- Norway

- /

- Real Estate

- /

- OB:OLT

Olav Thon Eiendomsselskap (OB:OLT): Examining Valuation After Recent 26% Share Price Rally

Reviewed by Simply Wall St

Olav Thon Eiendomsselskap (OB:OLT) has drawn interest lately as its stock performance stands out among Norwegian real estate firms. Over the past month, shares have climbed 26%, sparking questions about what is driving the recent rally.

See our latest analysis for Olav Thon Eiendomsselskap.

Momentum really appears to be building around Olav Thon Eiendomsselskap. After a strong 26% share price jump over the past month, the stock has now posted a 46% year-to-date share price return and a notable 56% total shareholder return over the past year. This reflects renewed optimism around property assets as well as investors warming up to its long-term growth prospects.

If Olav Thon’s surge has you thinking bigger, now is the perfect time to discover fast growing stocks with high insider ownership.

But with the stock hovering just below analysts' price targets after such strong gains, the question for investors now is clear: is there still value left to unlock, or is future growth already priced in?

Price-to-Earnings of 14x: Is it justified?

Olav Thon Eiendomsselskap trades at a price-to-earnings ratio of 14x, which is solidly below both its Norwegian real estate peers and the overall European industry. The last close was NOK334, suggesting the market sees relative value in these shares compared with others in the sector.

The price-to-earnings (P/E) ratio measures what investors are willing to pay for each unit of current earnings. In real estate, this is a key yardstick for comparing the company's profitability to others in the industry and for assessing whether the stock is priced attractively relative to its earnings power.

This P/E figure is meaningfully lower than the European Real Estate industry average of 14.6x and the peer group average of 18.1x. This suggests the market may be underestimating the company's earnings resilience. Compared to its estimated Fair Price-to-Earnings Ratio of 19.4x, there is even more room for the market to re-rate the stock toward higher levels if current trends persist and earnings hold up.

Explore the SWS fair ratio for Olav Thon Eiendomsselskap

Result: Price-to-Earnings of 14x (UNDERVALUED)

However, slower revenue growth and a recent decline in net income may challenge the outlook if these trends continue or worsen in the near term.

Find out about the key risks to this Olav Thon Eiendomsselskap narrative.

Another View: What Does Our DCF Model Say?

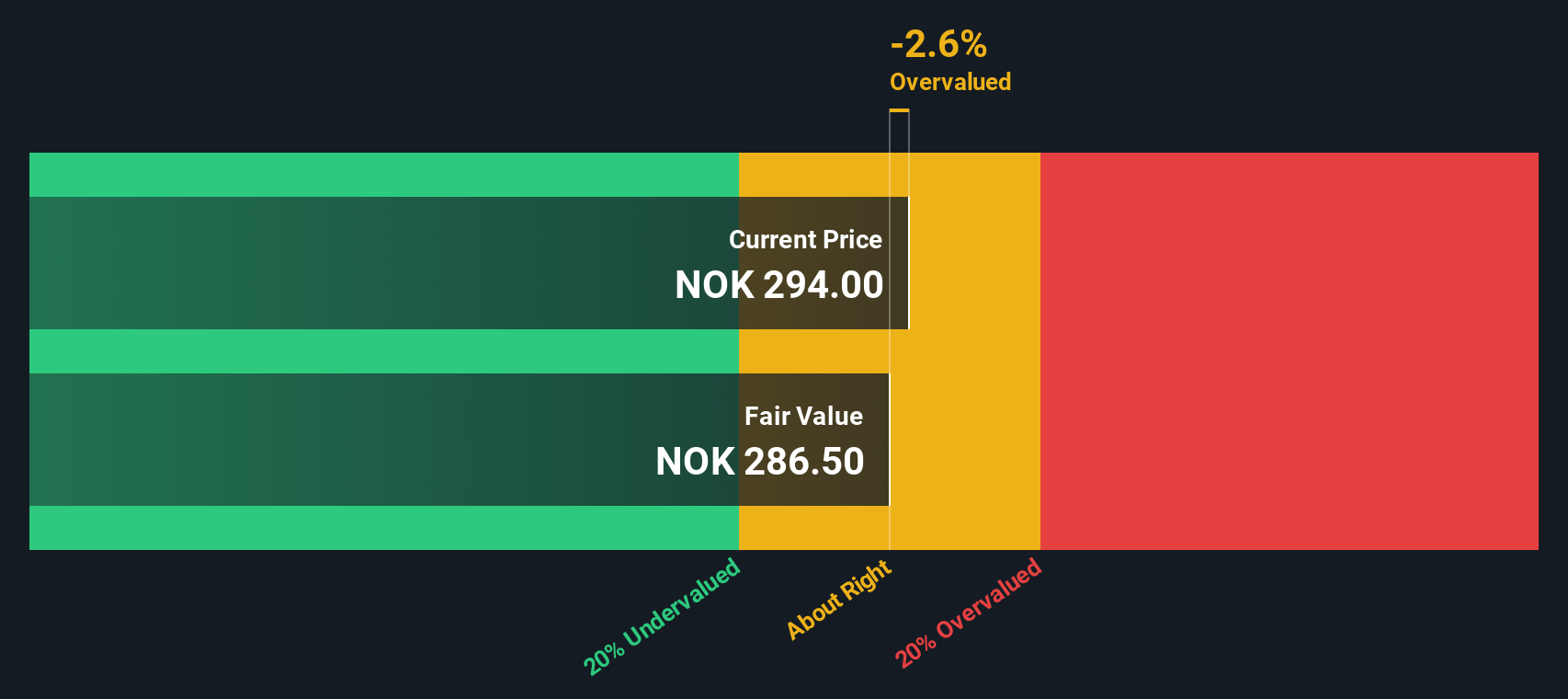

While Olav Thon Eiendomsselskap’s price-to-earnings ratio points to value compared to peers, our DCF model produces a different conclusion. According to the SWS DCF model, the shares are actually trading well above estimated fair value. This could signal less upside than the current optimism suggests. Will the future cash flows justify such a premium?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Olav Thon Eiendomsselskap for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Olav Thon Eiendomsselskap Narrative

If you see things differently or want to look deeper into Olav Thon Eiendomsselskap’s numbers, you can uncover your own story in just a few minutes. Do it your way.

A great starting point for your Olav Thon Eiendomsselskap research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit their watchlist to just one opportunity. Take your next step and give your portfolio fresh momentum by checking out these handpicked ideas:

- Spot new opportunities for substantial gains by reviewing these 915 undervalued stocks based on cash flows delivering strong cash flow value that may be overlooked by others.

- Maximize long-term income potential when you tap into these 15 dividend stocks with yields > 3% offering yields above 3% and consistent payouts.

- Catch the innovation wave in healthcare technology by starting with these 30 healthcare AI stocks making breakthroughs in diagnostics and patient care.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:OLT

Olav Thon Eiendomsselskap

Engages in the property rental business in Norway and Sweden.

Fair value second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026