Profitability Rebound and Maintained Output Guidance Could Be a Game Changer for P/F Bakkafrost (OB:BAKKA)

Reviewed by Sasha Jovanovic

- P/F Bakkafrost recently reported its third quarter 2025 results, showing improved net income of DKK 76.53 million despite lower quarterly sales, and confirmed ongoing full-year production guidance of 104,000 tonnes gutted weight across its Faroe Islands and Scotland operations.

- The latest update highlights both improved profitability from a prior year loss and increased smolt and harvest volumes in the Faroe Islands, helping to offset operational challenges in Scotland.

- We'll examine how Bakkafrost's maintained production outlook and profitability rebound influence the company's longer-term investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

P/F Bakkafrost Investment Narrative Recap

To be a shareholder in P/F Bakkafrost, you have to believe in the company's ability to deliver steady long-term salmon production growth, secure higher price premiums, and recover margins through operational efficiencies, especially in the Faroe Islands. The recent rebound in profitability, despite soft sales, provides some support for this thesis; however, the biggest near-term catalyst remains successful margin recovery in Scotland, while persistent operational issues there still pose the most significant risk. This update does not materially shift those risks or catalysts in the short term.

Among the latest announcements, the confirmation of full-year production guidance at 104,000 tonnes gutted weight directly addresses volume expectations. By maintaining this target, Bakkafrost signals confidence in its biological pipeline and operational performance, which is crucial for underpinning future earnings recovery and supporting the investment case amid ongoing price and cost challenges.

On the other hand, investors should be aware that, despite improving profitability, sustained negative cash flows and increased debt continue to raise concerns about...

Read the full narrative on P/F Bakkafrost (it's free!)

P/F Bakkafrost's outlook anticipates DKK10.7 billion in revenue and DKK2.1 billion in earnings by 2028. This is based on analysts expecting a 17.9% annual revenue growth rate and an increase in earnings of about DKK1.87 billion from the current level of DKK228.2 million.

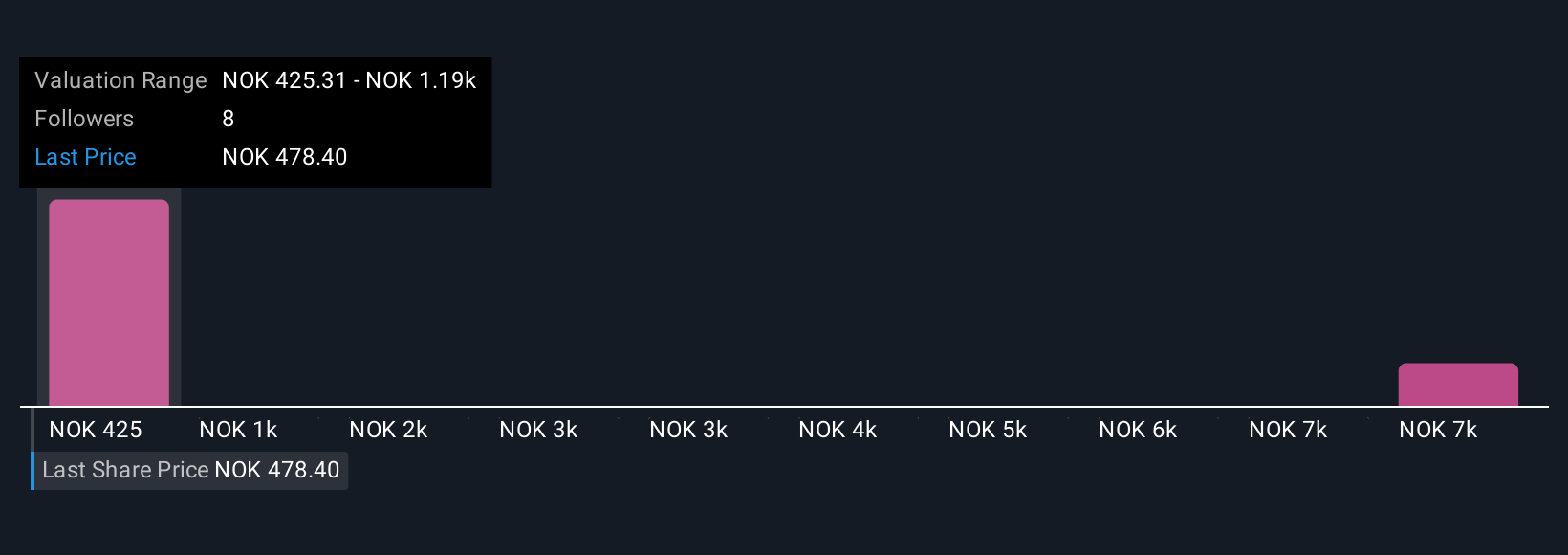

Uncover how P/F Bakkafrost's forecasts yield a NOK532.01 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Seven community fair value estimates for Bakkafrost range from DKK425.31 to DKK1,508.89, capturing wide investor opinions. Amid this diversity, margin recovery in Scotland is the company’s most watched variable for future earnings strength, explore the range of views and implications here.

Explore 7 other fair value estimates on P/F Bakkafrost - why the stock might be worth over 3x more than the current price!

Build Your Own P/F Bakkafrost Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your P/F Bakkafrost research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free P/F Bakkafrost research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate P/F Bakkafrost's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BAKKA

P/F Bakkafrost

Produces and sells salmon products in North America, Western Europe, Eastern Europe, Asia, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives