- Norway

- /

- Oil and Gas

- /

- OB:HUNT

Discovering Value: 3 European Penny Stocks With Market Caps Of €10M

Reviewed by Simply Wall St

The European market recently faced a downturn, with major indices like the STOXX Europe 600 Index experiencing declines amid trade deal disappointments and economic stagnation. Despite these challenges, investors often seek opportunities in lesser-known areas of the market where potential value can be uncovered. Penny stocks, although an outdated term, refer to smaller or newer companies that can offer significant upside when they possess strong financials and growth potential. In this context, we explore three European penny stocks that exhibit balance sheet strength and the possibility for future gains.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €0.97 | €14.41M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.44 | €45.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €307.44M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.97 | €62.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.93 | €18.43M | ✅ 2 ⚠️ 3 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK3.265 | SEK3.12B | ✅ 4 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.02 | €9.58M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.18 | €300.98M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.966 | €32.58M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 337 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Tecma Solutions (BIT:TCM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tecma Solutions S.p.A. is a tech company that develops technology and digital content for real estate businesses, with a market cap of €13.26 million.

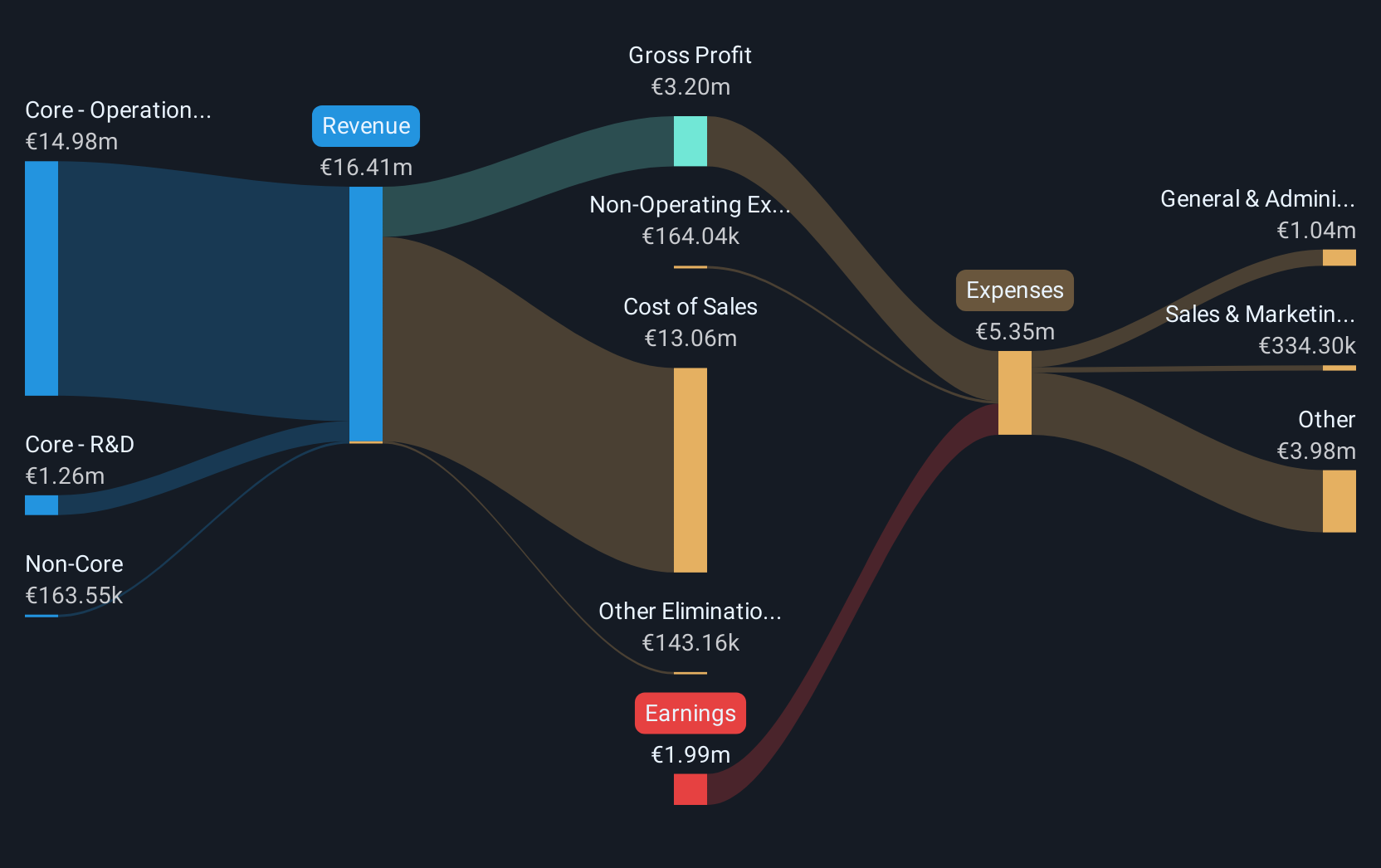

Operations: Tecma Solutions generates revenue primarily from its Core segments, with €1.26 million from R&D and €14.98 million from Operations, alongside a smaller contribution of €0.16 million from Non-Core activities.

Market Cap: €13.26M

Tecma Solutions S.p.A., a tech company in the real estate sector, reported revenue of €16.41 million for 2024, up from €15.12 million the previous year, despite remaining unprofitable with a net loss of €1.99 million. The company has a high debt-to-equity ratio of 57.9%, indicating significant leverage but maintains sufficient cash runway for over three years due to positive free cash flow growth. Although its share price is volatile and return on equity negative at -55.32%, Tecma trades below estimated fair value and has not diluted shareholders recently, suggesting potential value for risk-tolerant investors in penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Tecma Solutions.

- Examine Tecma Solutions' earnings growth report to understand how analysts expect it to perform.

Vivoryon Therapeutics (ENXTAM:VVY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vivoryon Therapeutics N.V. is a clinical-stage biopharmaceutical company dedicated to researching, developing, and commercializing small molecule-based medicines with a market cap of €38.04 million.

Operations: Vivoryon Therapeutics N.V. has not reported any revenue segments.

Market Cap: €38.04M

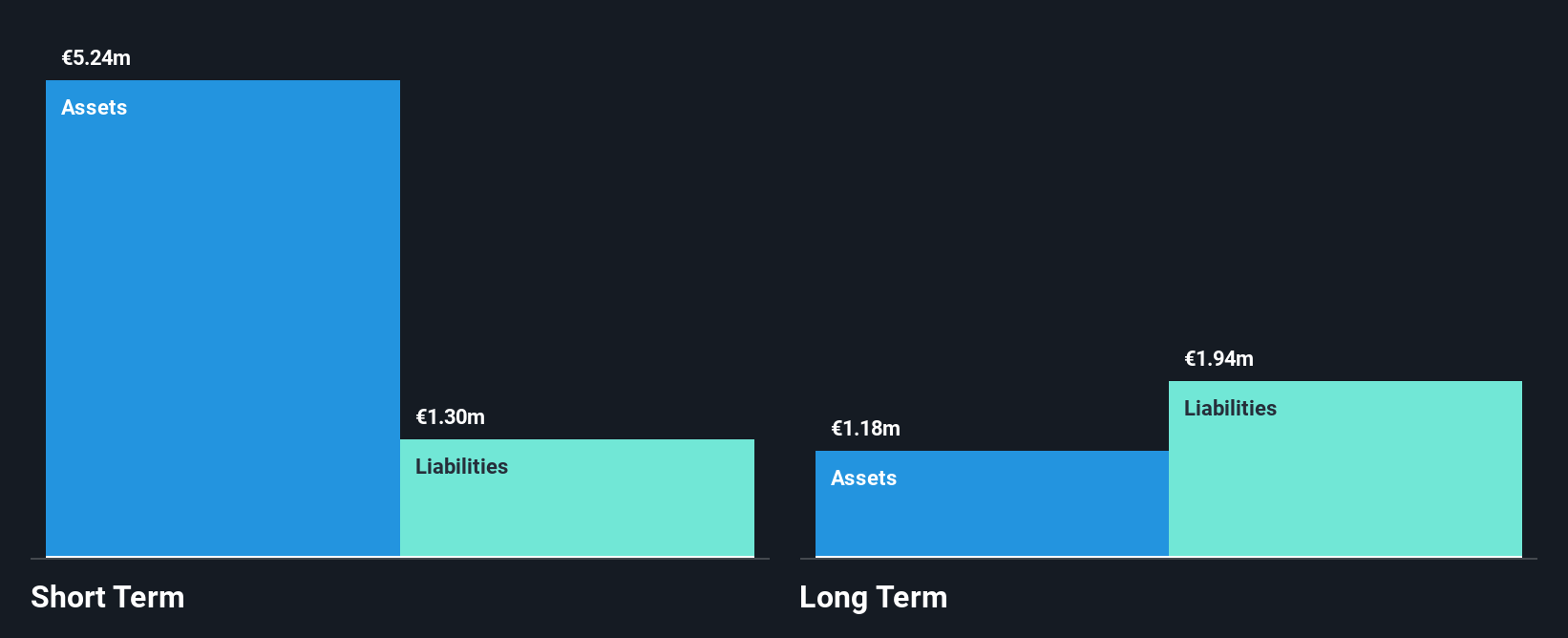

Vivoryon Therapeutics N.V., a clinical-stage biopharmaceutical company with a market cap of €38.04 million, is pre-revenue, reflecting its focus on developing small molecule-based medicines. Despite being unprofitable and not expected to achieve profitability within the next three years, Vivoryon remains debt-free with short-term assets of €10.1 million exceeding both short-term and long-term liabilities. Recent capital raises have extended its cash runway beyond the initial 9 months forecasted based on free cash flow estimates. The management team is experienced, although the board's average tenure suggests relative inexperience, which could influence strategic decisions in this volatile penny stock space.

- Get an in-depth perspective on Vivoryon Therapeutics' performance by reading our balance sheet health report here.

- Explore Vivoryon Therapeutics' analyst forecasts in our growth report.

Hunter Group (OB:HUNT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hunter Group ASA offers oil tanker chartering services through its Very Large Crude Carriers (VLCCs) in Norway and has a market capitalization of NOK 117.43 million.

Operations: The company's revenue segment primarily involves the development and operation of Very Large Crude Carriers (VLCCs), with reported revenues of -$10.05 million.

Market Cap: NOK117.43M

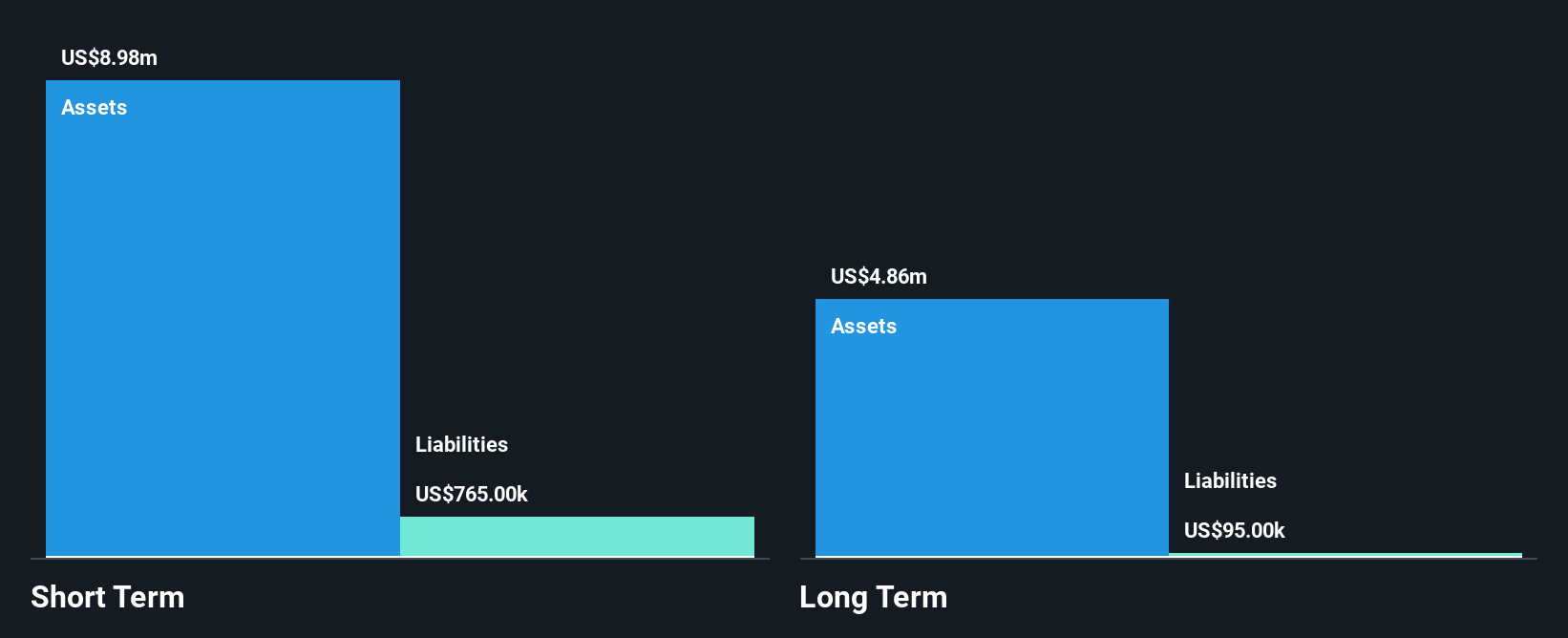

Hunter Group ASA, with a market cap of NOK 117.43 million, operates in the oil tanker sector but remains pre-revenue with reported negative sales and revenue figures. Despite its unprofitability and increased losses over the past five years, Hunter has managed to eliminate debt entirely, which is a positive aspect for risk management. The company's short-term assets significantly exceed both its short-term and long-term liabilities, providing some financial stability amidst high share price volatility. Although the management team is experienced with an average tenure of 7.3 years, the board's relative inexperience could impact strategic direction in this challenging penny stock environment.

- Take a closer look at Hunter Group's potential here in our financial health report.

- Examine Hunter Group's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Click this link to deep-dive into the 337 companies within our European Penny Stocks screener.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hunter Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:HUNT

Hunter Group

Provides oil tanker chartering services through VLCCs in Norway.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives