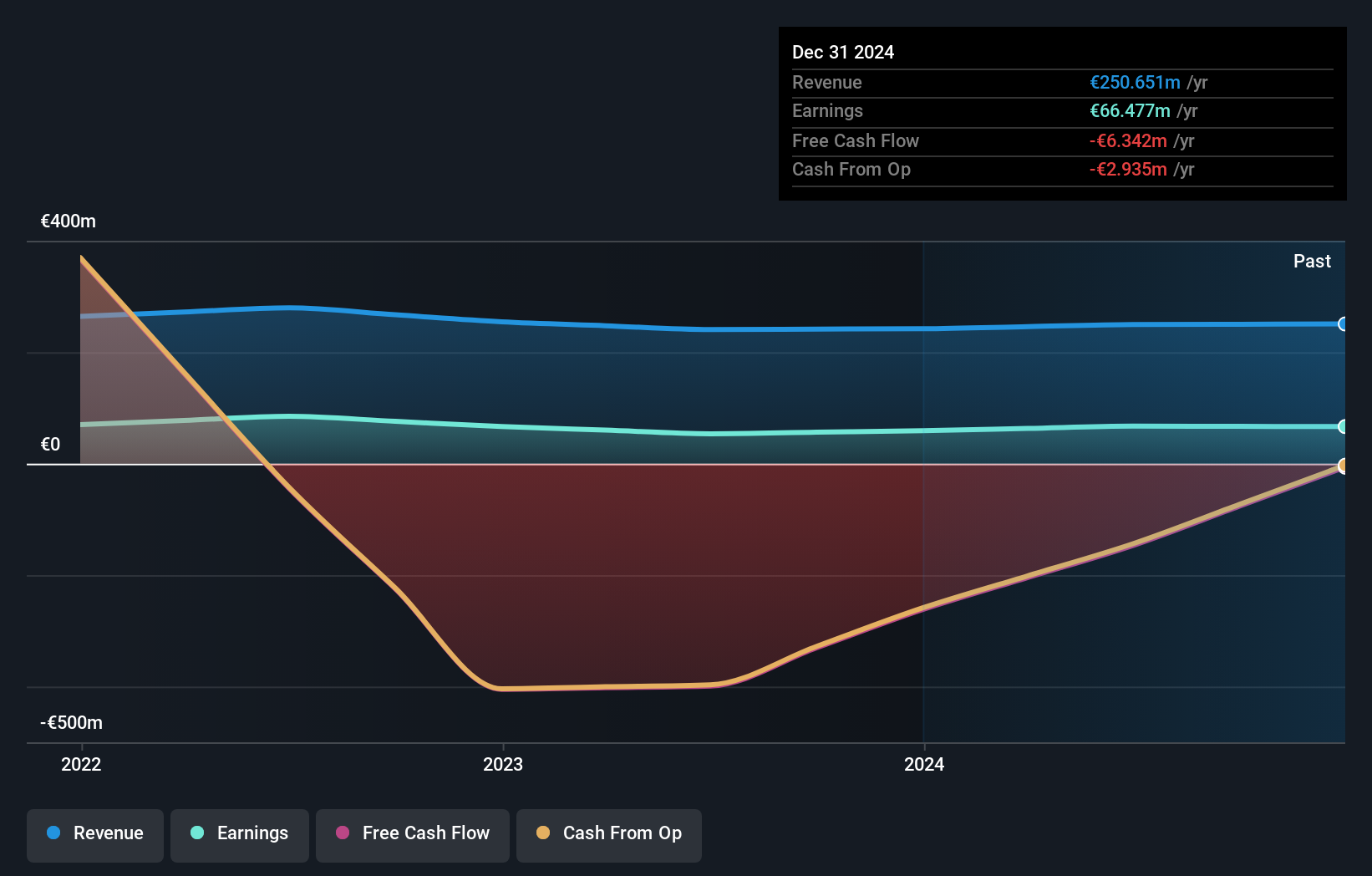

Operations: CAT31 generates revenue primarily through its retail banking segment, amounting to €250.65 million.

Caisse Regionale de Credit Agricole Mutuel Toulouse 31, a smaller financial entity in Europe, is making waves with its solid fundamentals. With total assets of €16.4B and equity of €2.0B, it showcases a robust balance sheet. The bank's deposits stand at €13.6B against loans of €12.0B, reflecting prudent lending practices supported by an appropriate bad loans ratio of 1.5%. Its earnings grew by 12% last year, outpacing the industry average growth rate of 3%. Trading at a significant discount to its estimated fair value adds to its appeal for potential investors seeking undervalued opportunities in the banking sector.

Lubawa (WSE:LBW)

Simply Wall St Value Rating: ★★★★★★

Overview: Lubawa S.A. is a company that specializes in manufacturing and selling products for military, police, and special forces both in Poland and internationally, with a market capitalization of PLN1.41 billion.

Operations: The primary revenue streams for Lubawa S.A. include Specialist Equipment - Retail, generating PLN249.92 million, and Fabrics, contributing PLN197.38 million. Advertising Materials also add to the revenue with PLN156.32 million.

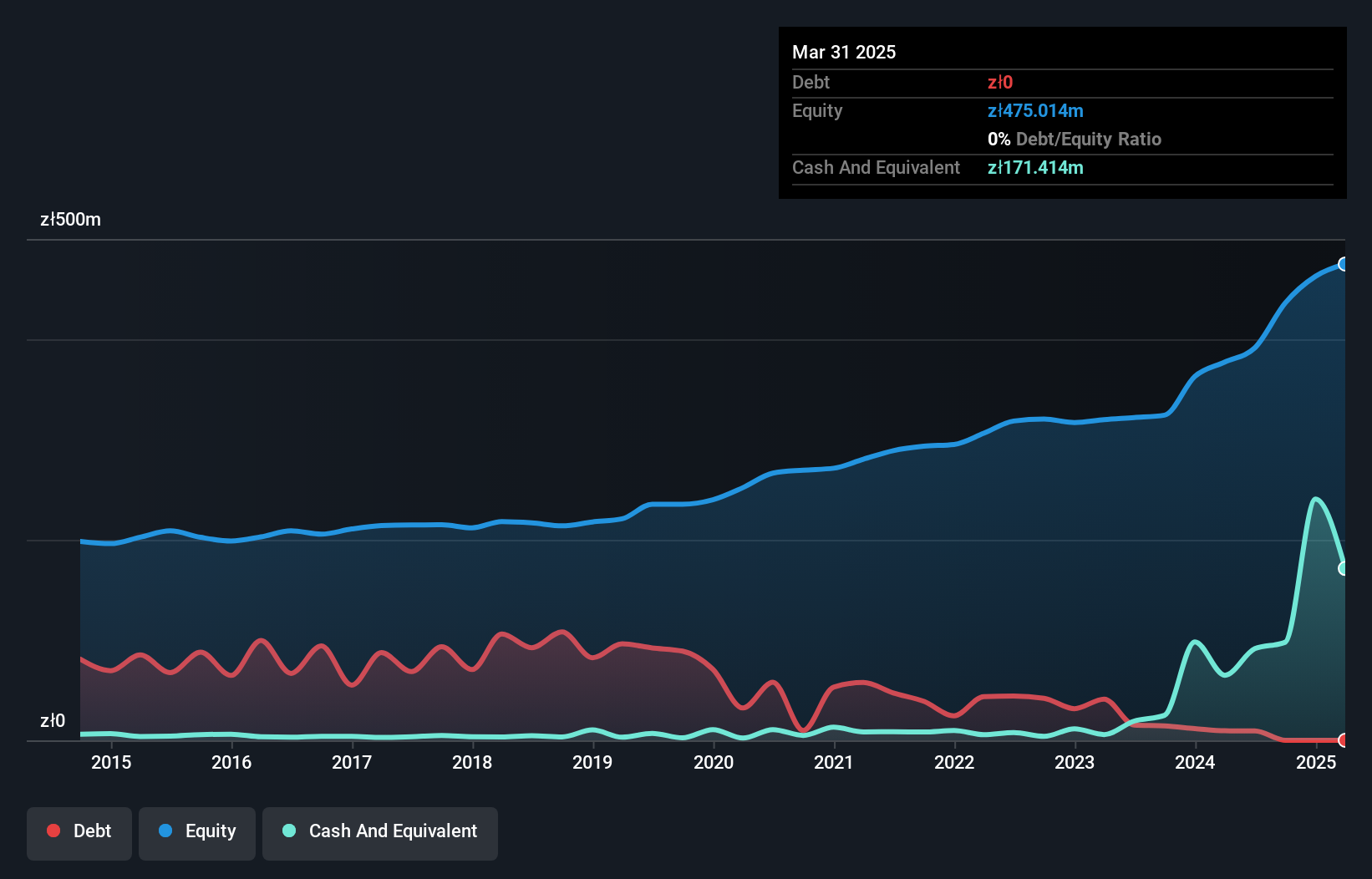

LBW, a notable player in the Aerospace & Defense sector, has shown impressive financial health with earnings growth of 67.3% over the past year, outpacing the industry's 28.7%. The company trades at a significant discount of 47.3% below its estimated fair value and boasts high-quality earnings. Recent financials reveal sales of PLN 510.23 million for 2024, up from PLN 377.61 million the previous year, while net income surged to PLN 100.8 million from PLN 45.61 million in the same period. Despite recent share price volatility, LBW remains debt-free with robust free cash flow generation capabilities.

- Unlock comprehensive insights into our analysis of Lubawa stock in this health report.

Gain insights into Lubawa's historical performance by reviewing our past performance report.

Taking Advantage

- Investigate our full lineup of 315 European Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ART

Arteche Lantegi Elkartea

Engages in the design, manufacture, integration, and supply of electrical equipment and solutions focusing on renewable energies and smart grids in Spain and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives