- Sweden

- /

- Aerospace & Defense

- /

- OM:GOMX

3 European Growth Companies With Insider Ownership Up To 31%

Reviewed by Simply Wall St

The European market has shown resilience, with major stock indexes such as the STOXX Europe 600 and Germany's DAX posting gains amid a backdrop of steady UK inflation and robust Eurozone business activity. In this context, identifying growth companies with significant insider ownership can be appealing, as it often signals confidence from those closest to the company's operations and strategic direction.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 43.9% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| Magnora (OB:MGN) | 10.4% | 75.4% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 49.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 51.4% |

Here we highlight a subset of our preferred stocks from the screener.

Andfjord Salmon Group (OB:ANDF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Andfjord Salmon Group AS operates in the land-based farming of Atlantic salmon in Norway and has a market capitalization of NOK2.83 billion.

Operations: The company's revenue segment is derived entirely from livestock, amounting to NOK0.94 million.

Insider Ownership: 26.5%

Andfjord Salmon Group is experiencing robust revenue growth, forecasted at 56.2% annually, significantly outpacing the Norwegian market. Despite a current net loss, it's expected to achieve profitability within three years. With Gro Skaar Knutsen transitioning to an operational role, the company is poised for strategic expansion and efficiency improvements in its aquaculture operations at Kvalnes. Recent smolt releases mark a pivotal scale-up phase, enhancing Andfjord's capacity and long-term growth potential.

- Click here and access our complete growth analysis report to understand the dynamics of Andfjord Salmon Group.

- According our valuation report, there's an indication that Andfjord Salmon Group's share price might be on the cheaper side.

GomSpace Group (OM:GOMX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GomSpace Group AB (publ) manufactures and sells nanosatellites, components, and turnkey satellite solutions internationally, with a market cap of SEK2.94 billion.

Operations: Revenue Segments (in millions of SEK): GomSpace generates revenue through the manufacture and sale of nanosatellites, components, and turnkey satellite solutions across Denmark, Sweden, France, the rest of Europe, the United States, Asia, and other international markets.

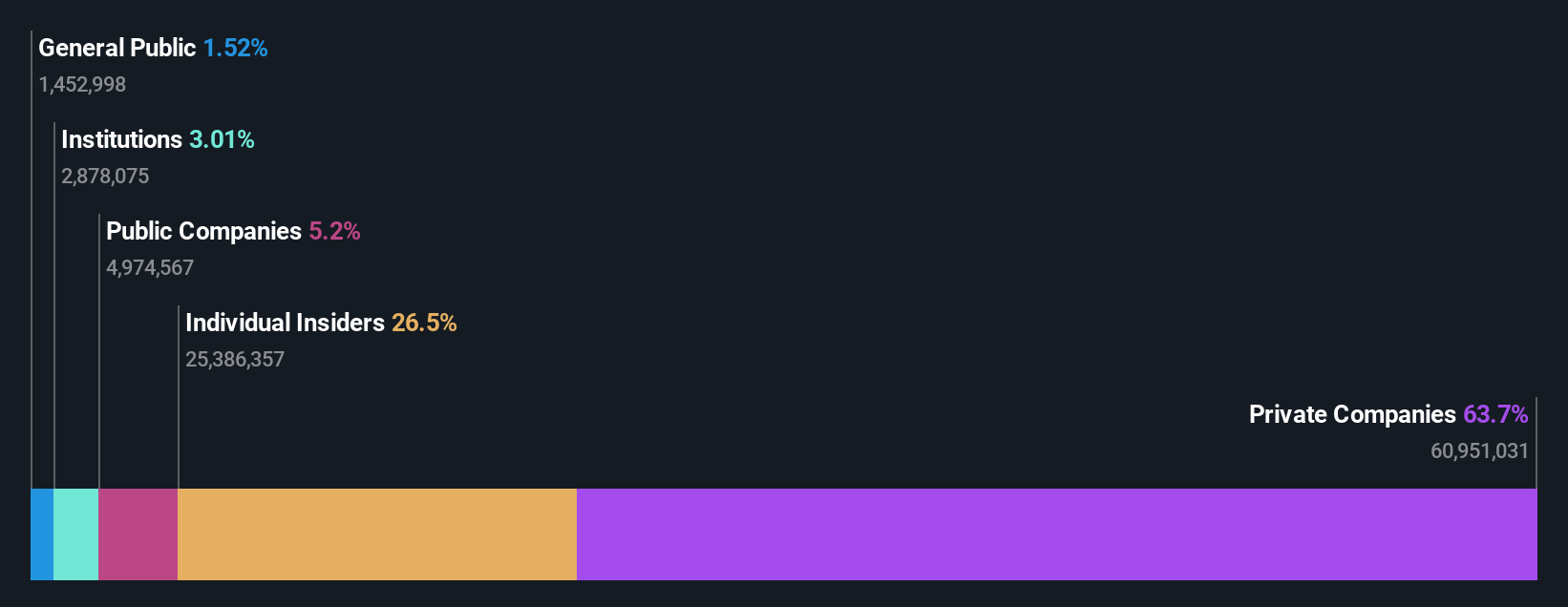

Insider Ownership: 27%

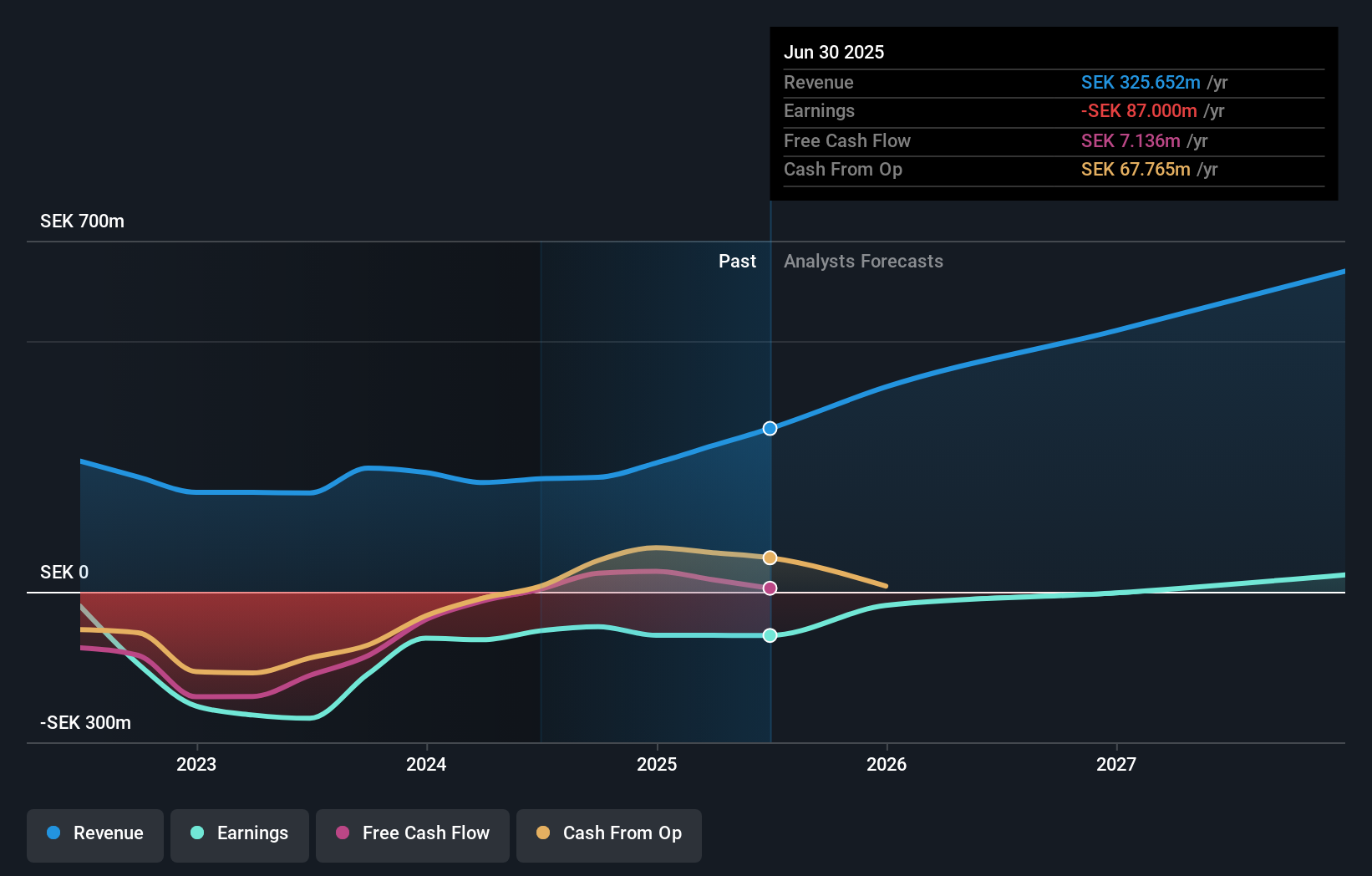

GomSpace Group is set for substantial growth, with revenue forecasted to rise 25.9% annually, surpassing the Swedish market. Recent contracts with the European Space Agency highlight its strategic advancements in satellite technology. Despite past shareholder dilution and a volatile share price, insider buying signals confidence in future prospects. The company raised its 2025 revenue guidance significantly and secured pivotal contracts that bolster its position in the space sector while navigating financial challenges like negative equity.

- Navigate through the intricacies of GomSpace Group with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report GomSpace Group implies its share price may be too high.

Nordrest Holding (OM:NREST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordrest Holding AB (publ) is a foodservice company operating in Sweden and internationally, with a market capitalization of approximately SEK2.79 billion.

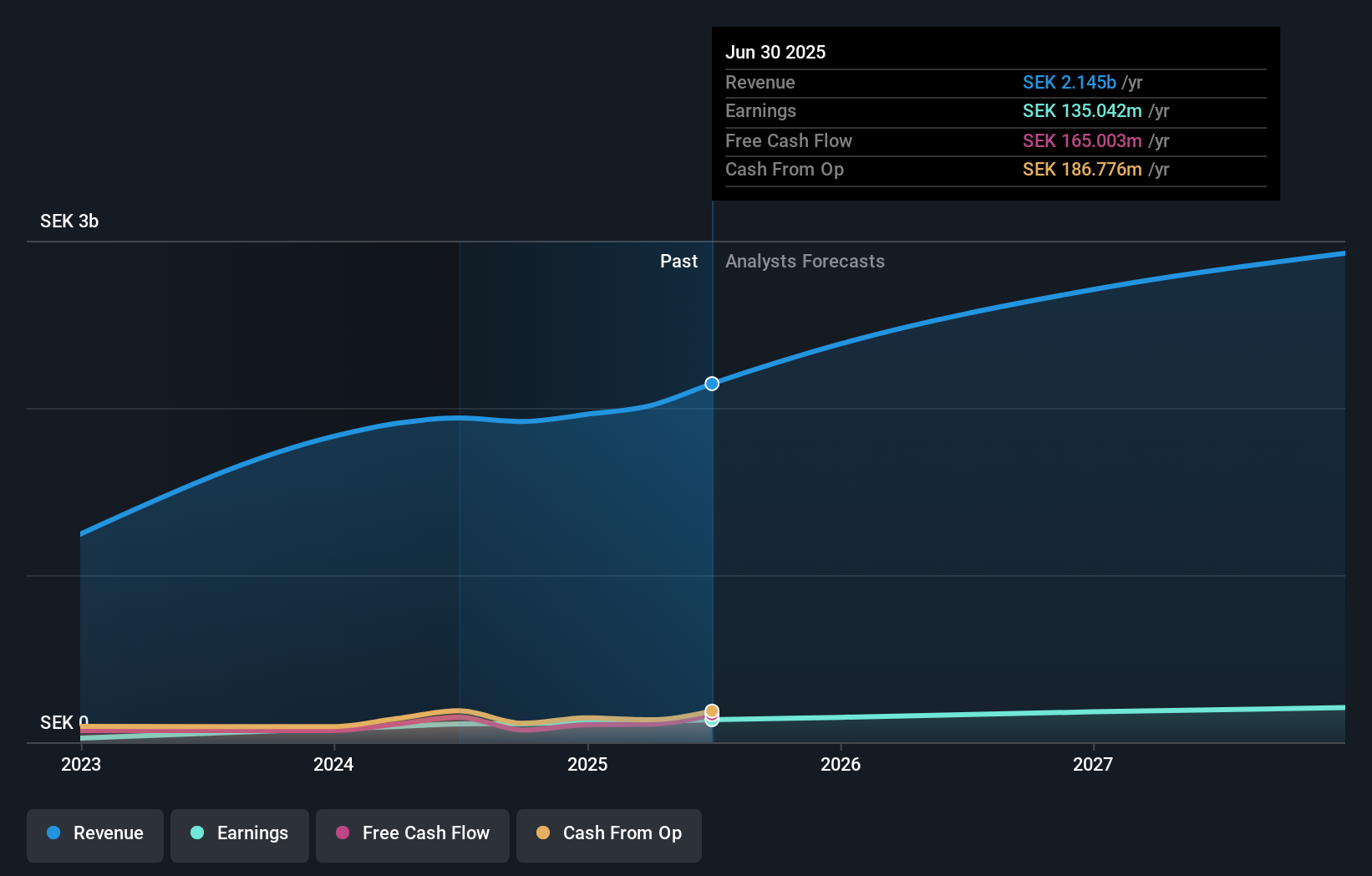

Operations: The company generates revenue primarily from its restaurants segment, amounting to SEK2.15 billion.

Insider Ownership: 31.1%

Nordrest Holding demonstrates promising growth with earnings forecasted to rise 17.47% annually, outpacing the Swedish market's 13.1%. Despite trading slightly below fair value, its revenue is expected to grow at a slower rate of 12.1% per year. Recent financial results show robust performance, with second-quarter sales increasing to SEK 615.13 million from SEK 474.69 million a year ago and net income rising to SEK 43.66 million from SEK 33.09 million, indicating solid operational execution amidst moderate insider ownership changes.

- Click here to discover the nuances of Nordrest Holding with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Nordrest Holding is priced higher than what may be justified by its financials.

Make It Happen

- Click this link to deep-dive into the 192 companies within our Fast Growing European Companies With High Insider Ownership screener.

- Looking For Alternative Opportunities? We've found 21 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:GOMX

GomSpace Group

Through its subsidiaries, manufactures and sells nanosatellites and components, and turnkey solutions for satellites in Denmark, Sweden, France, rest of Europe, the United States, Asia, and internationally.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives