ikeGPS (NZSE:IKE): Net Loss Rises to NZ$9.2m, Undermining Profit Turnaround Narratives

Reviewed by Simply Wall St

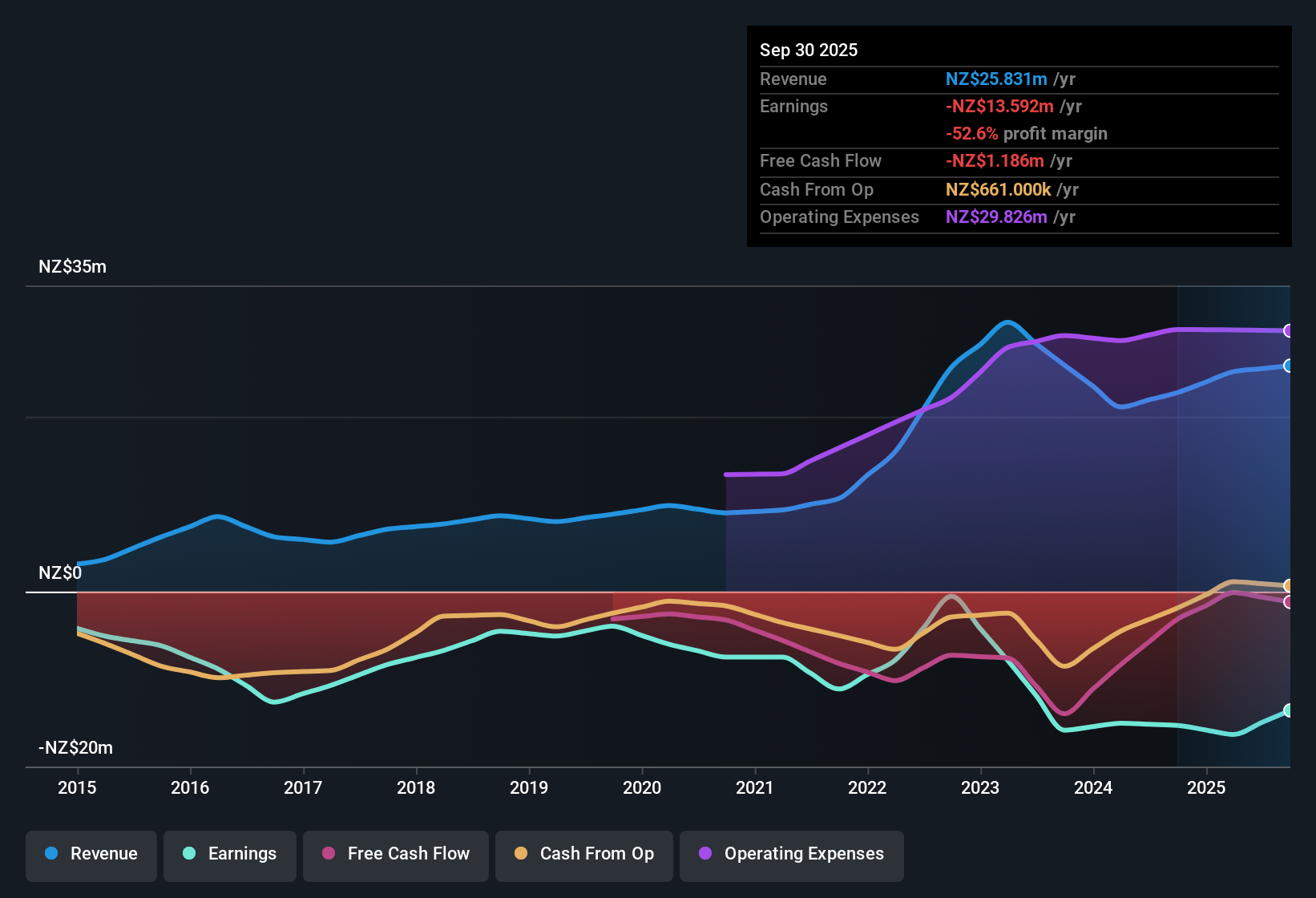

ikeGPS Group (NZSE:IKE) has just released its H1 2026 results, reporting revenue of $12.98 million and a basic EPS of -$0.064. Looking at the recent trend, the company has seen revenue move from $10.59 million in H2 2024 to $12.17 million in H1 2025, before reaching $12.98 million in the latest period. EPS remained negative over the same intervals. Overall, the numbers show that while top-line growth persists, earnings and margins continue to face headwinds.

See our full analysis for ikeGPS Group.Up next, we’ll see how the fresh numbers hold up against the prevailing market narratives, where expectations get confirmed and where the story might start to shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Widen as Net Income Drops to -$9.2 Million

- Net income (excluding extra items) for H1 2026 was -$9.23 million, extending the trajectory of rising losses from -$8.20 million in H2 2024 and -$7.11 million in H1 2025, based on the statement data.

- Despite forecasts pointing to robust 23.2% annual revenue growth ahead of the broader New Zealand market, the company remains unprofitable and consensus narrative points out that profitability is not expected within the next three years.

- The five-year annual rate of net losses increasing by 19.2% contrasts significantly with hopes of a near-term turnaround.

- Net profit margins show no sign of improvement, which consensus analysis highlights as an ongoing risk for shareholders.

Valuation Premium: 8.7x Price-to-Sales vs Peers

- ikeGPS trades at a price-to-sales ratio of 8.7x, nearly five times the global electronics industry average of 1.8x and more than quadruple its peer group’s 2.1x. This suggests a steep valuation premium relative to comparable companies.

- Consensus narrative observes that while rapid revenue growth projections may attract growth-focused investors, the elevated multiple could weigh down sentiment.

- At a share price of NZ$1.17, the stock sits well above its DCF fair value of NZ$0.99 and above analysts’ consensus target of NZ$1.11, making valuation a clear pressure point in the current situation.

- Shareholder dilution during the last twelve months may further test appetite for paying up despite top-line momentum.

Shareholder Experience: Volatility and Dilution in Focus

- The trailing twelve months have brought higher volatility for shareholders and dilution of existing positions, as explicitly noted in the trailing data and risk analysis review.

- Consensus narrative highlights concern that ongoing unprofitability, combined with a highly volatile share price and recent dilution, may erode confidence even with superior projected revenue growth.

- While 23.2% annualized revenue growth is notable relative to the 4% New Zealand market average, shareholder returns may lag unless profitability improves.

- Analysts note that investors should weigh these risks against IKE's industry-leading revenue outlook under current market conditions.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on ikeGPS Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

ikeGPS faces persistent losses, negative margins, and an expensive valuation. This situation raises real doubts about near-term profitability for shareholders.

If you are looking for better value and less price risk, use these 928 undervalued stocks based on cash flows to discover stocks trading below their fair value with greater upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ikeGPS Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:IKE

ikeGPS Group

Engages in the design, sale, and delivery of a solution for the collection, analysis, and management of distribution assets for electric utilities and communications companies in the United States.

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.