- Norway

- /

- Energy Services

- /

- OB:SDSD

Discover European Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

As European markets show resilience with the STOXX Europe 600 Index rising by 2.35%, investors are keenly observing opportunities in various sectors. Penny stocks, although a term that might seem outdated, still represent an intriguing investment area for those seeking potential growth in smaller or newer companies. These stocks can offer unique value and growth prospects, particularly when backed by solid financial health, making them worth watching for those interested in uncovering under-the-radar opportunities with promising long-term potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.64 | €82.4M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.02 | €15.15M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €234.7M | ✅ 3 ⚠️ 3 View Analysis > |

| Enervit (BIT:ENV) | €3.80 | €67.64M | ✅ 2 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.16 | €67.03M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.42 | €390.66M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.89 | €75.86M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.27 | €313.76M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.842 | €28.2M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 277 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

S.D. Standard ETC (OB:SDSD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: S.D. Standard ETC Plc is an investment holding company that operates in the energy, transport, and commodities sectors, with a market cap of NOK972.92 million.

Operations: The company's revenue segment includes Investment Holding, which reported -$0.49 million.

Market Cap: NOK972.92M

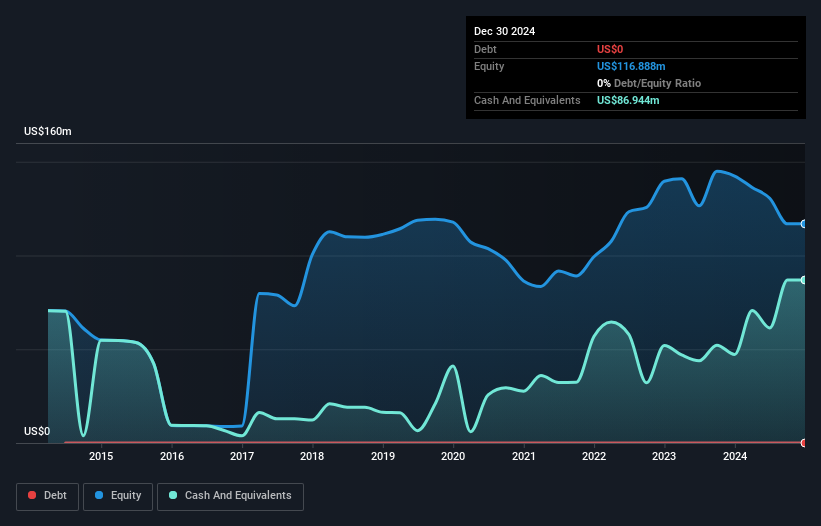

S.D. Standard ETC Plc has demonstrated a significant turnaround in recent performance, reporting third-quarter revenue of US$4.95 million and net income of US$4.42 million, marking a substantial improvement from the previous year's losses. Despite being pre-revenue previously, the company now shows positive free cash flow and maintains a cash runway exceeding three years without incurring debt. The seasoned management team contributes to stable operations with no shareholder dilution over the past year, while short-term assets comfortably cover liabilities, indicating financial resilience amidst its unprofitable status in prior periods.

- Dive into the specifics of S.D. Standard ETC here with our thorough balance sheet health report.

- Examine S.D. Standard ETC's past performance report to understand how it has performed in prior years.

KebNi (OM:KEBNI B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: KebNi AB (publ) develops, produces, and sells products and applications for stabilization, navigation, and satellite communications worldwide with a market cap of SEK470.63 million.

Operations: KebNi's revenue is primarily generated from its Unclassified Services segment, amounting to SEK147.92 million.

Market Cap: SEK470.63M

KebNi AB has shown a marked improvement in profitability, reporting a net income of SEK 4.2 million for the first nine months of 2025, compared to SEK 0.39 million a year ago. The company's short-term assets exceed both its long-term and short-term liabilities, indicating solid financial health without any debt burden. Despite low return on equity and high earnings volatility due to large one-off items, KebNi's shares trade significantly below estimated fair value. The experienced management team has maintained shareholder stability without dilution over the past year, although the board is relatively new with limited tenure experience.

- Unlock comprehensive insights into our analysis of KebNi stock in this financial health report.

- Review our growth performance report to gain insights into KebNi's future.

MAX Automation (XTRA:MXHN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MAX Automation SE, with a market cap of €181.47 million, provides automation solutions across various industries including automotive, electrical, recycling, raw materials recovery, packaging, and medical technology.

Operations: The company's revenue is primarily derived from its Vecoplan Group at €161.45 million, followed by the Bdtronic Group at €73.95 million, NSM + Jücker at €41.29 million, Elwema at €56.01 million, and AIM Micro at €5.69 million.

Market Cap: €181.47M

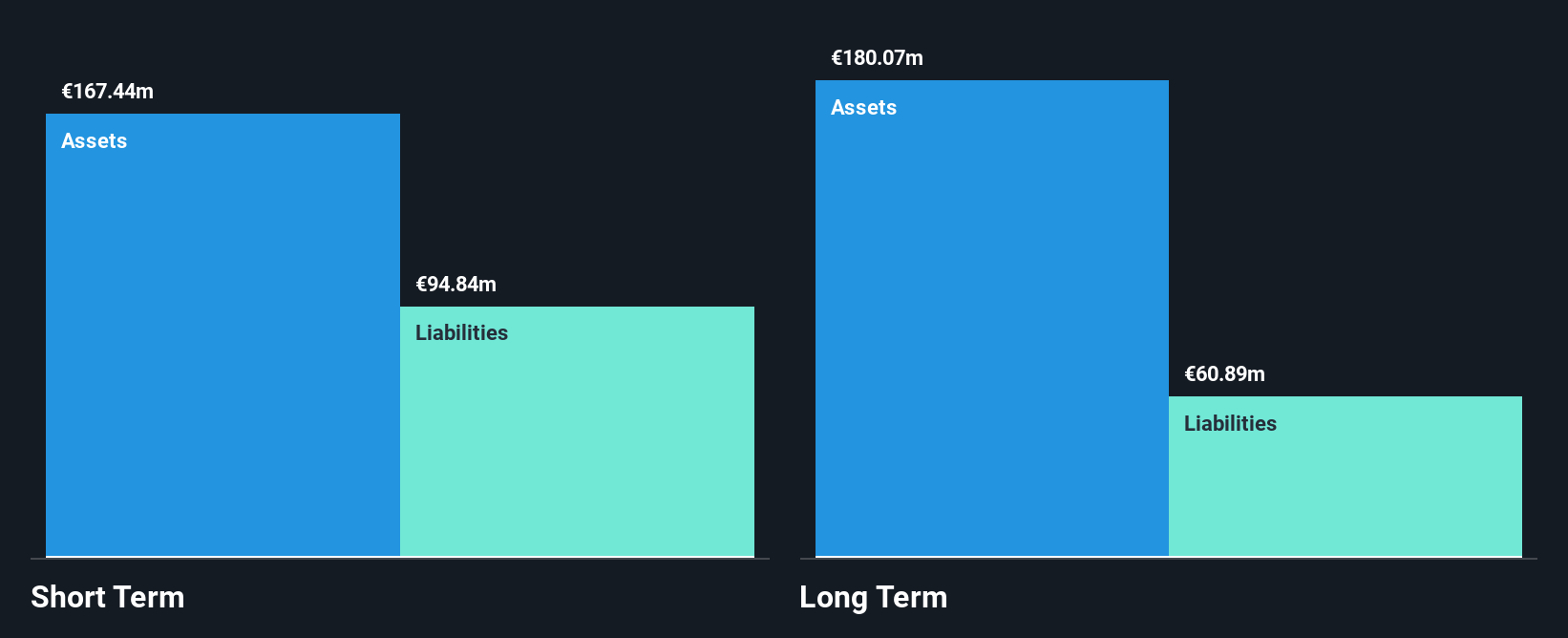

MAX Automation SE has demonstrated financial resilience with a satisfactory net debt to equity ratio of 14% and operating cash flow well covering its debt. The company's short-term assets surpass both short-term and long-term liabilities, reflecting robust liquidity. Despite recent net losses, MAX Automation has become profitable over the past five years, although earnings have been impacted by large one-off items. The stock is trading at a good value relative to peers, with analysts forecasting significant growth potential. However, return on equity remains low at 0.5%. Management and board members are experienced, ensuring steady governance without shareholder dilution recently.

- Navigate through the intricacies of MAX Automation with our comprehensive balance sheet health report here.

- Learn about MAX Automation's future growth trajectory here.

Make It Happen

- Click this link to deep-dive into the 277 companies within our European Penny Stocks screener.

- Interested In Other Possibilities? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SDSD

S.D. Standard ETC

An investment holding company, focuses on energy, transport, and commodities segments.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026