- Norway

- /

- Oil and Gas

- /

- OB:VAR

How a New Oil Discovery and Dividend Payout at Vår Energi (OB:VAR) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- On 11 November 2025, Vår Energi's extraordinary general meeting approved a third-quarter dividend of NOK 1.211 per share, totaling NOK 3.02 billion (about US$300 million), with payment set for 25 November 2025.

- In parallel, Vår Energi confirmed an oil discovery in the Zagato North appraisal well near the Goliat field, with estimated gross recoverable resources of up to 3 million barrels of oil equivalent, indicating potential for future development in the area.

- We’ll now explore how this recent oil discovery near the Goliat field may influence the company’s investment narrative and growth outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Vår Energi Investment Narrative Recap

Vår Energi’s investment case hinges on strong production growth, steady cash flows, and exploration success in Norway’s Barents and North Sea. The recent Zagato North oil discovery adds to its resource base, but with estimated recoverables of up to 3 million barrels of oil equivalent, it does not meaningfully shift the needle in terms of near-term catalysts or alter the principal risk: ongoing reliance on mature assets, which could see natural production declines after 2030 unless offset by larger finds or new projects.

Among recent corporate announcements, the series of substantial dividend approvals, including a third quarter payout of NOK 1.211 per share (US$300 million) set for late November, stands out as directly relevant. Regular, high-yield dividends appeal to income-focused investors but also highlight the importance of sustaining output and free cash flow amid asset maturity and industry cost pressures.

By contrast, one risk all investors should be aware of is the potential for rising decommissioning costs as infrastructure ages and cash requirements...

Read the full narrative on Vår Energi (it's free!)

Vår Energi's narrative projects $8.9 billion revenue and $1.0 billion earnings by 2028. This requires 7.8% yearly revenue growth and a $389 million earnings increase from $610.6 million.

Uncover how Vår Energi's forecasts yield a NOK38.49 fair value, a 10% upside to its current price.

Exploring Other Perspectives

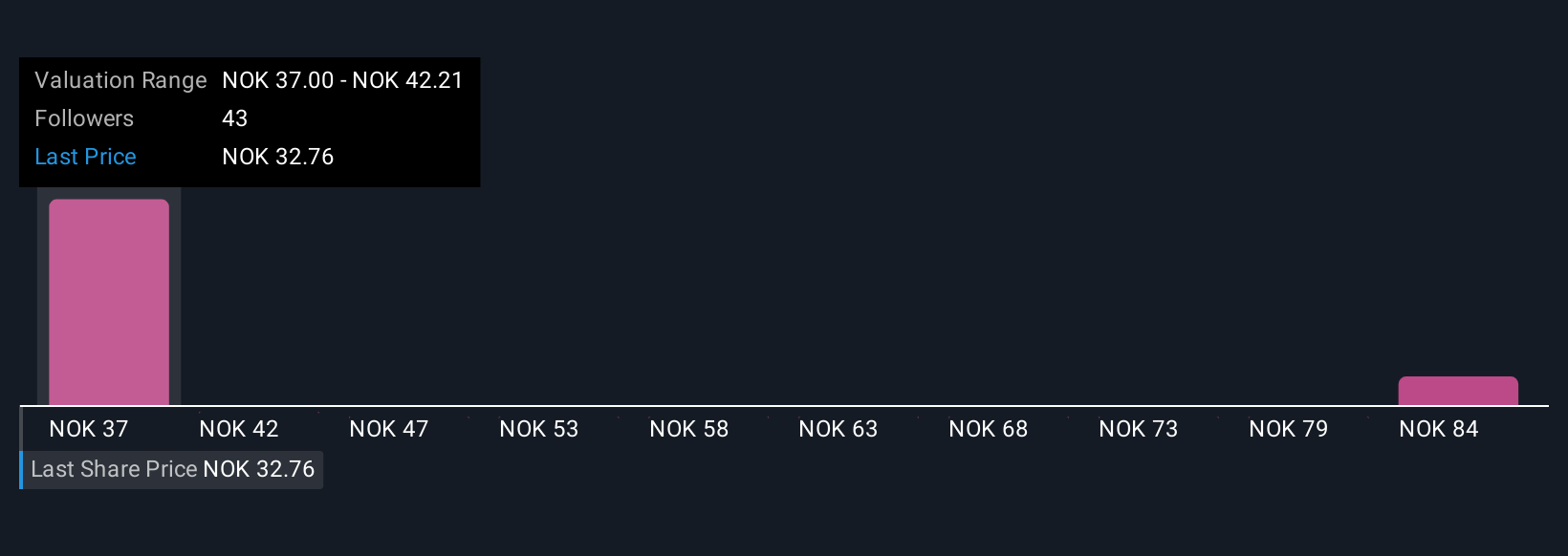

Six fair value estimates from the Simply Wall St Community show wide variation for Vår Energi, ranging from NOK37 to NOK129.56 per share. With such divergent views, and with future cash flow sustainability depending on new projects to offset mature asset decline, consider how your outlook fits among these perspectives.

Explore 6 other fair value estimates on Vår Energi - why the stock might be worth just NOK37.00!

Build Your Own Vår Energi Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vår Energi research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Vår Energi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vår Energi's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:VAR

Vår Energi

Operates as an independent upstream oil and gas company on the Norwegian continental shelf in Norway.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives