- Norway

- /

- Interactive Media and Services

- /

- OB:VEND

Will Vend Marketplaces' (OB:VEND) Share Buyback Reveal a New Approach to Capital Allocation?

Reviewed by Sasha Jovanovic

- Vend Marketplaces recently completed a share issue of approximately 5.3 million shares and announced a new share buyback programme of up to NOK 2 billion, with proceeds managed by Danske Bank and shares potentially being allocated for employee incentives or canceled subject to AGM approval.

- These capital management measures highlight a proactive approach to optimizing Vend's financial structure and signal management’s commitment to balancing growth initiatives with potential returns for shareholders.

- We'll take a look at how the new NOK 2 billion share buyback programme shapes Vend Marketplaces' investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Vend Marketplaces' Investment Narrative?

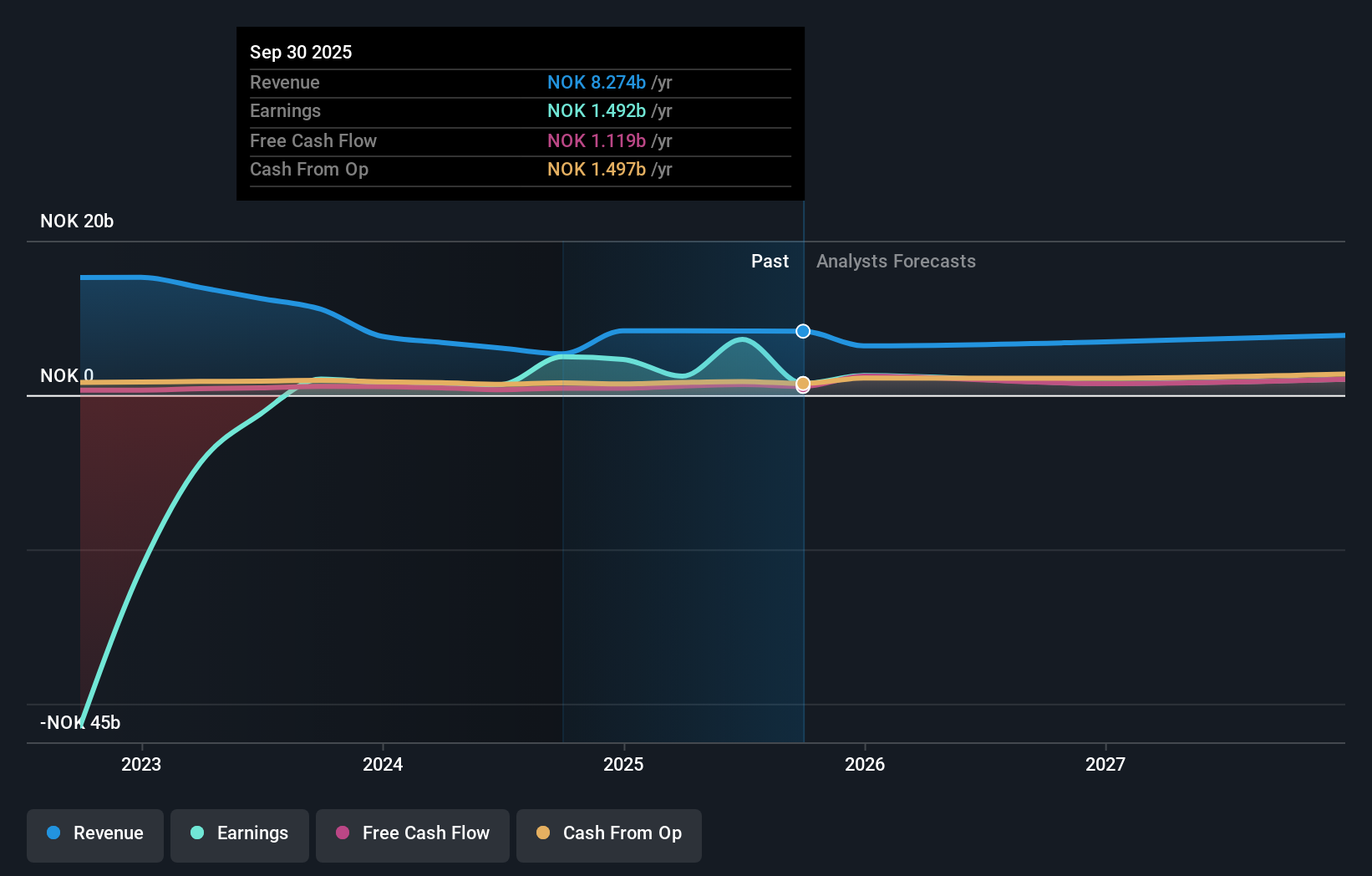

For anyone following Vend Marketplaces, the key question is whether you believe in the company’s ability to stabilize margins, reignite growth, and execute through transition, not just ride out shifting macro tides. The new share buyback and completed share issue touch directly on short-term catalysts like capital allocation, governance clarity, and market confidence. While these moves may shore up support after a year of price pressure and index removals, their real impact will depend on future earnings quality and sustained operational improvement. Recent financials show profit margin compression and a one-off gain, prompting scrutiny over the sustainability of results. In the short run, the buyback and simplified share structure could help mitigate governance and capital structure concerns, but the biggest risks remain the slow revenue growth forecast and a relatively inexperienced board and management. If optimism around these initiatives doesn’t translate into operational delivery, scrutiny over valuation and growth could persist.

But with restructuring comes another risk worth watching: how quickly can this new leadership team deliver results?

Exploring Other Perspectives

Explore another fair value estimate on Vend Marketplaces - why the stock might be worth as much as 19% more than the current price!

Build Your Own Vend Marketplaces Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vend Marketplaces research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Vend Marketplaces research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vend Marketplaces' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:VEND

Vend Marketplaces

Develops and operates various marketplaces in Sweden, Norway, Denmark, Finland, and Poland.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives