- Norway

- /

- Interactive Media and Services

- /

- OB:VENDA

Assessing Vend Marketplaces (OB:VENDA) Valuation Following Substantial Bond Repurchase and Strengthened Balance Sheet

Reviewed by Simply Wall St

Vend Marketplaces (OB:VENDA) just announced the repurchase of NOK 441 million in outstanding bonds across two issues. This move directly impacts the company's balance sheet, signaling a focus on reducing debt costs and increasing financial flexibility.

See our latest analysis for Vend Marketplaces.

The bond buyback comes at a time when Vend Marketplaces' share price has shown modest signs of recovery, up 1.94% over the past day and 3.59% for the week. The stock is still working to regain momentum after a 12.85% drop in the last three months. While the year-to-date share price return is slightly positive, the longer-term three-year total shareholder return stands out at 186.74%, showing the company’s ability to deliver value over time even as the one-year total return is currently a mild -1.87%.

If you’re weighing where other fast-moving opportunities might be, now’s a smart moment to broaden your view and discover fast growing stocks with high insider ownership

With the company executing a substantial bond repurchase and its recent share price movements, investors are faced with a key question: is Vend Marketplaces trading below its true value, or has the market already priced in expectations for future growth?

Price-to-Earnings of 10.5x: Is it justified?

Vend Marketplaces’ shares are trading at a price-to-earnings (P/E) ratio of 10.5x, well below both the global sector average and its peer group. With the last close at NOK 358, this signals the market may be overlooking earnings strength or potential for this online marketplaces operator.

The price-to-earnings ratio measures what investors are willing to pay for each unit of profit. For internet-based business models like Vend Marketplaces, this multiple reflects confidence in sustained profitability, platform growth, and competitive resilience.

In context, the company’s 10.5x P/E stands out as a bargain when compared with the interactive media and services industry average of 22.7x and peer average of 27.5x. This suggests investors are pricing in subdued prospects or being cautious despite recent strong earnings growth. If the market reevaluates assumptions about Vend’s future profits, the multiple could move upward toward the sector norm.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 10.5x (UNDERVALUED)

However, annual net income has declined sharply, and revenue growth remains negative. This could weigh on future market sentiment despite recent gains.

Find out about the key risks to this Vend Marketplaces narrative.

Another View: What Does Our DCF Model Show?

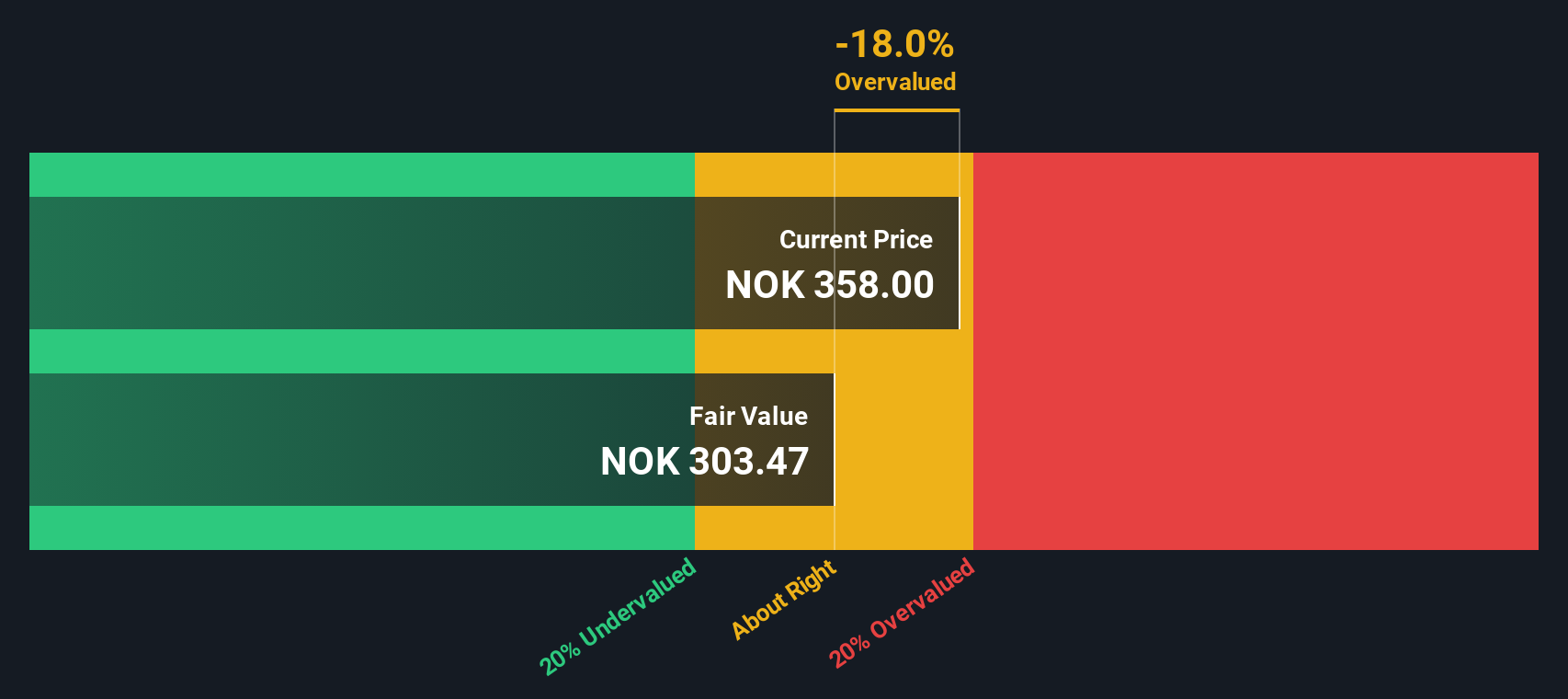

While the market seems to see value based on earnings multiples, our SWS DCF model offers a more cautious perspective. It suggests Vend Marketplaces shares are actually trading above their estimated fair value, which implies that future growth may already be reflected in the current price. Does this mean the upside is limited, or is the market pricing in something the DCF model misses?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vend Marketplaces for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vend Marketplaces Narrative

If the numbers or analysis above don’t fully match your perspective, you have the tools to dig into the data and craft your own take in just a few minutes. Do it your way

A great starting point for your Vend Marketplaces research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let top-performing stocks slip through your fingers. Set yourself up for smart gains by using Simply Wall Street’s screener to find compelling opportunities you might have missed.

- Spot fresh opportunities for rapid growth by checking out these 25 AI penny stocks leading innovation in artificial intelligence across multiple sectors.

- Unlock value ideas with these 916 undervalued stocks based on cash flows featuring strong cash flows and hidden potential before the broader market catches on.

- Pursue steady portfolio income by tracking these 15 dividend stocks with yields > 3% with reliable yields above 3%, optimizing your returns with high-quality picks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:VENDA

Vend Marketplaces

Develops and operates various marketplaces in Sweden, Norway, Denmark, Finland, and Poland.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026