Airthings (OB:AIRX investor one-year losses grow to 66% as the stock sheds US$100m this past week

Even the best stock pickers will make plenty of bad investments. Anyone who held Airthings ASA (OB:AIRX) over the last year knows what a loser feels like. The share price has slid 66% in that time. Because Airthings hasn't been listed for many years, the market is still learning about how the business performs. The last week also saw the share price slip down another 12%.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out the opportunities and risks within the NO Electronic industry.

Because Airthings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Airthings saw its revenue grow by 44%. We think that is pretty nice growth. Unfortunately it seems investors wanted more, because the share price is down 66% in that time. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. For us it's important to consider when you think a company will become profitable, if you're basing your valuation on revenue.

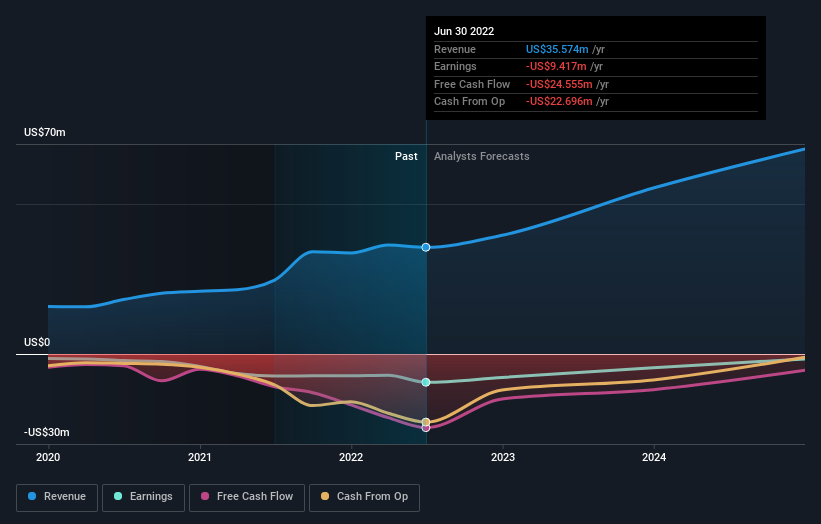

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free report showing analyst forecasts should help you form a view on Airthings

A Different Perspective

While Airthings shareholders are down 66% for the year, the market itself is up 0.2%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 6.5%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand Airthings better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Airthings you should know about.

Airthings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:AIRX

Airthings

A hardware-enabled software company, engages in the development of products and systems for monitoring indoor air quality, radon, and energy efficiency worldwide.

Excellent balance sheet and good value.