- Norway

- /

- Marine and Shipping

- /

- OB:WAWI

Assessing Wallenius Wilhelmsen (OB:WAWI) Valuation Following Improved Profitability in Q3 2025 Results

Reviewed by Simply Wall St

Wallenius Wilhelmsen (OB:WAWI) just released its third quarter 2025 earnings, with sales showing a slight decline year over year, while net income and basic earnings per share both moved higher. The nine-month figures reveal stronger profitability as well.

See our latest analysis for Wallenius Wilhelmsen.

Wallenius Wilhelmsen’s latest report landed shortly after a strong run in its share price, with a 7-day return of 11.8% catching attention. Despite some pullback recently, the stock’s one-year total shareholder return of 4.6% and multi-year gains highlight steady and long-term momentum.

If the company’s latest profit jump has you thinking bigger, now could be a good time to broaden your search and discover fast growing stocks with high insider ownership.

With profit margins on the rise and annual gains stacking up, investors might be asking if Wallenius Wilhelmsen is trading at an attractive valuation. Alternatively, the stock’s recent strength could indicate that the market already expects further growth.

Most Popular Narrative: Fairly Valued

With Wallenius Wilhelmsen’s share price closing at NOK85.60, the most widely followed narrative places its fair value at NOK84.27, nearly identical to the market price. This suggests balanced expectations and frames the debate over whether the current valuation can withstand competitive and industry crosscurrents.

Significant new vessel deliveries are coming online industry-wide (close to 40 delivered this year with more to come). This raises the risk of overcapacity, which could put sustained pressure on shipping rates and compress industry-wide margins, even if Wallenius Wilhelmsen's contracts provide some temporary protection.

What are the high-stakes assumptions holding this fair value together? The narrative’s numbers depend on bold estimates about shrinking profit margins, future contract strength, and how the shipping sector will manage a flood of new supply. Find out which financial forecasts make or break this target.

Result: Fair Value of NOK84.27 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing strength in Asian export demand or successful cost controls could quickly shift Wallenius Wilhelmsen’s outlook and challenge the prevailing fair value narrative.

Find out about the key risks to this Wallenius Wilhelmsen narrative.

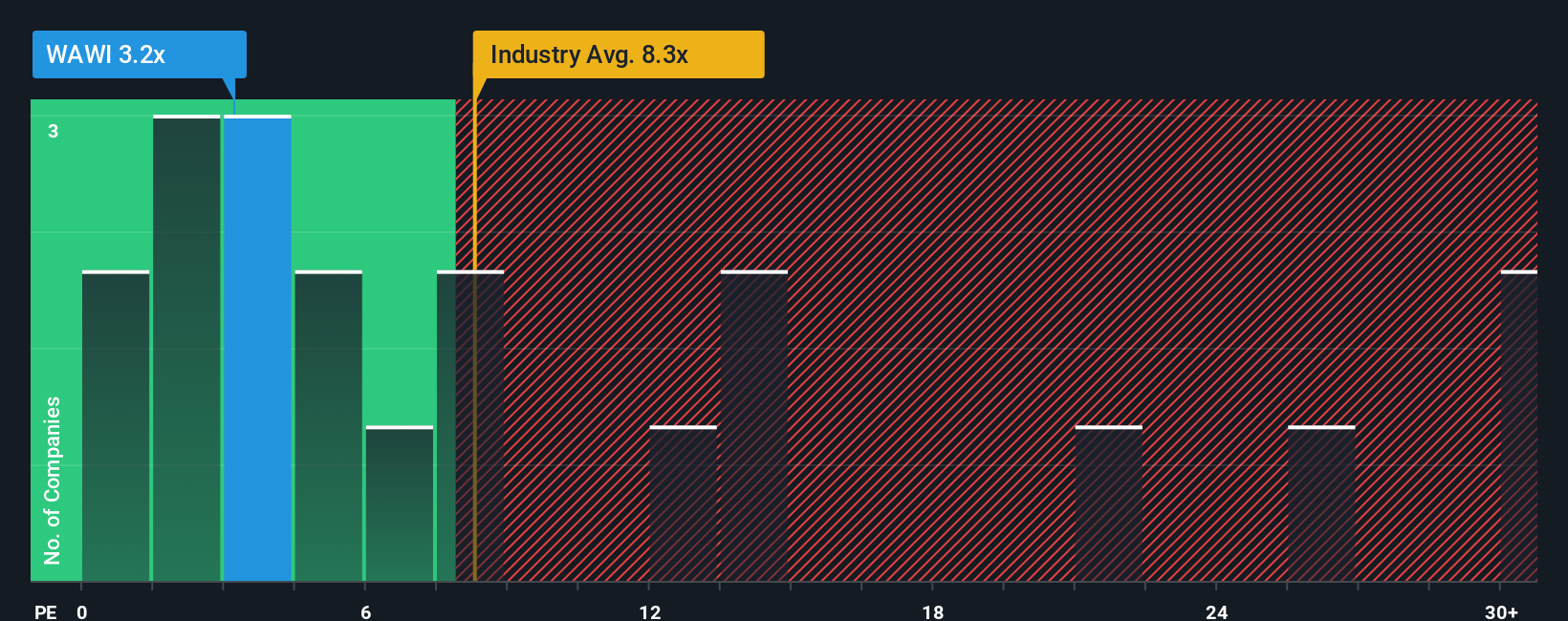

Another View: Value Through Earnings Multiples

Looking at Wallenius Wilhelmsen through the lens of its earnings multiple tells a different story. The company is currently trading at 3.2 times earnings, lower than both its industry peers (4.3x) and the broader European shipping sector (8.3x). This significant discount could suggest an overlooked value opportunity, depending on how sustainable today’s profits really are.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wallenius Wilhelmsen Narrative

If you see things differently or want to run the numbers your own way, it only takes a few minutes to craft your own take. Do it your way.

A great starting point for your Wallenius Wilhelmsen research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

The most rewarding opportunities rarely last long. Make your next smart move by checking out these powerful ways to spot strong stocks before the crowd:

- Capture growth potential by browsing these 26 AI penny stocks, which showcase leading innovations in artificial intelligence and automation, pushing boundaries and shaping entire industries.

- Maximize income with these 15 dividend stocks with yields > 3% that offer attractive yields above 3%, providing your portfolio with a consistent boost and peace of mind.

- Seize unique value with these 872 undervalued stocks based on cash flows, featuring companies currently underestimated by the market based on their cash flows and underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wallenius Wilhelmsen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:WAWI

Wallenius Wilhelmsen

Engages in the logistics and transportation business worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives