Does Telenor’s Upgraded Nordic Service Revenue Outlook Reshape the Long-Term Story for OB:TEL?

Reviewed by Sasha Jovanovic

- Telenor ASA recently updated its 2025 earnings guidance, now projecting 2-3% organic growth in Nordic service revenues, an increase from its earlier low single-digit forecast.

- This adjustment highlights a strengthened outlook for Telenor’s core Nordic operations and suggests heightened management confidence in regional market performance.

- We’ll explore how Telenor’s improved outlook for Nordic service revenue growth influences the company’s long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Telenor's Investment Narrative?

To be a Telenor shareholder, I think you have to believe in the company’s ability to drive stable cash flows from its leading position in the Nordic telecom market, while adapting to an ongoing wave of technological change and competitive pressure. The upgraded 2025 guidance for 2-3% organic Nordic service revenue growth points to more optimism from management right now, but recent earnings still showed mixed signals, with modest sales increases and shrinking net income in recent quarters. In my view, this improved guidance may provide a short-term catalyst if investors shift focus to renewed growth ambition, but it’s not enough to erase the bigger risks facing the group, particularly high debt levels, questions around the sustainability of the current dividend, and ongoing board and management turnover. Any shift in these risks could weigh more heavily on the stock than the guidance itself.

However, investors should not lose sight of the high debt load and evolving management team.

Exploring Other Perspectives

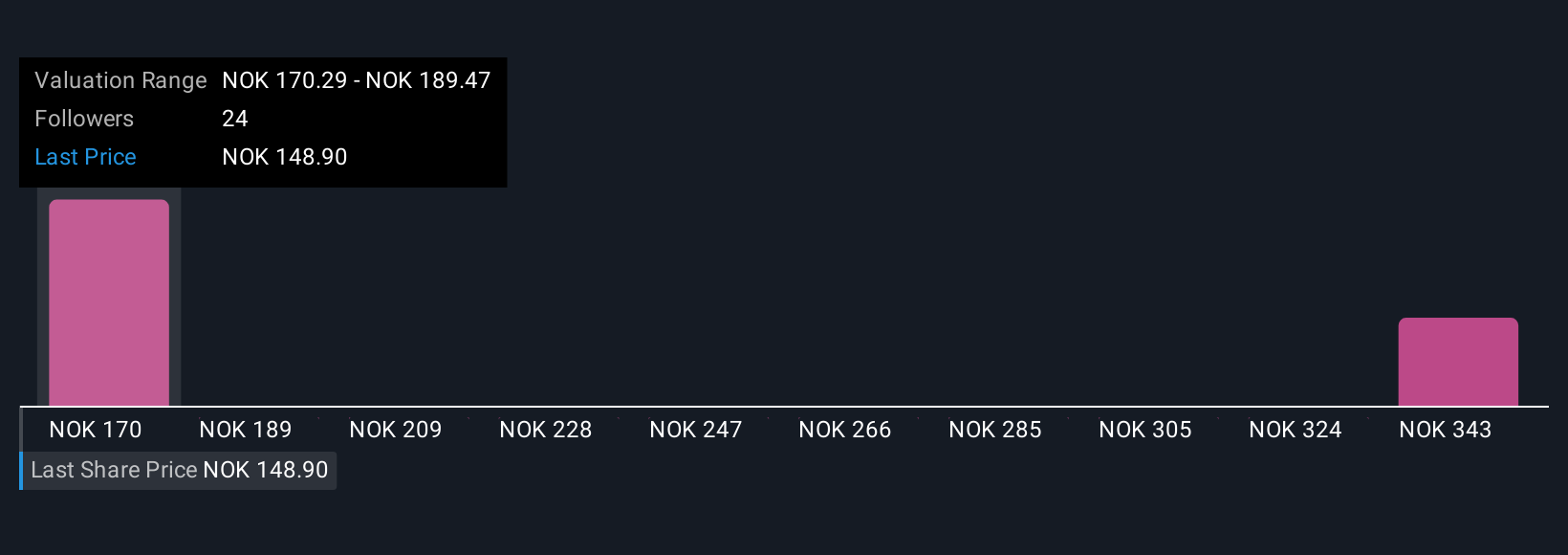

Explore 2 other fair value estimates on Telenor - why the stock might be worth just NOK170.29!

Build Your Own Telenor Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telenor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Telenor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telenor's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telenor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TEL

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives