- Norway

- /

- Oil and Gas

- /

- OB:OET

Okeanis Eco Tankers (OB:OET): Exploring Current Valuation Following Recent Share Price Strength

Reviewed by Simply Wall St

Okeanis Eco Tankers (OB:OET) has seen its share price trend upward throughout the past month, with returns hitting nearly 18%. Investors are turning their attention to what may be driving the stock's sustained momentum.

See our latest analysis for Okeanis Eco Tankers.

Okeanis Eco Tankers is riding a strong wave this year, with a 42.66% share price return since January and a stunning 48.55% total shareholder return over the past year. This recent momentum suggests that investors see further growth potential, especially with such consistent long-term returns.

If Okeanis’s recent surge has you looking for more, now’s the perfect chance to discover fast growing stocks with high insider ownership.

But with such strong recent gains, is Okeanis Eco Tankers still trading at a discount, or has the market already factored in all the upside? Could this be a real buying opportunity, or is future growth already reflected in the current price?

Most Popular Narrative: 4.1% Overvalued

The consensus narrative points to a fair value marginally below the latest closing price, signaling that Okeanis Eco Tankers may be trading at a slight premium. This sets up a deeper debate around whether the company's momentum is backed by enduring catalysts or optimism about its future trajectory.

Structural vessel undersupply, driven by an aging global fleet (half of VLCCs/Suezmaxes to be over 15 years by 2028), limited newbuild activity, and a large portion of "shadow" or sanctioned tonnage being both aging and unlikely to return to mainstream trading, is expected to sustain or elevate charter rates and boost long-term revenue and EBITDA.

Curious what number-crunching drives the narrative price target? It hinges on a rapid transformation in earnings margins and a bold future profit multiple. Uncover which projections the crowd is betting on and what makes this narrative so compelling.

Result: Fair Value of $340.48 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a faster than expected drop in oil demand or unfavorable shifts in regulations could quickly undermine the optimism that is fueling Okeanis Eco Tankers' valuation.

Find out about the key risks to this Okeanis Eco Tankers narrative.

Another View: DCF Paints a Much Cheaper Picture

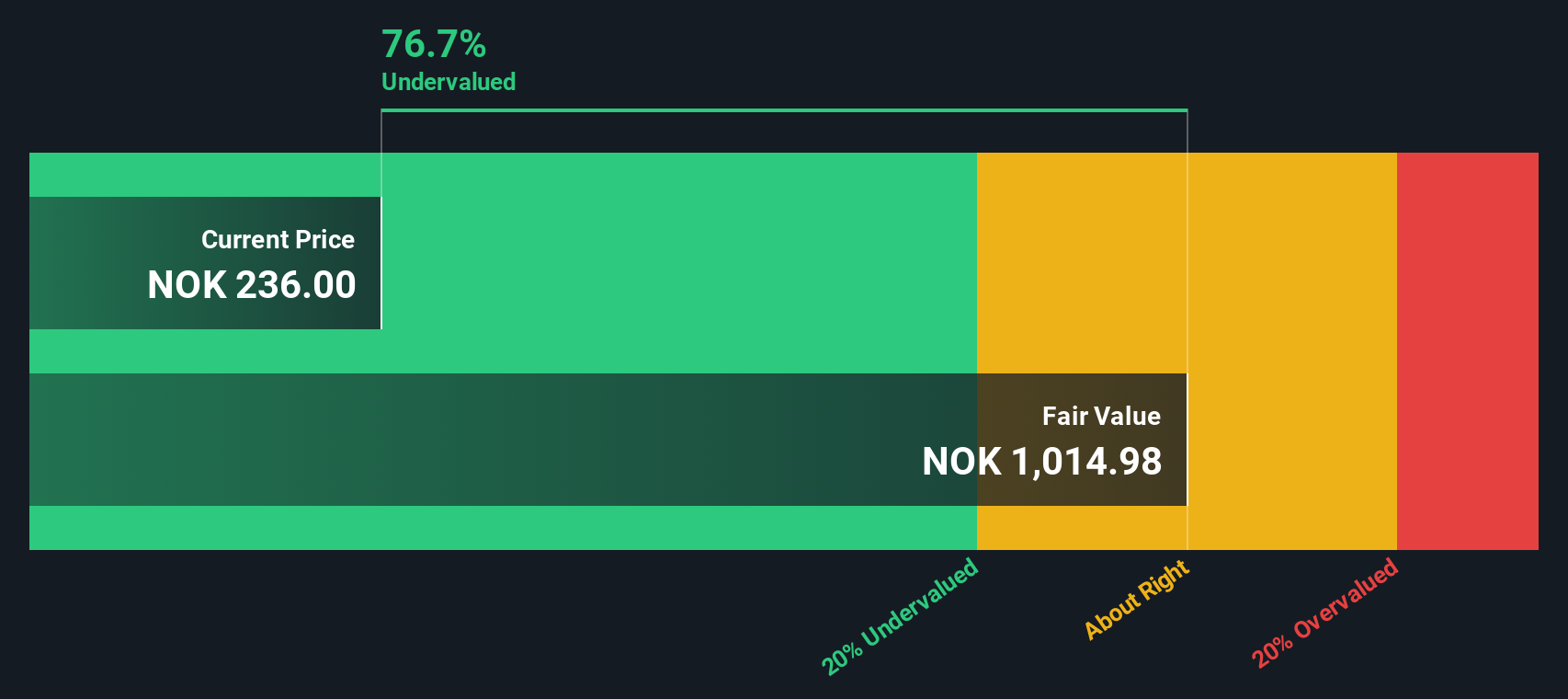

While the consensus price target suggests Okeanis Eco Tankers is a little overvalued, our DCF model paints a completely different picture. It estimates the shares are trading far below their fair value. This significant gap highlights just how much valuation opinions can differ. Is there a hidden opportunity here, or is the DCF model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Okeanis Eco Tankers for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Okeanis Eco Tankers Narrative

If you would rather dive into the numbers yourself or want a narrative shaped by your own insight, you can put one together quickly. Do it your way

A great starting point for your Okeanis Eco Tankers research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Hundreds of stocks with untapped potential are just a click away. Get ahead of market trends by searching for new opportunities backed by real financial data and analysis.

- Target stable income by reviewing these 15 dividend stocks with yields > 3%, which offers impressive yields above 3% and proven track records.

- Spot emerging market disruptors among these 26 AI penny stocks, with a focus on artificial intelligence breakthroughs and the future of automation.

- Unlock bargains in plain sight when you examine these 872 undervalued stocks based on cash flows, benefiting from strong cash flows and attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:OET

Okeanis Eco Tankers

A shipping company, owns and operates tanker vessels worldwide.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives