- Norway

- /

- Energy Services

- /

- OB:DOFG

DOF Group (OB:DOFG): One-Off $101M Gain Raises Fresh Questions on Profit Quality Narratives

Reviewed by Simply Wall St

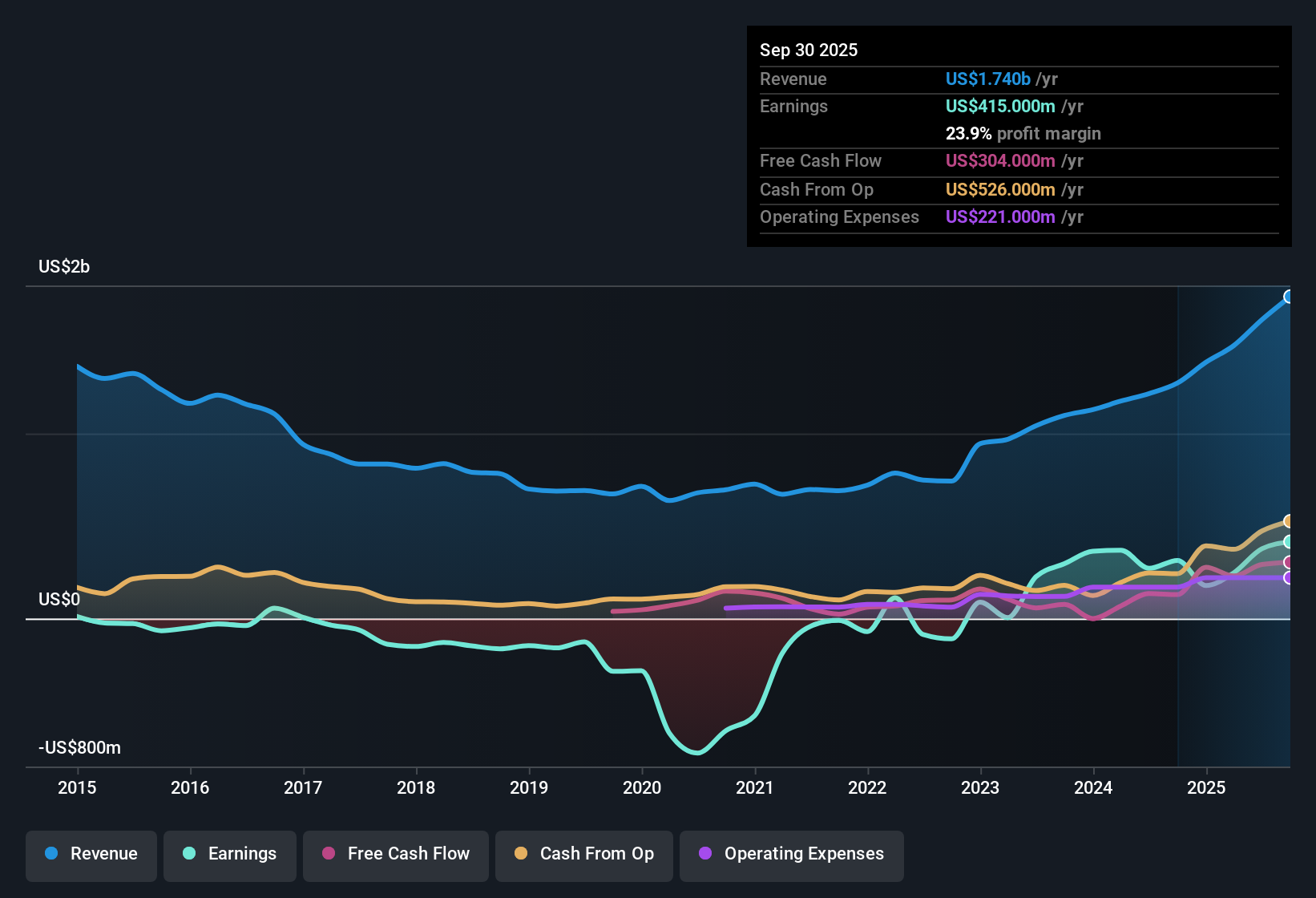

DOF Group (OB:DOFG) reported earnings growth of 32.2% for the recent period, behind its five-year average of 67.5% per year. Net profit margin is at 23.9%, slightly below last year’s 24.7%. The company’s bottom line benefited from a notable one-off gain of $101.0 million, which raises some questions about the underlying quality of reported profits. Looking ahead, earnings and revenue are expected to grow by 4.7% and 5.4% per year respectively, with revenue projected to outperform the broader Norwegian market, while profit growth may lag behind. For investors, this scenario offers a blend of attractive valuation, ongoing top-line expansion, and caution regarding exceptional items and profit quality.

See our full analysis for DOF Group.Next, we will examine how these headline results align with the key narratives investors follow and where the latest report might spark new discussion.

See what the community is saying about DOF Group

Backlog Surpasses $4 Billion, Bolstering Revenue Outlook

- DOF Group’s contract backlog has climbed above $4 billion, supported by multi-year awards and day rate increases up to 30%. This provides strong visibility on future top-line growth through at least 2030.

- Analysts' consensus view highlights that rising vessel utilization and integrated service offerings are allowing DOF to command premium pricing. Combined with the large backlog, this heavily supports the case that steady, high-margin revenue is now more durable than in previous cycles.

- This shift towards long-term contracts reduces risk for near-term earnings by locking in revenue even as broader offshore markets remain volatile.

- Consensus narrative notes the ability to flexibly deploy vessels worldwide, especially from lower-yielding to high-margin regions, as a key factor that is smoothing revenue and supporting margin expansion.

- To see how analysts integrate DOF’s substantial backlog into their outlook and what might change the consensus, check the in-depth narrative. 📊 Read the full DOF Group Consensus Narrative.

Margin Expansion Meets Shrinking Profitability Forecasts

- While profit margins remain robust at 23.9%, analysts expect these to shrink to 22.2% over the next three years, even as earnings are projected to rise from $377.0 million to $462.6 million by 2028.

- Analysts' consensus narrative spotlights how the margin trend puts pressure on the positive outlook:

- On one hand, margin gains are currently being driven by fast-growing integrated solutions and high utilization rates for advanced subsea vessels. These are key factors supporting the positive case.

- However, heavy capital needs for vessel upgrades and persistent debt mean expanding net earnings will depend on keeping costs contained and pricing power strong, despite market volatility in places like the North Sea.

Valuation Gap: Share Trades at Heavy Discount to Peers and Targets

- With a price-to-earnings ratio of 5.5x, DOF Group trades notably below both peer (16x) and industry (6.8x) averages. Its share price of NOK94.8 also sits well under the analyst target of NOK122.75 and DCF fair value of NOK429.58.

- According to the consensus narrative, the steep discount supports the view that the market is not fully crediting improving revenue stability and financial structure:

- Consensus points to deleveraging and restructuring as factors that can justify a re-rating toward peer multiples, provided execution on cost control and maintaining the contract backlog is sustained.

- On the other hand, there are arguments that questions around earnings quality (given the one-off profit gain of $101.0 million) and ongoing debt repayment needs could keep investors cautious despite the valuation gap.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for DOF Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? In just a few minutes you can share your perspective and shape the conversation, Do it your way

A great starting point for your DOF Group research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite solid revenue gains and backlog strength, DOF Group’s heavy debt load and need for ongoing deleveraging keep financial stability and profit quality under scrutiny.

If you would rather focus on businesses built for resilience, check out solid balance sheet and fundamentals stocks screener (1977 results) to discover companies with stronger balance sheets and lower financial risk profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:DOFG

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives