Strong week for Photocure (OB:PHO) shareholders doesn't alleviate pain of three-year loss

Photocure ASA (OB:PHO) shareholders should be happy to see the share price up 29% in the last month. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 38% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

On a more encouraging note the company has added kr258m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

While Photocure made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over three years, Photocure grew revenue at 15% per year. That's a pretty good rate of top-line growth. Shareholders have endured a share price decline of 11% per year. This implies the market had higher expectations of Photocure. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

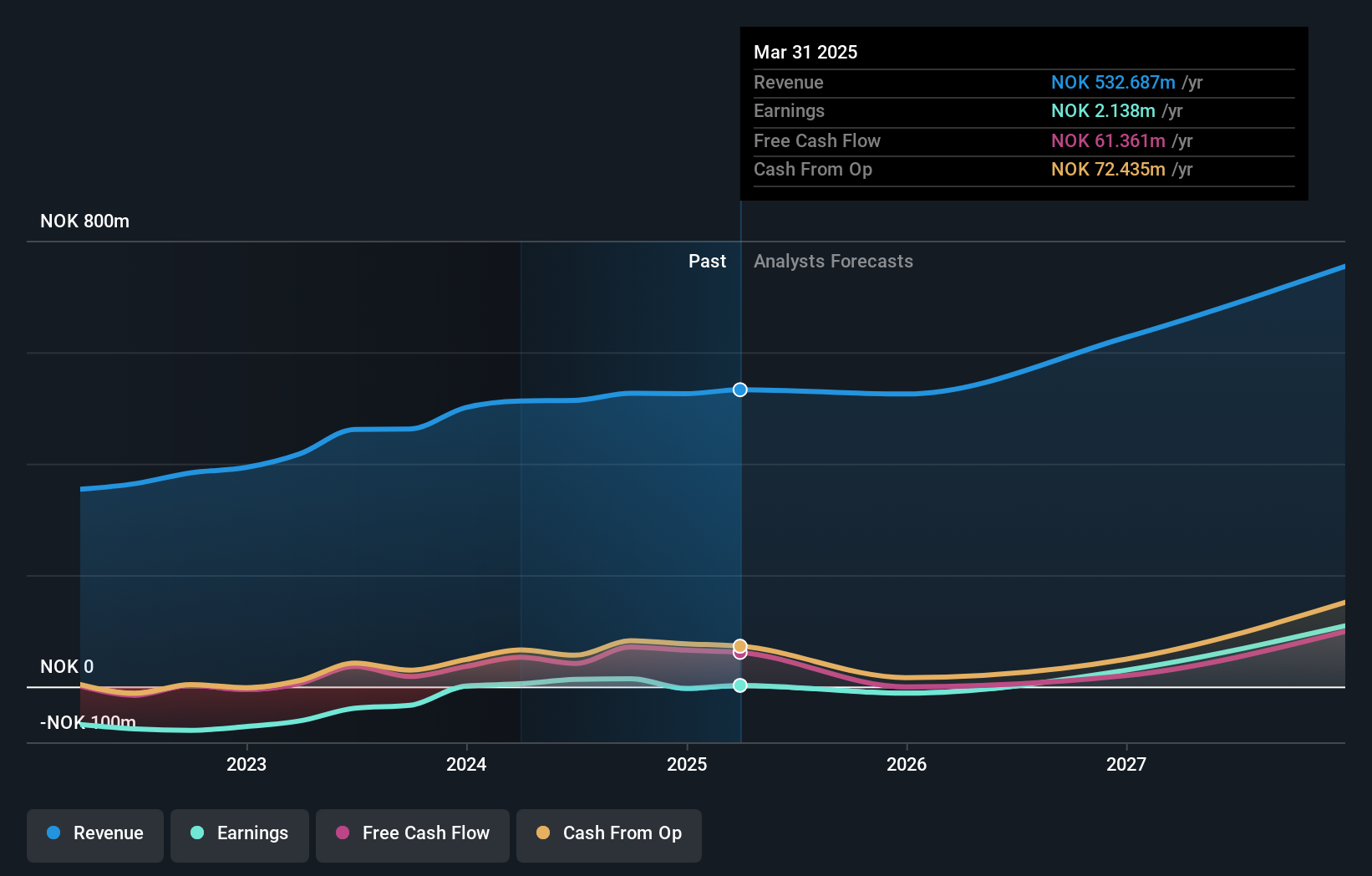

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Photocure has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Photocure's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Photocure shareholders have received a total shareholder return of 16% over the last year. Notably the five-year annualised TSR loss of 1.1% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Photocure you should know about.

But note: Photocure may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Norwegian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:PHO

Photocure

Engages in the research, development, production, distribution, marketing, and sale of pharmaceutical products.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives