- Norway

- /

- Real Estate

- /

- OB:ENTRA

Entra (OB:ENTRA): Assessing Valuation After Euronext 150 Entry and Green Bond Milestone

Reviewed by Simply Wall St

Entra (OB:ENTRA) has just been added to the Euronext 150 Index, which is catching the attention of institutional investors. The company also finalized a NOK 253 million green bond offering, highlighting ongoing access to capital and sustainable financing initiatives.

See our latest analysis for Entra.

Entra’s recent addition to the Euronext 150 Index and green bond milestone arrive as the stock has lost momentum, with a 1-year total shareholder return of -3.45% and a 30-day share price return of -6.3%. In the longer term, performance has been mixed. These developments could attract fresh investor attention as the company aims to turn the tide.

If Entra’s index move has you weighing new opportunities, now is the perfect moment to expand your search and discover fast growing stocks with high insider ownership

With Entra now in the spotlight and recent financial milestones on the table, is this a window for investors to acquire shares at a discount, or is the market already factoring in the company’s future growth prospects?

Most Popular Narrative: 7.9% Undervalued

According to the most followed narrative, Entra's fair value lands higher than its recent close, suggesting that the stock is trading below what analysts believe it's worth. This view takes into account new earnings forecasts, recent price movements, and shifts in rental agreements that could boost overall fundamentals.

Tightening green building requirements and tenant preferences for sustainable, energy-efficient offices position Entra's green-certified buildings to achieve rental premiums and support portfolio value uplift. This should improve net margins and support rising property values.

Curious about what drives this optimistic valuation target? The secret sauce is hiding in a set of bold profit growth predictions, higher revenue expectations, and a surprising outlook for long-term margins. Want to see the financial logic behind the price upgrade? Get the full story inside the narrative.

Result: Fair Value of $119.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent vacancies or changing workplace trends could put pressure on Entra's rental income and challenge its ability to meet optimistic earnings forecasts.

Find out about the key risks to this Entra narrative.

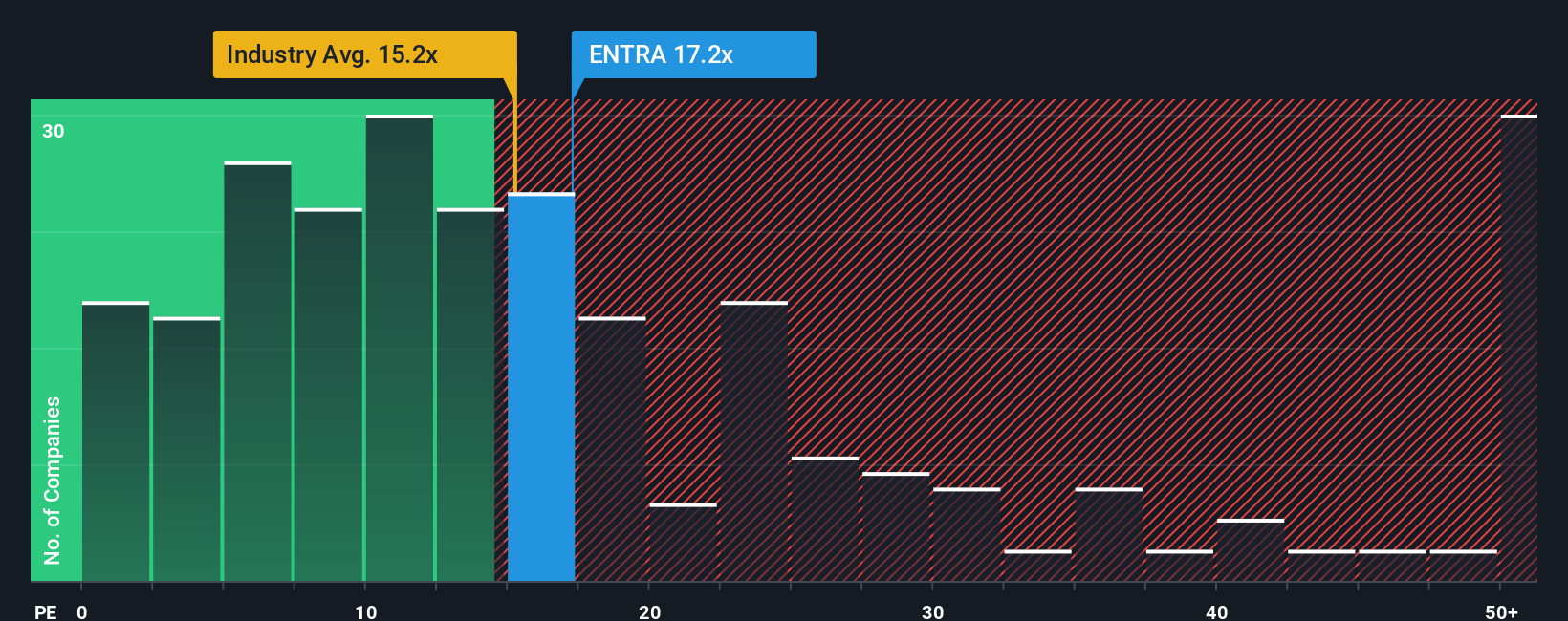

Another View: Multiple-Based Valuation

Looking through the lens of the price-to-earnings ratio, Entra trades at 14.4x, which is below its peer average of 16.3x and just under the industry average of 14.5x. Its fair ratio stands at 14.8x, a level the market could shift toward if sentiment turns. Does this pricing gap reveal a market risk, or a hidden value opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Entra for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Entra Narrative

If you are not convinced by these perspectives or prefer to analyze the numbers yourself, you can easily build your own view in just a few minutes. Do it your way

A great starting point for your Entra research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Top investors never let opportunity slip through their fingers. Cast a wider net and see if your next big winner is waiting among innovative possibilities you may have overlooked.

- Uncover reliable income plays by reviewing these 15 dividend stocks with yields > 3% with consistently strong yields above 3% and robust payout records.

- Accelerate your portfolio’s growth by targeting companies advancing artificial intelligence. Check out these 26 AI penny stocks poised for breakthroughs in this booming sector.

- Supercharge your search for high-upside opportunities by analyzing these 872 undervalued stocks based on cash flows, where promising businesses are trading at a discount to their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ENTRA

Entra

Develops real estate properties in Oslo, Bergen, Drammen, Sandvika, and Stavanger.

Fair value unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives